AAII Just Fine As Investors Intelligence Gets Extended

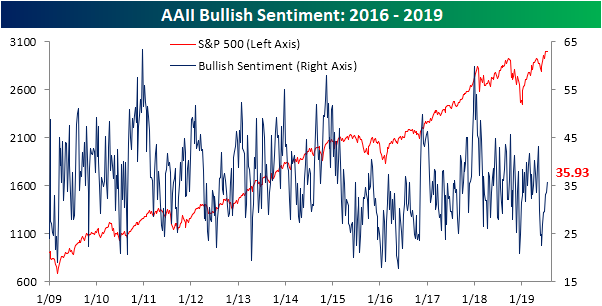

In the weekly AAII investor survey, bullish sentiment is the predominant sentiment reading for the first time since early May. Rising for the sixth week in a row, bullish sentiment now rests at 35.93%; the highest since May 9th when it was 43.12%. Bullish sentiment has slowly recovered following May’s retracement even as the major indices reached new all-time highs. Given this, bullish sentiment is still within a normal range and by no means is overly extended. At 35.93%, it remains below the historical average of 38.16% as it has for ten straight weeks now. That is the longest such streak of below-average readings since a 12-week streak ending in May of last year.

(Click on image to enlarge)

While bullish sentiment has remained relatively muted as measured by AAII, another sentiment survey run by Investors Intelligence has been running pretty hot leading to a pretty mixed overall picture based sentiment. In the past two week’s Investor Intelligence’s percentage of investors reporting bullish sentiment has risen up to 58% which is over one standard deviation above the historical average. As with AAII, this is negative from a contrarian perspective, as more extremely high readings have preceded significant market downturns. Granted, it was notably higher ahead of the past two downturns in 2018. Ahead of the January 2018 and Q4 2018 sell-offs, bullish sentiment by this measure topped 60%. In other words, while this is extended and something to watch, it isn’t necessarily sounding the alarm for worry yet, especially given the divergence from AAII.

(Click on image to enlarge)

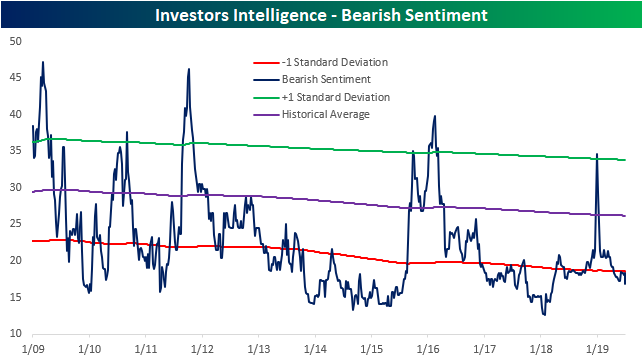

Similarly, Investors Intelligence’s bearish sentiment reading remains a bit extended to the downside as it has for the past 12 weeks. At 16.8%, it is the lowest in over a year (since March 21st, 2018).

(Click on image to enlarge)

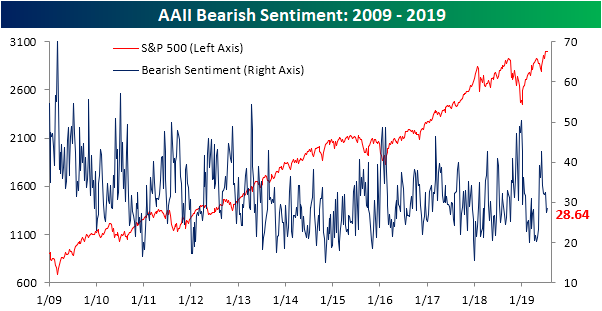

On the contrary, AAII’s reading on bearish sentiment actually saw a slight increase to 28.64% from 27.5% last week. As with AAII’s bullish sentiment, bearish sentiment is not extended to the up or downside and also sits below the historical average of just over 30%.

(Click on image to enlarge)

Bulls and bears borrowed from neutral sentiment this week as the percentage of investors reporting as neutral fell to 35.43%. While that is down off of readings above 38% that were observed through most of the past two months, neutral sentiment remains in a range from the mid to high 30’s as it has most of 2019. That is above the historical average of 31.52%.

(Click on image to enlarge)

Start a two-week free trial to Bespoke Institutional to access our interactive economic indicators monitor and much ...

more