A Trade To Hedge A Top In Facebook With A Rebounding Google

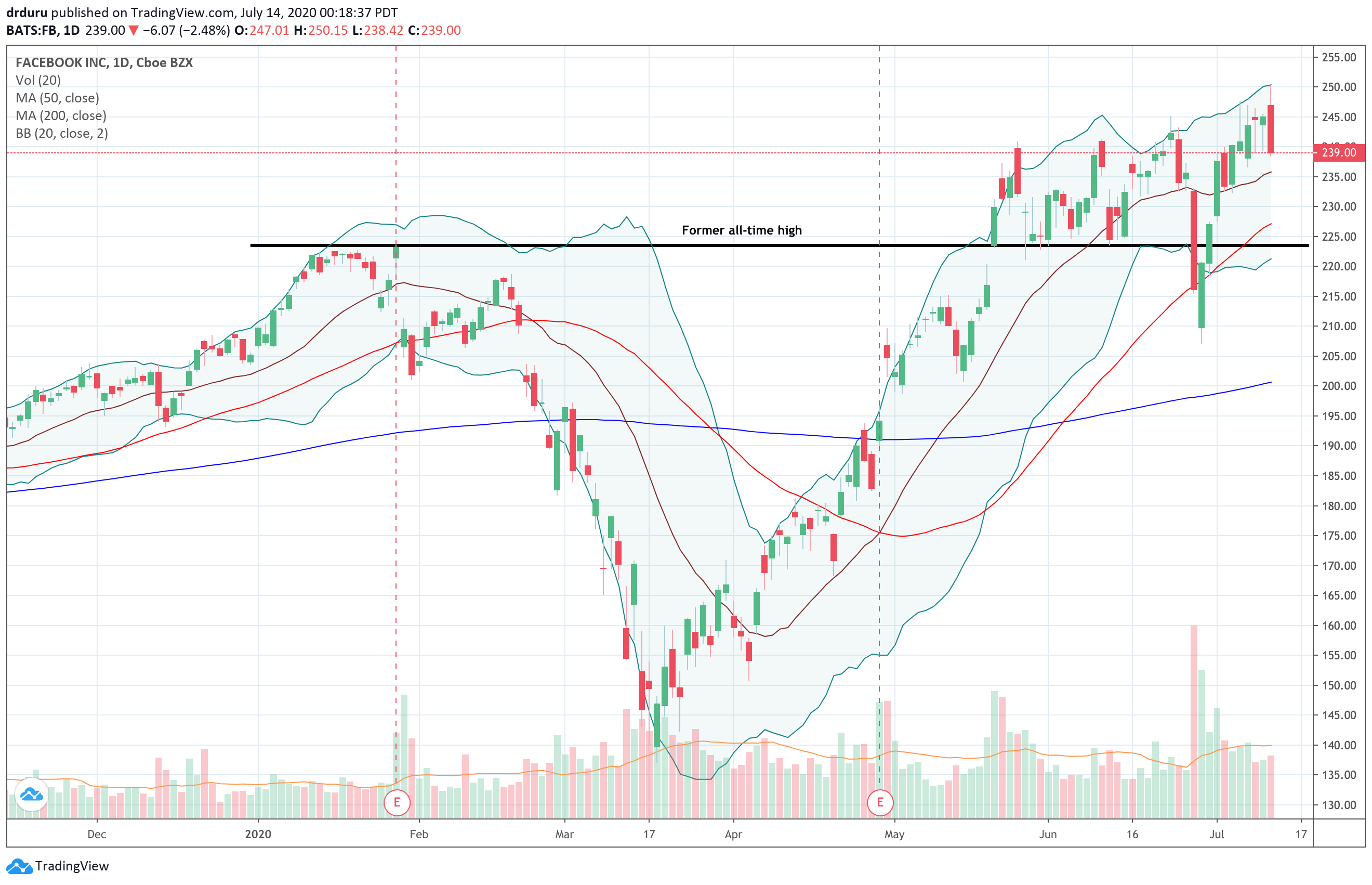

At the end of June, I laid out a trading case for Facebook (FB) based on an orderly examination of chaotic price action. Facebook turned out to be so orderly that the stock marched just three days into a reversal of its loss on a major test of support at its 50-day moving average (DMA). The sellers I thought would be relieved to get a second chance to bail at a better price just sat back and enjoyed the ride to a new all-time high. The long side of my hedged play (a calendar call spread) turned out to be far too conservative. I even had to take profits well ahead of schedule. I am now left with a put spread that will likely deliver minimal residual value.

(Click on image to enlarge)

The Facebook rebound to a new all-time was surprising and symbolic of a relentless market awash in liquidity. So when leaders of the NAACP, Color of Change, Free Press, and the Anti-Defamation League left a meeting with Facebook's leaders decrying a lack of commitment from the company for doing anything about hate speech, the stock market yawned and kept buying more FB. Not even the potential of extended boycotts deterred the enthusiasm for celebrating inaction and defiance. The next day, FB closed at a new all-time high.

Still, counter-moves have their time and place. At some point traders and investors no longer find it attractive to pay a higher price for the same risk that took the stock down in the first place. Monday's 2.5% loss and a technical "bearish engulfing" topping pattern looks like the classic exhaustion from climbing the wall of worry. Tech stocks, in general, suffered a major reversal on the day that suddenly exposed the risks of reality - at least for a moment.

Facebook benefited from a rush to big-cap tech stocks in general. When I constructed the earlier trade, I failed to take the larger context into consideration.

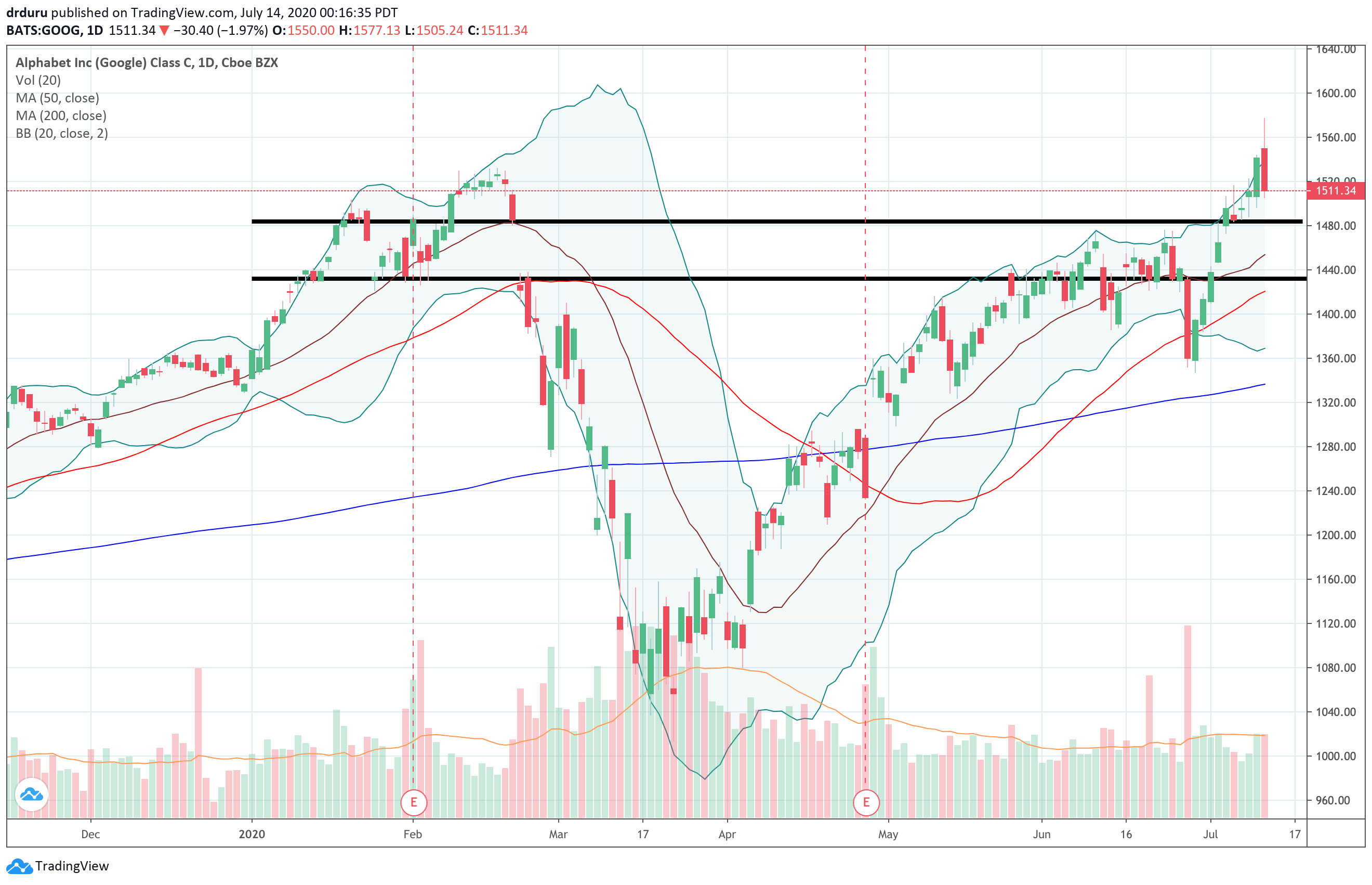

The most direct comparison for Facebook is Alphabet (GOOG) given the sizeable dependence on the dominant digital advertising business. A week before Facebook's drama, GOOG looked like it was stuck in a key trading range formed from the February gap-down. GOOG fell right out of that trading range in parallel with Facebook's big breakdown. GOOG lost 5.7% and, unlike Facebook, managed to close below its 50DMA support line. The stock looked severely damaged. However, like FB, GOOG took just three days to completely reverse the loss. Not being satisfied with that swift accomplishment, buyers went on to send GOOG to a long-overdue all-time high last week.

(Click on image to enlarge)

This whole episode offered a good trading lesson. Instead of the hedge with a put spread and a calendar call spread on FB alone, I should have considered a pairs trade long FB calls and short GOOG puts or vice versa. In fact, such a pairs trade looks like a great option at this juncture given the prospects for more big moves to the downside and/or upside.

To the downside, both stocks are at risk of retests of their 50DMA supports. The upside is essentially unlimited as all-time highs in big cap tech have tended to beget more all-time highs - classic momentum herding. Given the bearish divergence that opened up in the stock market, I am inclined to think the downside scenario is the more likely outcome. I still want to avoid paying earnings premiums (Facebook on the 29th and Google on the 30th), so I am targeting the July 24th expirations: FB July 24 $230 put around $4.40 and the GOOG July 24 $1550/1580 call spread for $5.60.

Traders can of course flip the bear/bull positioning. I chose FB for the downside as I think the company remains stuck in an impossibly difficult sandwich between censorship and free speech. On a technical basis, FB printed a bearish engulfing topping pattern. I chose GOOG for the upside because of my earlier conclusion that Google looks like a catch-up play for big cap tech. From a technical standpoint, GOOG may find support at the top of the previous trading channel (see chart above).

The $230 strike for Facebook is positioned just above 50DMA support with the assumption that support could melt away on a fresh sell-off. I chose the top of the GOOG call spread at the intraday all-time high which should get challenged in a rebound. The FB put allows for large gains if the sell-off really picks up steam. The GOOG call spread allows for enough gain to pay for the put and provide incremental profit.

Be careful out there!

This quote from AdExchanger was VERY telling about FB's earnings conference call:

"Although Facebook reported its Q2 earnings the day after CEO Mark Zuckerberg donned a suit to testify along with his big tech CEO bros in front of a congressional antitrust subcommittee – incredibly, not a single investor asked Zuckerberg about his appearance.

And the advertiser boycott barely got a mention, although Wehner pointed out that the Top 100 advertisers make up just 16% of Facebook’s ad revenue and falling.

According to Zuck: “Small businesses are the biggest part of our business, not the largest businesses. … We want to serve everyone, but if you as investors or analysts or anyone is thinking about our business, the really accurate way to think about what we do is we are in the business of serving small businesses.”

In that vein, Facebook announced a milestone on the call: It now has more than 9 million active advertisers across its services."

www.adexchanger.com/.../facebook-grows-revenue-arpu-and-users-in-q2-despite-the-pandemic/

I have never liked any aspect of facebook and I like it much less than that now. I wish them "Lots of luck," and every bit of the luck BAD.

Good one, William!

That makes sense. It is amazing how Facebook holds up despite those companies protesting it.

What would it take for Facebook to take a real hit? I would think they've lost millions if not billions in advertising already.

Perhaps new, smaller companies are taking advantage of the lack of competition for eyeballs by advertising on Facebook instead.

As long as millions of readers are on Facebook deadly, they'll still be able to attract readers.

That's right. The users are at the center of everything. It's next to impossible for advertisers to ignore a 2 billion, highly targetable audience for long.

Sadly people need to stop using it as they become a commodity to sell and sadly the most vulnerable get targeted by the most virulent like racists, gangs, cults, and terrorists.

These companies are boycotting #Facebook right now because it's the "in" think to do. Let's be honest, 99.9% of companies only care about one thing - the bottom line. It's a PR move right now to boycott Facebook. As soon as the uproar dies down, or the next big thing is the new talk of the town, all those companies will be back. Probably with even larger budget to make up for lost time. $FB

It seems small and medium-sized business matter most to FB, and the boycotters collectively don't matter much. And definitely if users stick by Facebook, advertisers have to return at some point.

Exactly right Dr. Duru. Facebook's users themselves would need to be far more socially conscious and boycott the company themselves. Sadly that doesn't seem to be helping.

I totally agree. I thought they were finished when Zuckerberg got hauled before congress, but somehow nothing seems to really stick to that company, even though they are clearly up to some inappropriate behavior.

True teflon Don.

Yes, Slick Willy's got nothing on Zuckerberg!

This is a god idea but dangerous given Facebook tends to move in larger percentage swings than Google.

The potential for bigger % move in Facebook is exactly why I bought a straight put on FB vs the call spread on Google. A spread on FB, as I learned with the last trade, significantly caps potential gains in the trade.