A New Interpretation For A Surge In Google Searches For "Recession"

The coronavirus pandemic forced the issue of recessionary forces that were building in the economy. Instead of a slow and steady drift through rumor and subtle signs, the shutdown of global economies resolved the issue of recession in one tragic swoop.

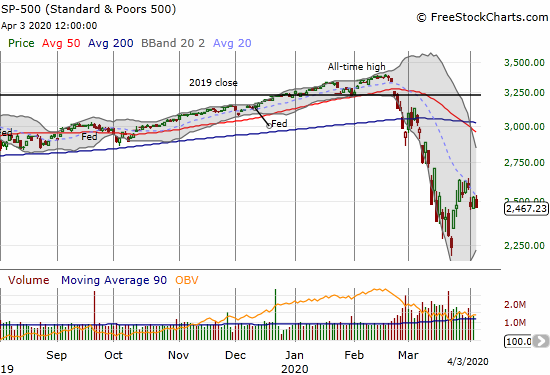

Last September, I examined a sudden spike in Google searches on “recession” to try to understand the specifics of what spooked people. I compared the surge to the jump in Google searches during the 2008-2009 financial crisis for insights. I concluded that while recessionary forces seemed real, it would take more time to determine the larger meaning of the recession searches. In particular, I wanted to see whether whether these searches created a higher baseline of activity or returned to the previous baseline.

It took two months for recession searches to return to normal. By then the S&P 500 (SPY) enjoyed a fresh breakout to a series of all-time highs that formed a fresh celebratory phase of the bull market. All seemed well.

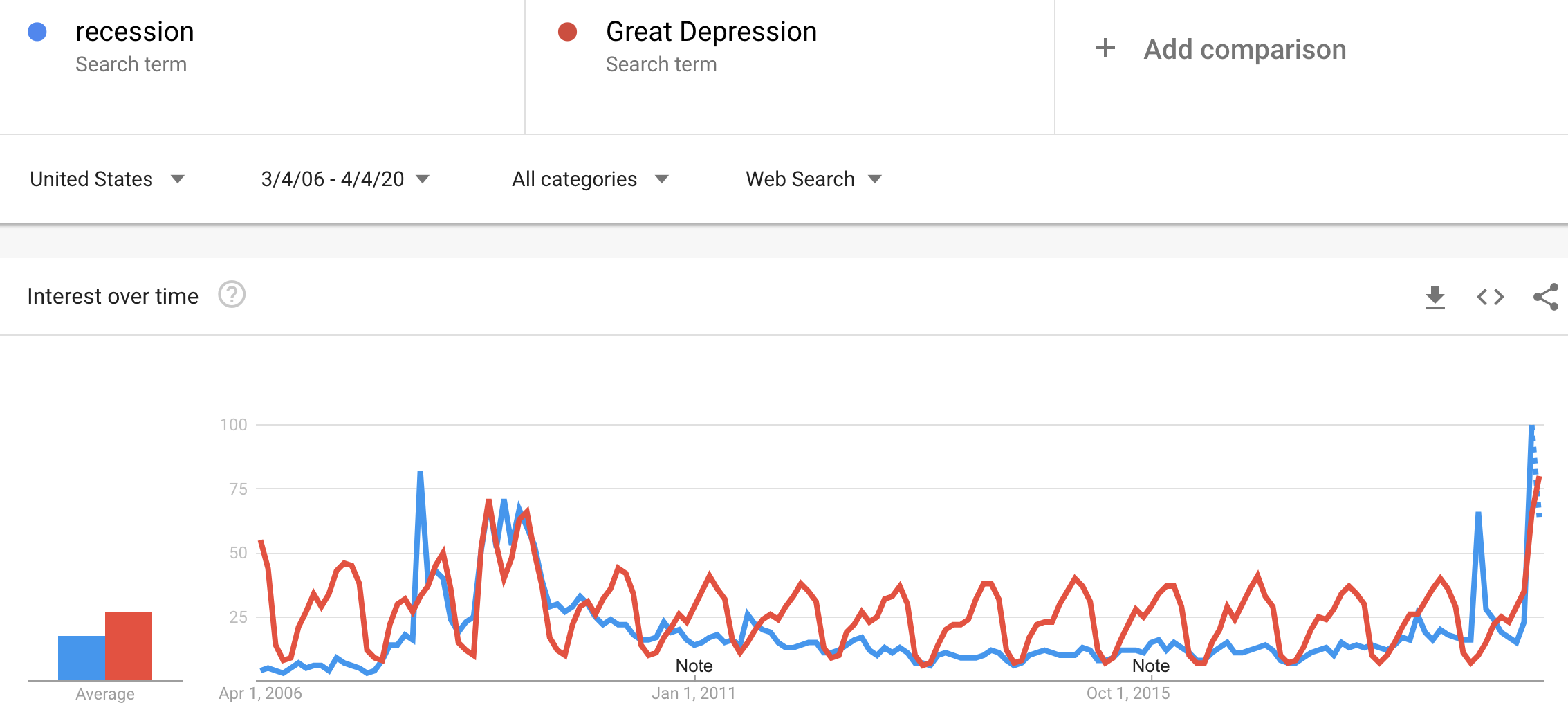

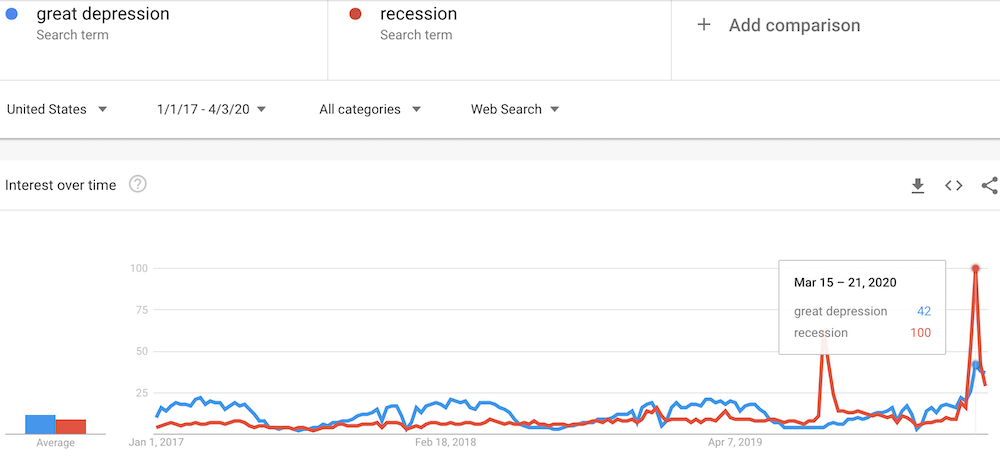

The searches on recession started to perk up again in the last week of February and the first week for March. This fresh indicator of trouble was accompanied by very real and growing fears of the coronavirus. In retrospect, these searches were an early warning signal (at the time, my technical indicator had already turned from “cautiously bearish” to bearish). In mid-March searches on recession really took off with a peak on March 17th with state after state taking drastic anti-pandemic measures like shelter in place. This occurred even as Treasury Secretary Mnuchin was insisting the U.S. would not plunge into a recession. With a recession a foregone conclusion even for government officials, I decided to layer on searches for the “Great Depression” as the new concern revolves around ever worse economic calamities.

Interestingly, the baseline searches on the Great Depression outpace those for recession. The searches are even cyclical with spikes happening every March and April and cyclical troughs every July and August. I suppose schools teach about the Great Depression at the same time and accordingly academics lose interest at the same time? This time around, the cyclical surge in searches was accompanied by the additional real fears of a depression. These searches have surpassed those of the financial crisis. The fears of a greater economic calamity thus look very real.

So why are these searches important? As part of the economic environment and the mechanics of investor sentiment, the searches can reveal a potential dampening effect on the willingness to invest throughout the economy ad financial markets. Depression fears during the financial crisis quickly faded back to normal by the summer of 2009 – a metaphorical and perhaps very real clearing of the runway of sentiment for the March, 2009 bottom to stick. Could something similar happen this time around? The daily view on searches shows Great Depression searches peaking in parallel with recession searches, but they have not yet tumbled down like recession searches. In other words, I am speculating that the recent bottom in the S&P 500 remains in peril because underlying sentiment is shaky.

Note well that I am not proposing a market timing tool with these searches. Instead, I am using these searches as a supplement for understanding the grinding dynamics of this historic oversold period – the second longest since 1986. My tool for trading and investing off bottoms created by oversold (or near oversold) periods uses the percentage of stocks trading above their 40-day moving averages (DMAs) (I call it AT40). The extreme nature of this oversold period broke most of my related trading rules. I even recently backed down from bullish to “cautiously bullish.” Now I am keenly watching these searches on the Great Depression to help confirm or invalidate my evolving understanding of this extreme oversold period. The next time someone analyzes the recessionary signal in bear markets, this episode will get its own special footnote.