A Long Road Of Growth For This Retailer

Multiple long-term tailwinds will drive profit growth for this company while its stock is priced for permanent profit decline. AutoZone Inc. (AZO: $1,141/share) is this week’s Long Idea.

We first made AutoZone a Long Idea in February 2014 before closing it out just under a year later for an 8% gain vs. 10% for the S&P 500. We also highlighted the firm in our report Seek Strong ROICs in Turbulent Markets in March 2020.

Despite its recent underperformance, we think this stock offers excellent risk/reward based on AutoZone’s:

- Long history of growing faster than its peers

- Opportunities for continued domestic and international growth

- Superior customer service, which diminishes threats from Amazon (AMZN) and Walmart (WMT)

- Position to benefit from rising used car sales, rising average age of cars on the road, and the forecasted growth in the number of global vehicles

- Stock trading as if profits will permanently decline by 30%

Slow and Steady Wins the Race

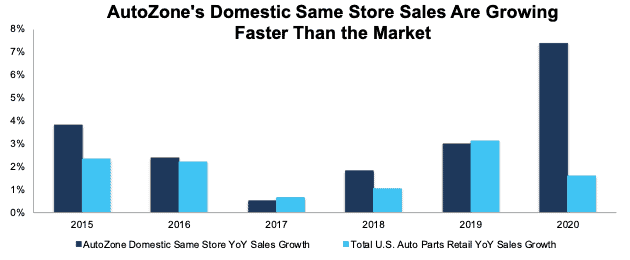

AutoZone has grown its revenue in each of the past 22 years. Since 2015, AutoZone’s domestic same store sales have grown by 3.1% compounded annually compared to just 1.8% compounded annual growth for the U.S. auto parts retail market. Figure 1 compares AutoZone’s year-over-year (YoY) domestic same store growth to the U.S. auto part retail sales growth.

Figure 1: Change in YoY Sales: AutoZone’s Same Store vs. Total U.S. Market

Sources: New Constructs, LLC, company filings & FRED

AutoZone has also consistently grown its international stores as Mexico and Brazil stores represent 10% of total stores in 2020 compared to 5% in fiscal 2010. We expect these international stores to be a long-term source of revenue growth.

Customer Service Provides a Moat Against Retail Giants

Like most specialty retailers, AutoZone faces competition from auto-part store peers as well as big box retailers and e-commerce giants like Walmart (WMT) and Amazon (AMZN). AutoZone’s ability to provide specialized customer service that its big box retailer and e-commerce competitors cannot match gives it a major competitive advantage. Free services such as AutoZone’s tool loaning program, diagnostic services, check engine light readings, battery testing, battery charging, and collection of oil for recycling are important to building customer loyalty and make switching costs high. Additionally, AutoZone helps customers locate and, in some cases, even install parts.

Even though many customers prefer the convenience of walking out the door of a brick and mortar store without having to wait for an Amazon delivery, AutoZone has developed a competitive e-commerce platform for those who prefer to find their auto parts online. The firm has two websites, one for retail and one for commercial customers, that offer in-store pickup or delivery, which is next-day for 80% of the U.S.

Older Cars Provide Long-Term Tailwind

While the firm consistently outperforms the industry already, and its customer service creates a lasting competitive advantage, long-term demand for auto parts remains important to AutoZone’s future profit growth. We think the rising age of cars provides long-term demand for auto parts that will drive long-term growth in profits for AutoZone.

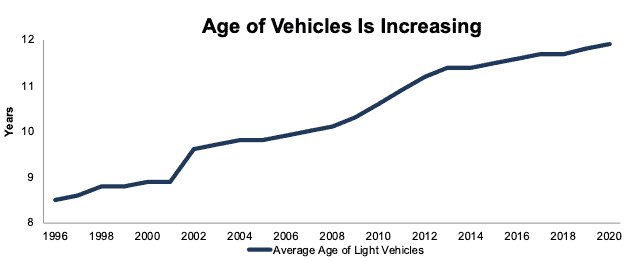

Per Figure 2, the average age of light vehicles on the road in the U.S. has steadily climbed from 8.5 years in 1996 to 11.9 years in 2020. AutoZone calls vehicles seven years and older “our kind of vehicles” because these vehicles are typically out of warranty and require more maintenance and repair than newer ones.

Figure 2: Average Age of U.S. Light Vehicles Since 1996

Sources: New Constructs, LLC, BTS & IHS Markit

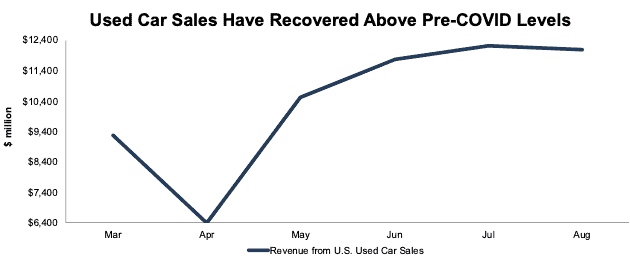

We think the average age of vehicles on the road will continue to rise as used cars sales rise. After falling to just $6.4 billion in April 2020, used car sales climbed higher each subsequent month before reaching an all-time high of $12.2 billion in July 2020.

Figure 3: Used Car Sales Since March

Sources: New Constructs, LLC and company filings.

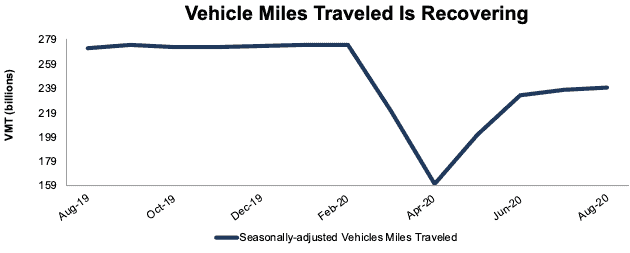

Revenues Rose Despite COVID-Related Decline in Miles Driven

COVID-19-related disruptions led to a dramatic decline in seasonally adjusted vehicle miles traveled (VMT) in the U.S. While much of the decline in VMT appears to be attributable to short-term pandemic-related disruptions, many are concerned that the rise of work from home will keep VMT low. However, seasonally-adjusted VMT has been on the rebound. VMT fell from 275 billion in February 2020 to just 160 billion in April 2020, before improving to 240 billion (just 13% below February 2020’s level) in August 2020 (the last date available).

Furthermore, the lingering reluctance to fly and use public transportation likely provides a boost to VMT over the medium to long term.

Figure 4: U.S. Vehicle Miles Traveled

Sources: New Constructs, LLC and FRED.

Most importantly, lower VMT has not translated to lower sales for AutoZone. Despite the decline in seasonally adjusted VMT, AutoZone’s sales in fiscal 2020 reached an all-time high. COVID-19-related disruptions have given many customers more time for DIY projects, which drove higher revenue for AutoZone just as it has for Home Depot (HD) and other retailers that support DIY projects. If this short-term trend turns into a long-term shift in consumer behavior, the firm is positioned to continue to enjoy even more growth.

Electric Vehicles Require Maintenance, Too

Perhaps, the biggest concern bears have with auto parts retail growth is the growing adoption of electric vehicles (EV). While it is true that EVs have fewer parts and lower maintenance costs, their maintenance costs are only 26% lower than conventional vehicles[1].

AutoZone already supplies several parts for Tesla’s such as struts, brake pads, rotors, windshield wipers, headlights, cabin air filters, and mirror replacement glass.

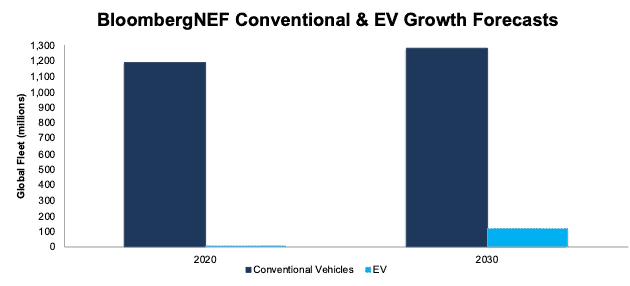

Offsetting the lower maintenance costs from EVs is the fact that the global auto fleet will continue to largely consist of conventional vehicles for many years to come. BloombergNEF expects there will be 200 million more conventional vehicles on the road by 2030 while the number of EVs increases by only 108 million. In other words, the number of new conventional vehicles on the road will increase nearly twice as much as the number of EVs.

Figure 5 shows the forecasted growth of conventional vehicles and EVs from 2020 to 2030.

Figure 5: EV’s Forecasted to Comprise Just 8% of Global Passenger Fleet by 2030

Sources: New Constructs and BloombergNEF.

Assuming EVs are 8% of the global fleet in 2030 (as forecast by BloombergNEF), total maintenance spending would grow by 1% compounded annually, as the increase in the number of conventional vehicles offsets the lower maintenance costs of EVs. Even if the EV fleet is 56% of the global fleet in 2030, total maintenance spending still equals 2020’s level of $1.5 trillion.

Getting More From Less

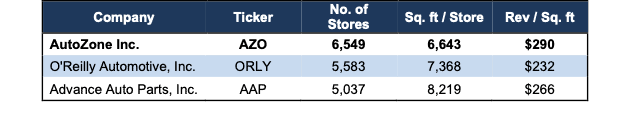

Today, AutoZone has more stores than any other auto parts retailer and has grown its total number of stores from 4,627 in fiscal 2010 to 6,549 in fiscal 2020, or 4% compounded annually.

While AutoZone has the largest number of stores, its average store size is smaller than O’Reilly Automotive (ORLY) and Advance Auto Parts’ (AAP) stores. In this case, smaller seems to be better. Per Figure 6, AutoZone generates more revenue per square foot of store space than O’Reilly Automotive and Advance Auto Parts.

Figure 6: AutoZone Generates More Revenue / Sq. ft Than O’Reilly & Advance Auto Parts

Sources: New Constructs, LLC and company filings.

While the firm has consistently grown revenue, it has also reduced expenses. AutoZone’s operating, selling, general & administrative expense have fallen as a percent of revenue from 37% in fiscal 2018 to 34% in fiscal 2020.

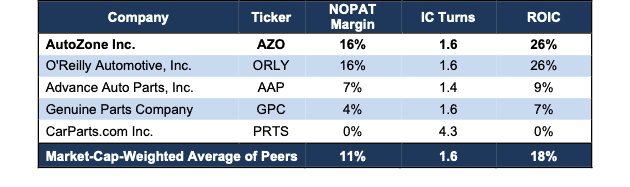

Best-in-Class Profitability

The ability to grow sales while reducing expenses means AutoZone’s profitability is best amongst its peers, too. AutoZone’s invested capital turns equal the market-cap-weighted average of its peers, while its net operating profit after-tax (NOPAT) margin of 16% is well above its peer group’s margin of 11%. AutoZone’s return on invested capital (ROIC) of 26% is also much higher than its peer group’s ROIC of 18%.

AutoZone’s peers include O'Reilly Automotive, Advance Auto Parts, Genuine Parts Company (GPC), and CarParts.com Inc. (PRTS).

Figure 7: AutoZone’s NOPAT Margin, Invested Capital Turns & ROIC vs. Peers’

Sources: New Constructs, LLC and company filings.

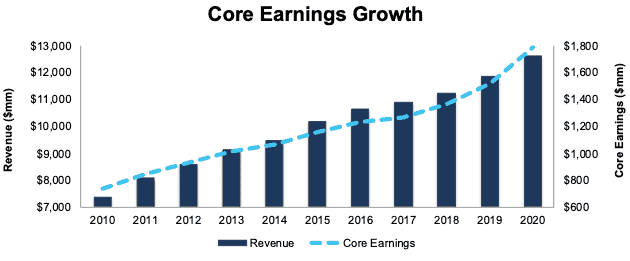

AutoZone’s superior profitability drives the firm’s consistent growth in core earnings[2]. AutoZone has grown core earnings by 9% compounded annually over the past decade and 10% compounded annually over the past two decades. The firm increased its core earnings margin from 10% in 2010 to 14% in 2020.

Figure 8: Core Earnings & Revenue Growth Since 2010

Sources: New Constructs, LLC and company filings.

AutoZone has also generated $5.9 billion (22% of market cap) in free cash flow (FCF) over the past five years. The firm’s $833 million in FCF in fiscal 2020 gives AutoZone a 2% FCF yield, which is significantly above the Consumer Cyclicals Sector average FCF yield of 0%.

Executive Interests Are Aligned With Shareholders’

AutoZone keeps managers focused on creating value for shareholders by linking its executive compensation plan to return on investment (ROIC). No matter the macro environment, investors should look for companies with executive compensation plans that directly align executives’ interests with shareholders’ interests. Quality corporate governance holds executives accountable to shareholders by incentivizing them to allocate capital prudently.

In addition to stock options and stock purchase plans, AutoZone’s executive compensation plan pays annual cash incentives that are tied to EBIT and ROIC objectives. AutoZone’s compensation plan is not just advantageous for the company’s executives, but also to its shareholders as there is a strong correlation between improving ROIC and increasing shareholder value. AutoZone’s focus on economic profit and ROIC has created value for shareholders. AutoZone has grown economic earnings from $672 million in fiscal 2010 to $1.7 billion in fiscal 2020.

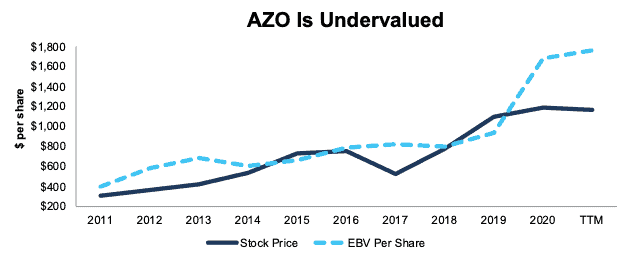

AZO Is Undervalued

Despite being the largest and most profitable auto parts supplier, multiple industry tailwinds, and high quality corporate governance, AZO trades well below its economic book value (EBV), or no-growth value. Its current price-to-economic book value (PEBV) ratio of 0.7 is the cheapest since 2017. This ratio means the market expects AutoZone’s NOPAT to permanently decline by 30%. This expectation seems overly pessimistic over the long term. For reference, AutoZone has grown NOPAT by 9% compounded annually over the past two decades.

AutoZone’s current economic book value is $1,757/share – a 51% upside to the current stock price.

Figure 9: Stock Price vs. Economic Book Value (EBV) per Share

Sources: New Constructs, LLC and company filings.

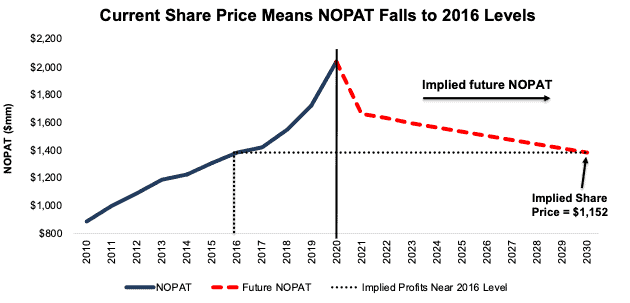

AZO’s Current Price Implies 30% NOPAT Decline

Below, we use our reverse DCF model to quantify the cash flow expectations baked into AutoZone’s current stock price. Then, we analyze the implied value of the stock based on different assumptions about AutoZone’s future growth in cash flows.

Scenario 1: In this worst-case scenario, we assume:

- NOPAT margin falls to 13% (10-year average compared to 16% TTM)

- Revenue declines 1.5% compounded annually for ten years (compared to 3.5% compounded annual consensus estimated revenue growth from 2021 to 2023)

In this scenario, AutoZone’s NOPAT declines 2% compounded annually over the next 10 years, and the stock is worth $1,152/share today – near the current stock price. See the math behind this reverse DCF scenario.

Figure 10 compares the firm’s implied future NOPAT in this scenario to its historical NOPAT. This worst-case scenario implies AutoZone’s NOPAT a decade from now will be 32% below its fiscal 2020 NOPAT. In other words, this scenario implies that 10 years from now, AutoZone’s NOPAT will be at 2016 levels. In any scenario better than this one, AZO holds significant upside potential, as we’ll show below.

Figure 10: Current Valuation Implies Severe, Long-Term Decline in Profits: Scenario 1

Sources: New Constructs, LLC and company filings.

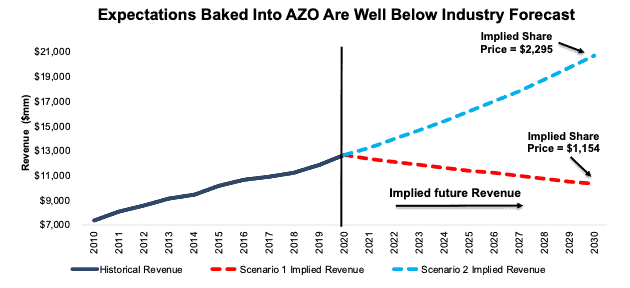

Scenario 2: To put the expectations baked into AutoZone’s current price into perspective, we provide Scenario 2. In this scenario, we assume the same margins as Scenario 1, but revenue grows by 5.1% compounded annually (or the forecasted global automotive aftermarket (CAGR). Figure 11 compares the implied revenue growth/decline for both scenarios. Note that the implied 2030 revenue in Scenario 1 is 50% below the implied revenue in Scenario 2.

Figure 11: Current Valuation Implies Negative Revenue Growth While Industry Grows at 5%

Sources: New Constructs, LLC, company filings, and Prescient & Strategic Intelligence.

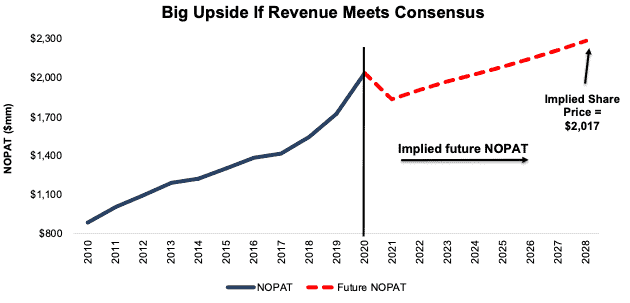

Scenario 3: Big Upside With Consensus Growth Rates

Even if AutoZone grows slower than industry projections and meets consensus estimates, AutoZone is worth much more than its current price. In this scenario we assume:

- NOPAT margin falls to 14% (five-year average compared to 16% TTM)

- Revenue declines 3.5% compounded annually from 2021 to 2023 (consensus estimates) and grows at 3% a year thereafter, which is below the average global GDP growth rate since 1961 (3.5%)

In this scenario, where AutoZone’s NOPAT grows by just 3% compounded annually over the next 10 years, the stock is worth $2,017/share today – a 73% upside to the current stock price. See the math behind this reverse DCF scenario.

Figure 12 compares the firm’s implied future NOPAT in this scenario to its historical NOPAT.

Figure 12: Significant Upside with Moderate Revenue Growth: Scenario 3

Sources: New Constructs, LLC and company filings

Sustainable Competitive Advantages Will Drive Shareholder Value Creation

Here’s a summary of why we think the moat around AutoZone’s business will enable it to continue to generate higher NOPAT than the current market valuation implies. The following competitive advantages help AutoZone grow its market share over the long term:

- Largest and most profitable firm in its industry

- A customer-service intensive offering that non-specialty retailers cannot replicate

- Existing relationships with commercial customers

What Noise Traders Miss With AutoZone

These days, fewer investors focus on finding quality capital allocators with shareholder friendly corporate governance. Instead, due to the proliferation of noise traders, the focus is on short-term technical trading trends while high-quality fundamental research is overlooked. Here’s a quick summary of what noise traders are missing:

- Significant tailwinds for auto part demand: large increase in conventional vehicles and average age of vehicles over the next decade

- EVs are not growing fast enough to keep auto part demand from growing

- Valuation implies profits permanently decline by 30%

Catalysts: A Consensus Beat & Return of Total Vehicle Miles to Pre-COVID Levels

According to Zacks, AutoZone beat EPS estimates in 10 of the past 12 quarters and doing so again could send shares higher, especially in the current uncertain economic environment.

While seasonally-adjusted VMT in the U.S. have recovered from their April lows, they are still well below levels from before the pandemic. Should VMT reach pre-COVID levels, demand for AutoZone’s offerings should increase as well, and investors may realize the disconnect between the firm’s strong growth potential and undervalued stock price.

Additionally, if the increase in revenue attributed to new DIY customers persists, future sales could receive a nice boost and carry the stock price higher along with it.

Share Repurchases Are Back and Could Provide Significant Yield

AutoZone neither pays a dividend nor has plans to pay one in the future.

Historically, AutoZone has returned capital to shareholders through share repurchases. Since fiscal 2015, AutoZone has repurchased $8.3 billion (31% of market cap) worth of shares. Though the firm temporarily suspended its repurchase activity in fiscal 2020 to conserve liquidity in response to uncertainty related to COVID-19, AutoZone has since announced it plans to resume share repurchases in fiscal 1Q21. At the end of fiscal 2020, AutoZone had $796 million remaining under its authorization to repurchase shares. Should the firm use all of this authorization at the stock’s current price in fiscal 2021, investors would see a 2.9% yield.

Insider Trading and Short Interest Trends

Over the past twelve months, insiders have bought a total of 5 thousand shares and sold 89 thousand shares for a net effect of 84 thousand shares sold. These sales represent less than 1% of shares outstanding.

There are currently 364 thousand shares sold short, which equates to 2% of shares outstanding and two days to cover. Short interest is down 5% from the prior month. The low and falling short interest indicates not many investors are willing to bet against this firm.

Critical Details Found in Financial Filings by Our Robo-Analyst Technology

As investors focus more on fundamental research, research automation technology is needed to analyze all the critical financial details in financial filings as shown in the Harvard Business School and MIT Sloan paper, "Core Earnings: New Data and Evidence”.

Below are specifics on the adjustments we make based on Robo-Analyst findings in AutoZone’s fiscal 2020 10-K:

Income Statement: we made $517 million of adjustments, with a net effect of removing $305 million in non-operating expenses (2% of revenue). You can see all the adjustments made to AutoZone’s income statement here.

Balance Sheet: we made $2.7 billion of adjustments to calculate invested capital with a net decrease of $1.2 billion. One of the largest adjustments was $354 million in other comprehensive income. This adjustment represented 4% of reported net assets. You can see all the adjustments made to AutoZone’s balance sheet here.

Valuation: we made $11.1 billion of adjustments with a net effect of decreasing shareholder value by $8.6 billion. Apart from total debt, one of the most notable adjustments to shareholder value was $1.3 billion in excess cash. This adjustment represents 5% of AutoZone’s market cap. See all adjustments to AutoZone’s valuation here.

Attractive Funds That Hold AZO

The following funds receive our Attractive-or-better rating and allocate significantly to AZO:

- PFS Bretton Fund (BRTNX) – 5.0% allocation and Very Attractive rating

- Fiera Capital U.S. Equity Long-Term Quality Fund (FCUIX) – 4.0% allocation and Attractive rating

- Invesco Endeavor Fund (ATDCX) – 4.0% allocation and Very Attractive rating

- Clifford Capital Partners Fund (CLIFX) – 3.4% allocation and Attractive rating

- Fiera Capital Global Equity Fund (FCGIX) – 3.0% allocation and Attractive rating

[1] A recent AAA study estimates the average annual maintenance costs for EVs is $949 compared to $1,279 for conventional vehicles.

[2] Our core earnings are a superior measure of profits, as demonstrated in Core Earnings: New Data & Evidence a paper by professors at Harvard Business School (HBS) & MIT Sloan. The paper empirically shows that our data is superior to “Operating Income After Depreciation” and “Income Before Special Items” from Compustat, owned by S&P Global (SPGI).

Disclosure: David Trainer, Kyle Guske II, and Matt Shuler receive no compensation to write about any specific stock, style, or theme.