A Hidden Clue That The Economy Is Going To Stay Strong In 2020

2020 is almost here. It’s a new year, a new decade, and perhaps most importantly, an election year in the US. While the 2020 election is the biggest event that is likely to occur next year, it won’t happen until November. So what’s in store for the economy in the meantime?

In a nutshell, the macroeconomic picture looks pretty good. The Fed isn’t expected to do anything to rates for possibly the entire year. That’s because rates were lowered to counter an impending recession. However, the labor market has remained strong. And, even consumer spending continues to look good.

Nevertheless, after going through a cycle of cuts, the Fed isn’t likely to start raising rates again anytime soon. Low rates are likely to remain for the foreseeable future. That’s typically a good thing for stocks.

Just as an aside, I think the Fed had very little choice when it came to lowering rates. While the job market has remained strong, wage levels have mostly stagnated. And, debt remains an issue for many Americans. Plus, business spending still looks weak, and earnings levels have steadily dropped.

That being said, the danger of a recession seems small at the moment. It certainly helps that China and the US have made progress on a trade deal. Stock investors also seem to be optimistic about the news, sending the major indexes to new highs.

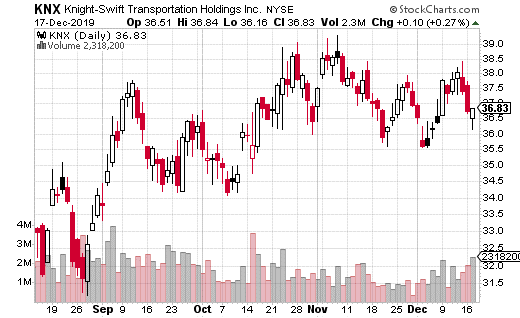

Nevertheless, not all clues to the economy are out in the open. Sometimes, you can get a better picture of what’s going on under the surface by doing a little digging. For instance, a large number of covered calls trading on Knight-Swift Transportation (KNX) may be a good indicator that the economy is going to remain robust for at least the first half of 2020.

First off, KNX is a major trucking company in the US. As you may have guessed, the trucking business improves as the economy grows. It can be a reasonable indicator of how the economy is doing health-wise.

A large trader purchased about 900,000 shares of KNX at $36.60 and sold 9,000 calls against those shares expiring in June. The calls were sold at the 45 strike for $1.30. That’s more than $1 million brought in from the trade, or a 3.5% yield over the life of the position.

What makes this trade so bullish is that the calls were sold at the 45 strike. That leaves room for 25% stock appreciation over the next six months. Whoever placed this position is clearly bullish on the stock and doesn’t want to cap potential upside gains in the share price.

Basically, this position will generate 3.5% in income plus whatever dividends are paid during the next six months, while still allowing for nice upside gains if the stock rallies. Since the upside potential is capped all the way up at 25% gains, that’s a very bullish view on KNX.

With KNX’s performance very much tied to the country’s economic performance, you can argue that this trade is a bullish bet on the economy. It’s also a reasonably safe way to bet on an improving economy next year while also generate some income. Moreover, you can pretty easily make this same trade in your own account.