A Great Example Of Stopping Volume On The Bristol-Myers Squibb Daily Stock Chart

Bristol Myers Squib (BMY) was a stock I mentioned in my weekly stock webinar last week on the topic of stopping volume and I want to follow up on that here as it has developed into an excellent example of the kind of VPA anomalies we look for and what these can reveal in the context of buying and selling by the market makers. In VPA it is the market makers we follow and it is their intentions that are revealed through the prism of volume. This is because they cannot hide their activity and in this way, we can follow their lead.

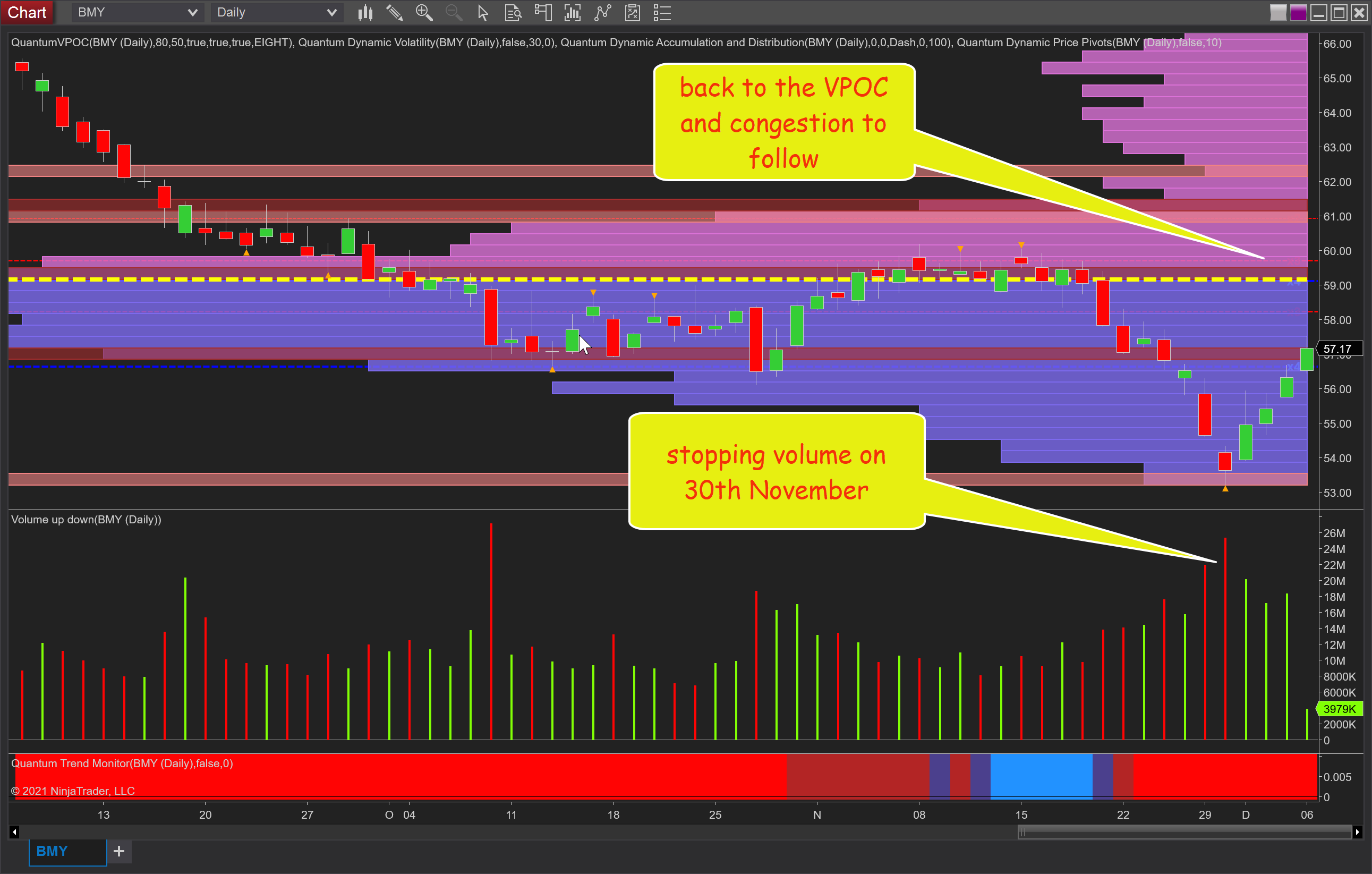

In this example, we are on the daily chart for the stock and one which had fallen from $70 per share down to congestion at the VPOC at $59 per share. Towards the end of November, the price picks up the bearish sentiment once again and breaks away from the VPOC in a price waterfall accompanied by rising volume which is what we always want to see as this confirms the momentum of the move. Then comes the stopping volume on the 30th of November as the market makers step in and start buying. How do we know this? Put simply, if the selling by the market makers were continuing then this candle would be wide in spread, and volume and price in agreement. But as we can see clearly on the chart they are not as the candle is a narrow spread, and on a gap down too, which can often be the precursor to a reversal. Remember, gaps do get closed and precursors to a trap.

The reason we call it stopping volume is precisely for that reason. It is bringing the move to a ‘stop’ as the market makers step in to buy heavily preventing the price from falling further, hence the high volume on a narrow spread candle. Another typical example would be a hammer candle where we would see a deep wick to the lower body, but the net result is the same. This is the reason we have seen the stock rally from the lows of $53 per share back to $57 per share over the last few days. The next question now is whether this is a stock to buy for a longer-term investment? And in my opinion, the short answer right now is no. Why? Because on this timeframe the share price only has $2 to go before it runs back into serious resistance at $59 per share where the VPOC waits as denoted with the yellow dashed line awaits. However, it will be a stock to watch and one I will be featuring in upcoming stock webinars for more VPA lessons.

(Click on image to enlarge)

Disclaimer: Futures, stocks, and spot currency trading have large potential rewards, but also large potential risk. You must be aware of the risks and be willing to accept them in order to invest in ...

more