A Good Time To Buy Roku

Roku (ROKU) stock has been under considerable selling pressure lately. Shares of the streaming leader are down by more than 40% from their highs of the past year, accumulating a 22% decline year to date.

Data by YCharts

Advertising demand is quite cyclical and vulnerable during a recession, and this is being reflected in the company's numbers. Besides, the recent appearance of Android-powered TCL smart TVs in the U.S. is creating additional uncertainty around Roku stock.

But the big picture still looks quite solid over the long term. Investors in Roku need to be willing to tolerate substantial uncertainty and price volatility going forward, but the risk and reward trade-off looks clearly attractive at current prices.

The Long-Term Picture Remains Solid

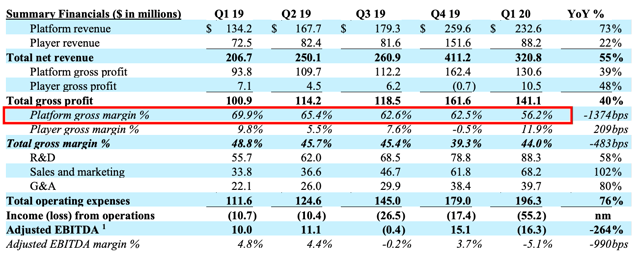

Roku reported healthy growth metrics for the first quarter of 2020. However, the decline in advertising demand during the recession is having a negative impact on profitability levels.

Source: SEC Filings

User growth and engagement remain stronger than ever. Roku added 2.9 million active users during the quarter, ending the period with 39.8 million active accounts. Roku users streamed 13.2 billion hours in the period, an increase of 49% year over year, and sales of player units grew 25%. The average revenue per user, or ARPU, reached $24.35 on a trailing 12-month basis, increasing 28% year over year.

The company is feeling the impact of the recession due to weaker advertising demand, which is hurting profit margins. However, tighter advertising budgets also mean that advertisers are increasingly focused on maximizing effectiveness and measurability, which favors programmatic advertising in general and Roku in particular over the traditional linear TV advertising industry.

In the words of founder and CEO Anthony Wood:

The pandemic is accelerating the shift to streaming by both viewers and the industry. People are spending more time at home and so TV viewing is increasing. Viewers are selecting streaming because of its excellent content and value. Increased unemployment and a likely recession are making value more important than ever. These factors have driven dramatic increases in our new account growth rate since the pandemic took hold.

In the short-term, the pandemic is slowing the growth of Roku’s video advertising business. While advertisers are spending less, reduced budgets mean marketers are looking for ways to invest more effectively and this should accelerate the shift to streaming ad bytes. Our large content distribution business continues to perform well and is seeing a surge in SVOD trials and increased TVOD activity. We believe that the pandemic is accelerating secular trend source streaming and that these changes will be permanent.

Even while expecting a decline in total U.S. advertising expenditures in 2020, management considers that Roku will still be able to deliver substantial revenue growth during the year, albeit at a slower pace and generating a lower gross profit than originally expected before the recession.

The key point to consider is that the negative impact of the recession - declining advertising spend - is temporary in nature. On the other hand, Roku is still benefitting from major tailwinds, such as growing streaming demand and superior effectiveness from programmatic advertising in comparison to linear advertising venues.

An additional reason for concern among investors in Roku is that TCL has recently started selling Android-powered smart televisions in America. However, management clarified at the Bank of America Global Technology Conference 2020 that Roku's relationship with TCL remains as strong as ever and that the company keeps working on multiple new products with TCL.

A recent note from Rosenblatt provides further support to the idea that this is not much of an issue, since Roku still has nearly three times the market share of Android, and Roku also comes well ahead of Android when it comes to value and functionality.

Risk And Reward Going Forward

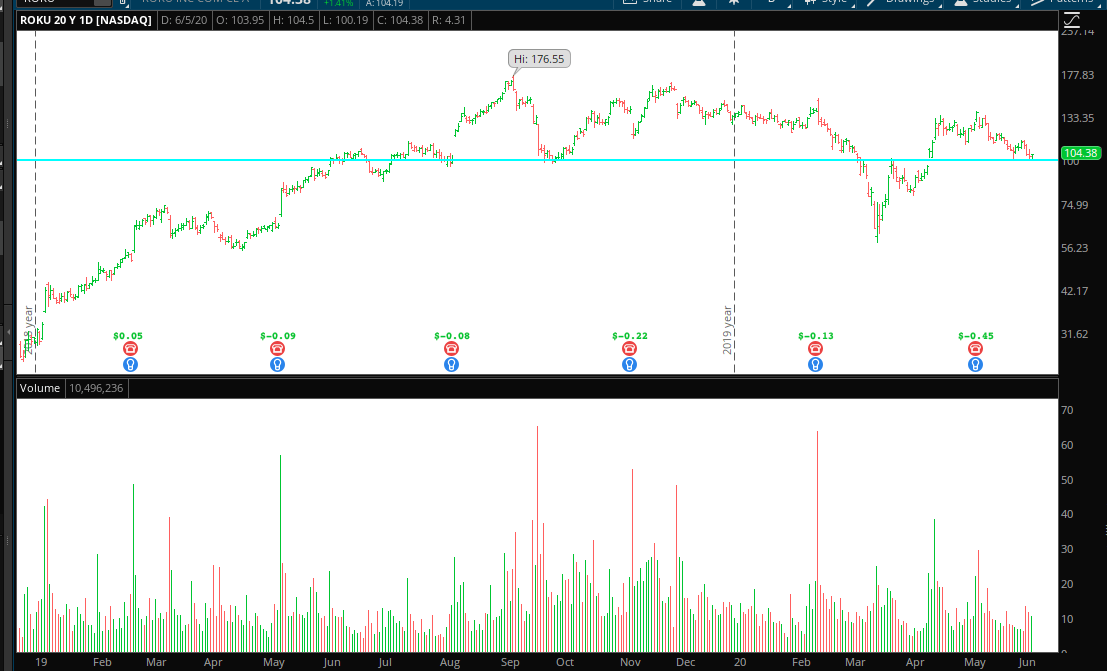

The area around $100 per share has worked as support on multiple occasions over the past two years. If past history is any valid guide for the future, it would be no surprise to see buyers stepping in as the stock approaches $100 again.

(Click on image to enlarge)

Source: TOS

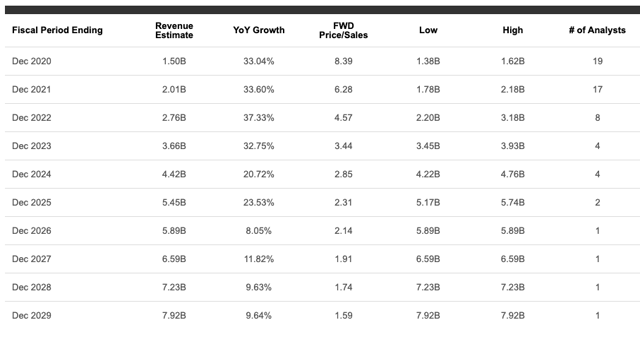

In terms of valuation, the stock is fairly reasonably priced considering the company's long-term growth prospects. The table below shows revenue forecasts and the price-to-sales ratio implied by those forecasts in the years ahead. Roku is trading at a forward price-to-sales ratio of 6.3, which is hardly excessive for a company that can sustain revenue growth rates well above 30% over the middle term.

Source: Seeking Alpha

Profit margins will be affected by weak advertising demand during the recession, but the business model allows for attractive profitability at the fundamental level, and it makes sense to expect Roku to deliver expanding margin in the years ahead if management executes well.

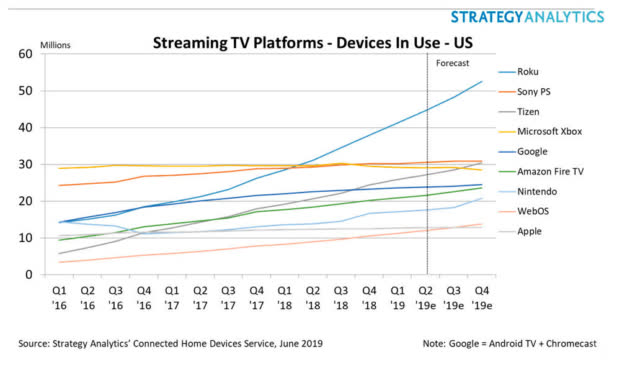

The online streaming revolution is here to stay, and it will only get stronger going forward. Favorable demographic trends are a major tailwind for streaming, and Roku leads the industry by a wide margin. Besides, the company is barely giving the first steps in international expansion, so Roku still benefits from an enormous room for growth.

Source: Strategy Analytics

In simple terms, shares of Roku have been hurt by the recession and by excessive negativity from investors regarding the news from TCL. But the market is usually too short-sighted, and it can be easy to miss the forest for the trees when you pay too much attention to the recent developments.

Recessions will come and go, and buying a fundamentally sound business during a period of transitory weakness can be a good strategy for superior returns. Competitive risk is a major factor to watch, but it is not a reason to stay away from Roku at this stage. The company is still the undisputed market leader, and the size of the opportunity should be large enough for Roku and other players to perform well over the long term.

The industry is rapidly evolving, so a position in Roku carries significant risks, no doubt about that. However, smart investing is not about avoiding all risks, but rather about assuming the risks that are well-compensated when considering both the probability of success and the potential payoff versus the downside risk. At these prices, there is a good probability that investors in Roku will be well-rewarded with strong returns going forward.

Disclosure: I am/we are long ROKU.

Disclaimer: I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with ...

more