A Good Time To Buy Micron

Micron (Nasdaq: MU) operates in a challenging industry, and the company is being affected by economic risk and by the trade war with China, including the recent restrictions to Huawei. Nevertheless, management has proven that it can deliver solid performance through good and bad times, and the stock is quite attractively priced at current levels. Interestingly, both the price action and the fundamental momentum indicators look bullish for Micron over the middle term.

Solid Performance In A Challenging Period

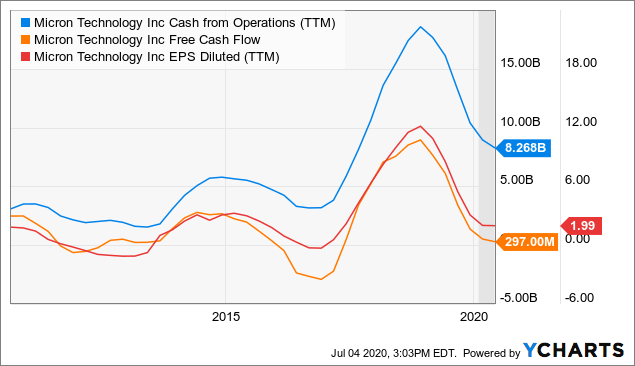

Cyclicality and fluctuating pricing conditions in the industry are always a major source of uncertainty for investors in Micron. However, the company has managed to deliver positive sales, cash flows, and earnings through the ups and downs in the industry cycle over recent years.

Data by YCharts

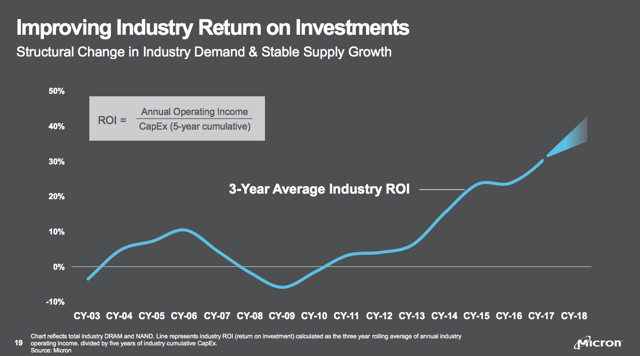

There has been a consolidation process in the industry over recent years. This is making the supply and demand dynamics and the pricing practices more rational and balanced, allowing for better profitability through good and bad periods.

Source: Micron

Long-term technological trends in areas such as data centers, mobile computing, automotive, and Internet of Things are driving a secular shift in demand for Micron's products in terms of both quantity and quality. More sophisticated products generally carry higher pricing power and better profitability metrics than the more basic versions.

The numbers from the most recent earnings report confirm that the business keeps doing well in a difficult period. Total revenue during the quarter reached $5.4 billion, an increase of 14% year over year. The company generated $2 billion in cash from operations during the period accounting for a healthy 37% of revenue. Free cash flow in the quarter was $101 million, marking the 14th consecutive quarter of positive free cash flow for Micron.

Financial performance is still quite volatile, but it is good to see Micron producing consistently positive free cash flows in all kinds of environments. In terms of financial risk, a company that generally delivers positive cash flows is far superior to one that can burn big sums of cash during challenging times.

The pandemic is causing some disruptions in demand, with the auto, smartphone, and PC markets being negatively affected. On the other hand, increasing online activity, e-commerce, online gaming, and video streaming are driving additional data center capacity requirements. Working-from-home and online learning trends could be major tailwinds going forward.

Emerging technologies such as drone-based deliveries and the increased use of robotics across many applications are now being pursued with urgency and adoption of these technologies is being accelerated. These factors are ultimately bullish for Micron in the years ahead.

Visibility over the coming few months is quite blurry due to the pandemic, the macroeconomic uncertainty, and the trade war with China. However, management expects the data center outlook to remain healthy in the coming quarter. Demand for smartphones is expected to increase, and new gaming consoles will drive stronger DRAM and NAND demand, so the overall outlook seems reasonably healthy.

Even more important, the big picture still looks remarkably attractive over the long term. From the earnings conference call:

As these risks recede, we expect a resumption of industry growth, with a long-term bit growth CAGR of mid to high teens for DRAM and approximately 30% for NAND. This growth will be supported by powerful secular technology trends ranging from AI and machine learning to cloud computing, 5G and the growth in edge computing, and the industrial IoT economy.

Attractive Valuation

Being a cyclical company, it can be difficult to assess valuation levels for Micron because margins and earnings can fluctuate considerably from quarter to quarter and from year to year. Nevertheless, it is hard to argue against the fact that Micron is attractively priced in comparison to earnings expectations for the company in the years ahead.

The table below shows Wall Street earnings estimates and the forward PE ratio implied by those estimates from 2020 to 2022. The PE ratio starts at 18 for fiscal 2020 and then it declines to 11 and then to 7 in the next two years. Based on these numbers, Micron is very conservatively valued, if not downright undervalued.

| Fiscal Period Ending | EPS Estimate | YoY Growth | Forward PE |

| Aug 2020 | 2.77 | -56.31% | 17.96 |

| Aug 2021 | 4.57 | 64.80% | 10.9 |

| Aug 2022 | 6.81 | 48.95% | 7.32 |

Source: Seeking Alpha

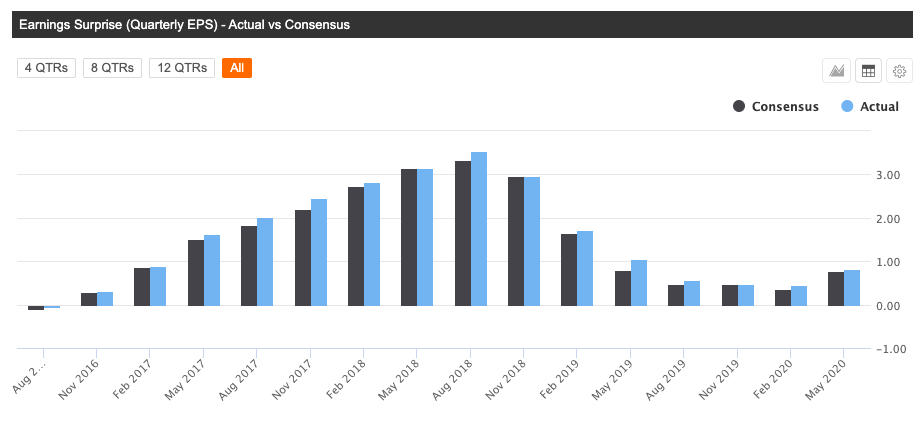

Earnings estimates always carry a considerable margin of error, and there is no guarantee that the company will in fact deliver in accordance with Wall Street expectations. However, it is worth noting that Micron has outperformed Wall Street forecasts in the past 16 quarters in a row. This track record of consistent outperformance is not easy to find in such a cyclical and competitive industry.

(Click on image to enlarge)

Source: Seeking Alpha

The table below shows valuation ratios for Micron in comparison to the median values in the sector. Looking at PE, forward PE, EV/Sales, EV/EBITDA, and price to cash flow, the stock is priced at a considerable discount versus sector standards. Even assuming that Micron could deserve a discount because of the company's cyclicality, the valuation numbers look clearly compelling.

| MU | Sector Median | % Diff. to Sector | |

| P/E GAAP | 25.03 | 35.5 | -29.49% |

| P/E GAAP (FWD) | 20.9 | 38.23 | -45.34% |

| EV / Sales | 2.67 | 3.15 | -15.26% |

| EV / EBITDA | 6.82 | 16.5 | -58.64% |

| Price / Cash Flow (FWD) | 9.09 | 21.73 | -58.19% |

| Avg Discount | -41.38% | ||

Source: Seeking Alpha

The Timing Looks Good

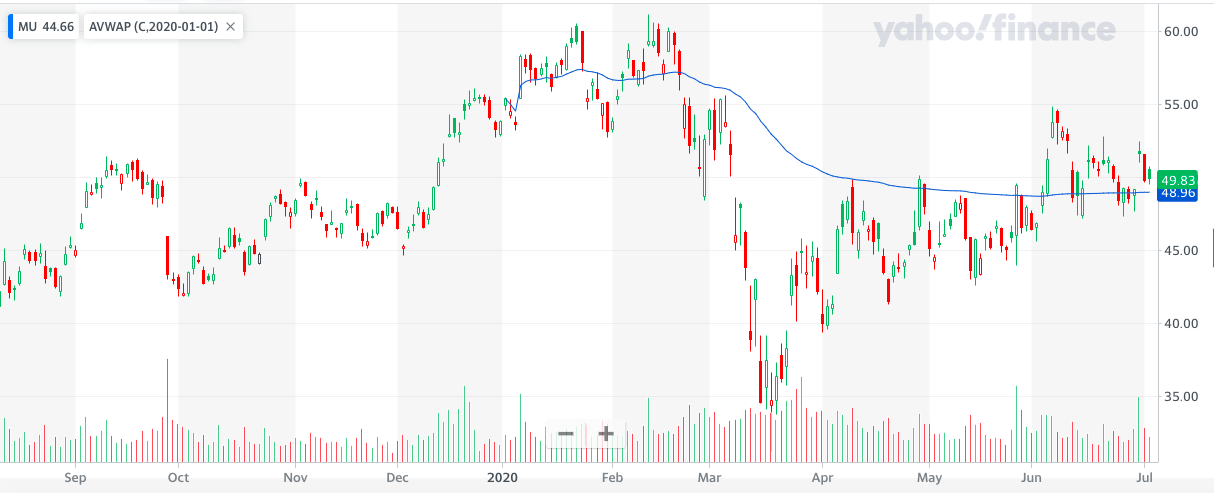

Micron stock has been steadily moving in the right direction from the March lows, and it has been making a series of higher lows over time, which is the main definition of an uptrend. The blue line in the chart shows the Anchored Volume-Weighted Average Price - AVWAP - for Micron since the beginning of the year.

The markets are made by investors, and investors have a memory. When the price is below the AVWAP price, this means that the average buyer since the beginning of the year is losing money and the bears are in control of the price action. Alternatively, when the price is above the AVWAP, the average buyer is making money, and bulls are in control of the price action.

We can see that Micron broke below this level during the market crash in March, and then it struggled to get above the AVWAP on four occasions during April and May. In June the stock managed to finally move above this key level, and this can present a good entry point for investors in Micron in terms of risk versus reward.

(Click on image to enlarge)

Source: Yahoo Finance

Analyzing charts in order to assess supply and demand for a particular stock at specific price levels can be an art as much as a science, and there is a lot of value in putting up the work to find those key levels of supply and demand. Nevertheless, charts can be too subjective sometimes, so it makes sense to complement the visual analysis with a more quantitative approach to analyzing the timing in a position.

The Stocks on Fire algorithm is a quantitative algorithm that ranks stocks in a particular universe based on a combination of two main factors: fundamental momentum and price momentum.

Stock market returns do not depend on the fundamentals alone, but the fundamentals in comparison to expectations are what really move stock prices. If the company is doing better than expected from a fundamental perspective, chances are that the stock price will increase in order to reflect raising earnings and sales expectations for the business.

For this reason, the algorithm measures the adjustment in sales and earnings expectations in order to find companies that are doing better than expected and also generating rising expectations about future performance. From a mathematical perspective, the stronger the increase in earnings and sales expectations, the higher the ranking in fundamental momentum.

Winners tend to keep on winning in the stock market. Besides, money has an opportunity cost, and when you buy a stock with sub-par performance, that capital is not available for investing in stocks with superior strength. You don't just want to buy stocks that are performing well, you want to buy the stocks that are also performing better than others.

The price momentum metric measures returns over different time frames - the past three months, the three-month period that ended three months ago, etc. - in order to identify consistent price winners. The stronger the returns over different time frames, the higher the ranking in price momentum for a particular stock.

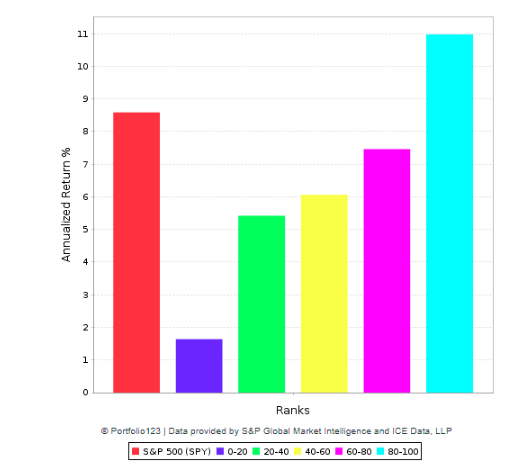

The chart below divides the US stock market into five different buckets based on the quantitative algorithm in order to evaluate past performance since 1999. The data indicates that companies with an elevated ranking tend to perform better than those with a low ranking.

Data from S&P Global via Portfolio123

Micron has a Stocks on Fire ranking above 90 as of the time of this writing, this puts the company in the top 10% of companies in the U.S. stock market based on a combination of fundamental momentum and price momentum.

In other words, not only the chart looks good in terms of potential support and resistance levels, but also the quantitative indicators for fundamental momentum and price momentum are currently bullish for Micron too.

The Bottom Line

Micron operates in a cyclical industry with considerable competitive pressure and fluctuating profitability levels. Macroeconomic risk and the trade war with China are two key factors that can create substantial volatility around the price of the stock. Micron is clearly not the right choice for investors who want stable and predictable returns over time.

However, these risks are already well-acknowledged by the market and incorporated into expectations to a good degree. The company has proven its ability to deliver solid financial performance through good and bad economic times, the long-term picture looks intact, and the stock is very reasonably priced at current prices. Besides, the timing for a position looks good as long as the stock remains above $47 per share in the near term. All in all, the potential reward versus risk in Micron stock looks favorable to the bulls at current prices.

Disclosure: I/we have no positions in any stocks mentioned, but may initiate a long position in MU over the next 72 hours.

Disclaimer: I wrote this article myself, and it expresses my ...

more