A Good Time To Buy Alteryx

Alteryx (AYX) reported earnings on Wednesday, May 6, after the market close. The numbers for the first quarter were clearly strong, but guidance for the second quarter came in below expectations and the company provided no guidance for the full year of 2020. As a reaction, some Wall Street analysts are cutting their price targets on Alteryx, citing factors such as disappointing Q2 guidance.

There is a considerable chance that management is being overly conservative with guidance, and I wouldn't be surprised at all if the numbers for the second quarter turn out to be materially above expectations. Besides, the business fundamentals are as strong as ever, and Alteryx is proving that it can provide valuable solutions for clients during the pandemic and the recession that comes with it.

At current prices, Alteryx looks conveniently valued in comparison to other high growth stocks in the sector, and the company offers plenty of upside potential in the years ahead.

Management Is Being Too Conservative

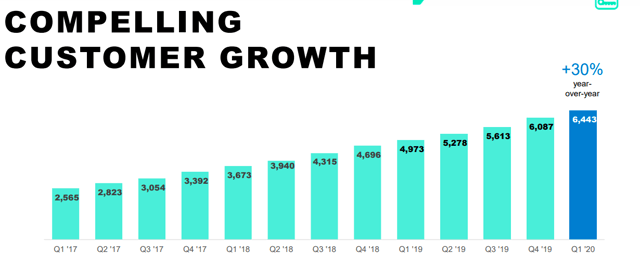

Total revenue during the quarter grew 43% to $108.8 million, and the company generated $20 million in operating cash flow during the period. Alteryx added 356 new customers and the net dollar retention rate was remarkably strong at 128%. The numbers show that the company kept gaining new customers and also making more revenue per customer during the period, so the value propositions for customers are as strong as ever.

Source: Alteryx

However, management is expecting a modest increase of 10% to 15% in revenue during the second quarter. This was the main weak spot in the report and the main reason for disappointment among the analysts following the stock.

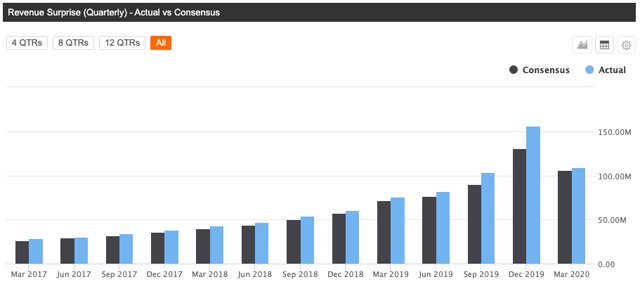

To begin with, it is important to keep in mind that Alteryx always provides modest guidance numbers, as the company likes to keep expectations at bay and consistently overdeliver. In fact, Alteryx has delivered revenue numbers above Wall Street expectations in each of the past 13 quarters in a row.

Source: Seeking Alpha

One of the analysts in the conference call asked for more precision regarding the guidance numbers, and this is what management had to say:

"We've always been conservative even though we've seen some glimmers of hope in April. It turns out of the logos we brought-in in April 35% of them were actually in the highly impacted verticals, that's also some silver lining in this. But as you know, we've been fairly conservative."

In a nutshell, management is saying that the numbers for April showed some encouraging signs, and the company did in fact close some deals with customers that are being highly affected by the pandemic.

But Alteryx is always conservative when it comes to guidance, and the current economic environment is unprecedentedly uncertain, so it makes sense for the company to be especially modest in its assumptions for the second quarter of 2020.

The Big Picture Remains Intact

Data analytics are increasingly important for companies all over the world, not only to identify new growth venues, but also to increase efficiencies and reduce costs. The company calculates that its total addressable market is worth nearly $28 billion, and over the coming years, the size of such a market opportunity is expected to reach as much as $49 billion.

Even among existing customers, the company still has a lot of room for further growth, and Alteryx is barely getting started in terms of international expansion.

During a recession, it can be hard for a company such as Alteryx to gain new customers among companies that are facing a big slump in revenue. However, it is also worth noting that businesses are increasingly relying on data analytics to maximize all kinds of efficiencies and reduce costs.

Management highlighted during the conference call that Alteryx did business with several top players in highly impacted verticals such as leisure and entertainment, energy, and financials.

Some of the names mentioned by the company are Caesars Entertainment, Choice Hotels, Copa Airlines, Royal Caribbean Cruise Lines, Chevron USA, Dominion Energy Services, Mid-American Energy Company, BNP Paribas, Royal Bank of Canada, and Standard Charter Bank, among others.

The fact that Alteryx's solutions are being demanded by these companies situated at the eye of the storm shows that making sense of data and focusing on efficiencies can be remarkably important during a recession.

In other areas, Alteryx is even benefiting from increased analytics needs because of the pandemic. An existing public sector client purchased additional Alteryx licenses to analyze and measure the effectiveness of a multi-billion-dollar aid program. Similarly, a hospital leveraged Alteryx to quickly adapt their supply chain and to build predictive models to understand the need for ICU beds.

Alteryx is a top player in high-quality data analytics, and the business is benefiting from enormous opportunities in the years ahead, with or without the pandemic. Even during tough periods for the economy, effective analytics is not only a growth investment, but sometimes, even a necessity for survival.

Attractive Valuation

The table below shows some key statistics for Alteryx in comparison to other highly successful companies in the industry: Twilo (TWLO), Okta (OKTA), The Trade Desk (TTD), Data Dog (DDOG), and Zscaler (ZS). The comparisons are not very straightforward since these 6 companies operate in different segments and there are some important differences in their business models.

However, it can still be illustrative to compare Alteryx versus other successful industry players with similarly elevated growth expectations. To begin with, Alteryx has the highest gross margins in the table and the second-highest operating margin behind The Trade Desk, which is an exceptionally profitable business.

In spite of having similar expected growth rates in revenue and comparatively attractive profitability levels, Alteryx is trading at the lowest price to sales ratio in the table.

| Growth | AYX | TWLO | OKTA | TTD | DDOG | ZS |

| Sales Growth TTM | 61.40% | 67.91% | 46.79% | 36.70% | 83.15% | 48.23% |

| Sales Growth Projected | 30.71% | 24.62% | 29.73% | 37.68% | 32.43% | 28.90% |

| Gross Margin | 92.90% | 60.62% | 75.84% | 80.16% | N/A | 83.85% |

| Operational Margin | 5.42% | -29.12% | -31.12% | 16.74% | N/A | -11.64% |

| Price to Sales | 19.01 | 19.76 | 35.13 | 21.75 | 46.68 | 26.4 |

Data from S&P Global via Portfolio123

Many of the companies in the table are actually beneficiaries of the shelter-at-home directives during the pandemic, and this needs to be considered when assessing relative valuation metrics. Nevertheless, it looks like Alteryx is more than reasonably priced on a relative basis.

An interesting way to look at valuation is by inverting the process. We can take a look at the growth expectations and try to assess if the company can meet or exceed those expectations. If the company can outperform growth expectations in the future, this means that the stock could offer attractive upside potential from current prices.

The table below shows revenue estimates, year-over-year growth rates, and the price to sales ratio implied by those expectations. Estimates for 2020 are obviously very uncertain, but the market is expecting a 30.7% increase in revenue during 2021, and a subsequent deceleration in the following years. This would represent a material deceleration versus a 43% increase in sales during the first quarter of 2020, which includes the impact of the recession in March.

It is generally safer to make conservative growth assumptions when valuing a stock, but I wouldn't be surprised at all to see Alteryx exceeding growth expectations in the coming quarters and years.

| Fiscal Period Ending | Revenue Estimate | YoY Growth | FWD Price/Sales |

| Dec 2020 | 501.88M | 20.09% | 17.12 |

| Dec 2021 | 656.03M | 30.71% | 13.1 |

| Dec 2022 | 836.68M | 27.54% | 10.27 |

| Dec 2023 | 1.00B | 19.54% | 8.59 |

| Dec 2024 | 1.23B | 22.61% | 7.01 |

| Dec 2025 | 1.49B | 21.35% | 5.78 |

| Dec 2026 | 1.78B | 19.55% | 4.83 |

| Dec 2027 | 2.10B | 17.79% | 4.1 |

| Dec 2028 | 2.44B | 16.63% | 3.52 |

| Dec 2029 | 2.82B | 15.54% | 3.04 |

Source: Seeking Alpha

Valuation should be interpreted in its due context. A company that generates strong profitability and consistently beats expectations deserves a higher price to sales ratio than a business with below-average profitability and underperforming expectations.

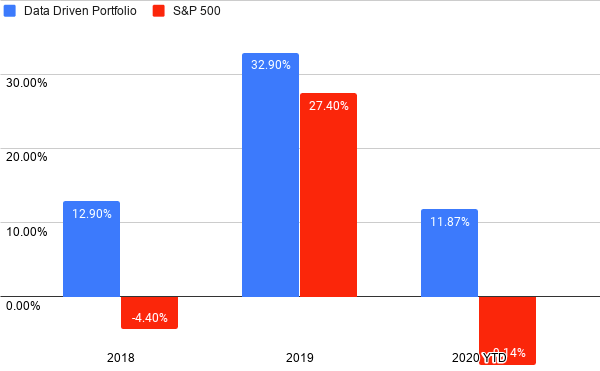

However, it can be difficult to incorporate multiple factors into the analysis and quantify them in order to see the complete picture. In that spirit, the PowerFactors algorithm is a quantitative system that ranks companies in a particular universe according to a combination of factors: financial quality, valuation, fundamental momentum, and relative strength.

Data from S&P Global via Portfolio123

The backtested performance numbers show that companies with high PowerFactors rankings tend to deliver superior returns over the long term, and the higher the ranking, the higher the expected returns.

Alteryx has a PowerFactors ranking above 85 as of the time of this writing. This means that the stock is comfortably in the top 20% of companies in the US stock markets based on financial quality, valuation, fundamental momentum, and relative strength together.

It is important to keep in mind that an algorithm such as PowerFactors is based on current data and current expectations about future data. This provides an assessment based on hard data, as opposed to opinions, but it also has some limitations.

In essence, forward-looking returns will depend on the cash flows that the business can produce in the future. The algorithm is saying that Alteryx is attractively priced based on current expectations and past history. However, the company needs to continue leading the industry and capitalizing on its long-term growth opportunities in order to meet and ideally exceed expectations going forward.

The main strength of a quantitative algorithm is that it provides a quantifiable approach based on hard data to make investment decisions supported by evidence. However, investors should always assess the business behind those numbers in order to analyze if the numbers are sustainable or not going forward.

The main point is that Alteryx is reasonably valued in comparison to other high growth companies in the sector. Future growth expectations among the analysts following the stock are more than reasonable, and the valuation metrics based on multiple factors are clearly strong. As long as management keeps leading the company in the right direction, Alteryx should be able to deliver solid returns from current price levels.

Performance as of May 10, 2020:

Disclosure:

I am/we are long AYX, TWLO, TTD.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it ...

more