A Good Entry Point In Ollie's

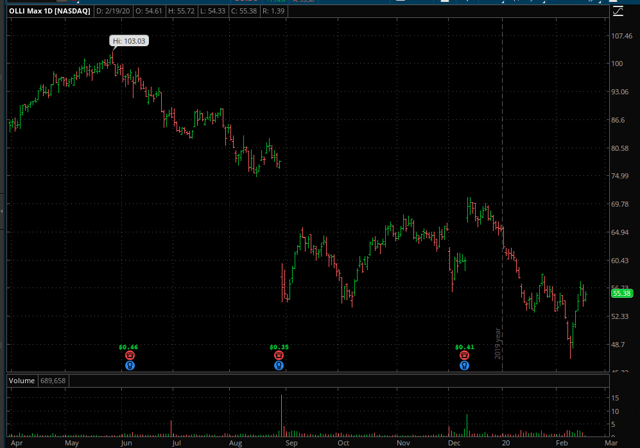

Shares of Ollie's Bargain Outlet Holdings (OLLI) have been under heavy selling pressure lately. The stock is down by more than 45% from its highs of the year, mostly due to industry-wide pessimism and declining same-store sales from the company. However, the business remains solid from a fundamental perspective, with both total revenue and earnings growing nicely. At current prices, the risk and reward trade-off in Ollie's looks favorable to the bulls over the middle term.

The Reasons For The Decline

First and foremost, it is important to understand the broad market context for the sector. Brick and mortar retailers in different categories have been under a lot of pain due to online competition and brutal pricing conditions in the industry over recent years.

Investors tend to generalize, and they, many times, make rough extrapolations from one company to another. After seeing retailers delivering dismal performance over the past several years, there is little patience for companies such as Ollie's bargain when they show any weakness.

Adding to the concerns, Ollie's founder and CEO, Mark Butler, unexpectedly passed away in December. The company has a deep management team with highly experienced executives, but the loss of such an important leadership figure is understandable generating uncertainty.

It is interesting to note that Ollie's bargain actually reported both sales and earnings numbers above Wall Street expectations last quarter, and the stock had a strong rally of over 12% as an initial reaction to the report on December 10, 2019.

But over the ensuing days, the stock lost all of the post-earnings gains and then some more. These declines happened in the context of lackluster numbers from Five Below (FIVE) and other companies in the sector, indicating that this is more of a sector-wide phenomenon as opposed to a company-specific issue alone.

(Click on image to enlarge)

Source: TOS

Back to the specific numbers from Ollie's, total revenue growth was a healthy 15.3% during the quarter, but comparable-store sales declined by 1.4% year over year, and this was arguably the main weak spot in the report.

The company had already announced a big earnings miss in the second quarter of the year, and the stock price was already down considerably as a reaction to the numbers for the second quarter. In a sense, it is hard to say that the numbers for the third quarter were much worse than could be expected based on the numbers and the guidance from the prior quarter.

The company had already reported a decline of 1.7% in comparable sales during the second quarter, and management explained at the time that the decline was due mostly to cannibalization from new store openings and the impact from the stores that the company acquired from Toys-R-Us.

The exceptional strength, rapid pace of openings and larger footprint of these new stores impacted comparable store sales through increased cannibalization and supply chain pressures that reduced comparable store inventory levels. Comparable store sales were also affected by headwinds from store classes with exceptionally strong first-year sales now normalizing as they entered the comparable store base

In light of those numbers, the company had already adjusted its guidance for the full year, expecting a comparable store sales decrease in a range of 0.5% to 1.5%.

Keeping these factors in consideration, the 1.4% decline in comparables last quarter doesn't look particularly dire, especially since both total revenue and earnings outperformed expectations during the period.

From the most recent conference call:

As we stated on our last call, the outsized cannibalization impact of the TRU sites and the record performance of our new stores entering the comp base are expected to remain headwinds for the remainder of this year. However, our long-term growth algorithm remains the same.

It is never nice to see declining same-store sales for a company that was previously reporting consistent growth in this metric. But overall revenue is still growing nicely, and it looks like the drivers behind the decline are not particularly negative for the business over the middle term.

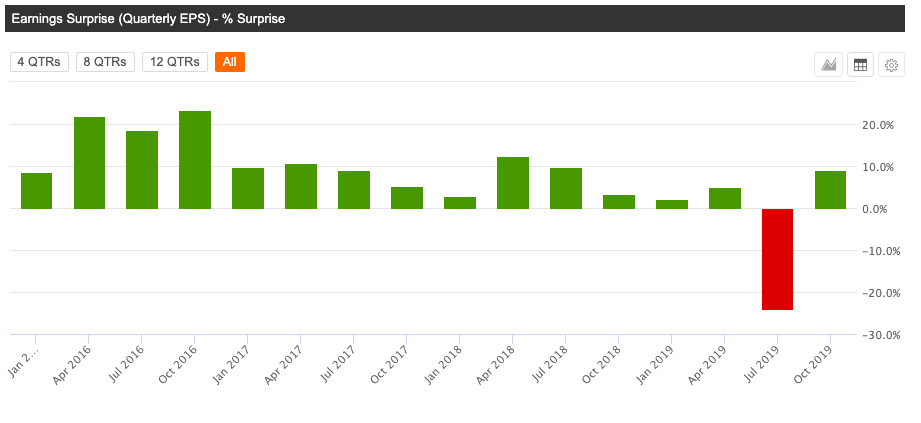

It is important to keep the big picture in perspective when analyzing financial performance, Ollie's Bargain Outlet has only missed earnings estimates in just one of the past 16 quarters. This is actually quite an outstanding track record of beating expectations for a business operating in such a challenging and competitive sector.

(Click on image to enlarge)

Source: Seeking Alpha

The Fundamentals Remain Solid

The decline in same-store sales is a yellow flag in terms of financial performance, but it's not like the company is facing shrinking revenue and burning money. Far from that, in fact.

Net sales totaled $327 million in the third quarter of fiscal 2019, an increase of 15.3% compared with net sales of $283.6 million in the third quarter of fiscal 2018. The company opened 42 new stores in the fiscal year, which includes 14 former Toys R Us locations. The 1.4% decline in same-store sales was more than compensated by a 16.2% year-over-year increase in store count.

Gross profit increased 15.5% year over year to $133.3 million in the third quarter of fiscal 2019. Gross margin as a percentage of revenue increased 10 basis points to 40.8%. This increase in gross margin was driven by an increase in merchandise margin, partially offset by higher supply chain costs.

Operating income increased 22% to $35.7 million in the quarter. Operating margin increased 60 basis points to 10.9%, driven by the increase in gross margin and the reduction of pre-opening expenses as a percentage of net sales. Adjusted net income per share increased 28.1% year over year.

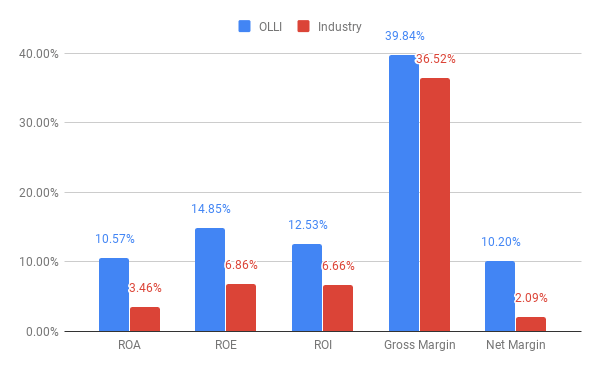

Ollie's Bargain Outlet has always produced profitability levels well above those of other companies in the industry, and this remains the case as of the most recent quarter.

The chart below compares key profitability metrics for Ollie's versus the average company in the multiline retail industry. Looking at return on assets, return on equity, return on investment, gross margin, and net margin, Ollie's is clearly superior to the average industry player by a wide margin.

(Click on image to enlarge)

Data from S&P Global via Portfolio123

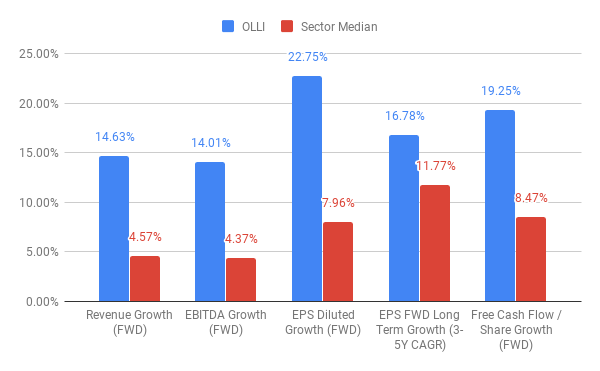

When comparing growth metrics versus other players in the sector, Ollie's Bargain Outlet is also way ahead of other companies. The chart shows revenue and earnings growth metrics in comparison to the median values in the consumer discretionary sector.

(Click on image to enlarge)

Data Source: Seeking Alpha

Valuation Is Looking Attractive

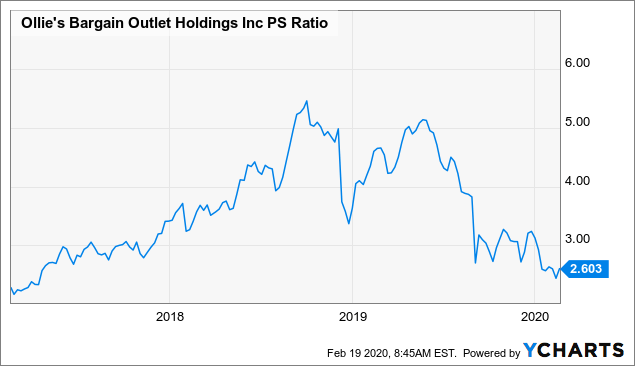

With revenue consistently expanding and the stock price declining in recent months, the price to sales ratio is now at 2.6, which is nearly half of what it used to be when the stock was at record highs. Granted, the stock was arguably too expensive at the highest point, but there is also a considerable chance that valuation is too low currently.

(Click on image to enlarge)

Data by YCharts

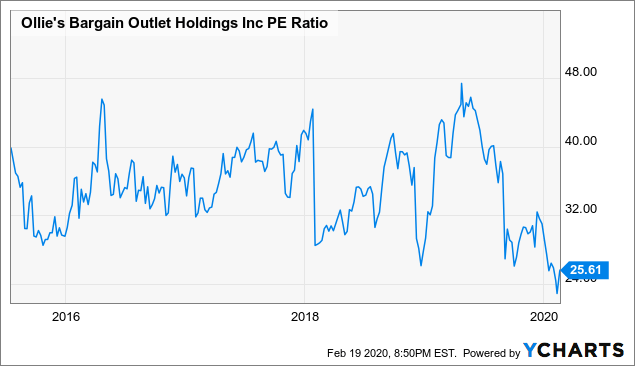

Looking at the price to earnings ratio, Ollie's Bargain Outlet is trading at the lowest valuation levels in the past decade.

(Click on image to enlarge)

Data by YCharts

To put the numbers in perspective, the average price target among the analysts following the stock is $71.5. This level would represent an attractive upside potential of 28% versus current market prices, and it is not too unreasonable at all when keeping valuations in a historical perspective.

Ollie's Bargain Outlet operates in a very challenging sector, and the loss of the company's CEO in addition to declining same-store in recent quarters are valid reasons for concern.

But those factors are already acknowledged by the market and incorporated into the stock price. From these levels, the stock looks well-positioned for attractive returns in the middle term.

Disclaimer: I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in ...

more