A Few Red Flags That Signal A Stock Market Correction Is Coming

It's been a while since the stock market took a deep dive lower. With the perpetual Fed put in place, sentiment has been unstoppable for a very long time now. In fact, it seems like many market participants forgot about how much pain a real correction could bring. Well, I see several red flags out there, and things could get ugly very soon. The market looks increasingly weak in recent sessions. Considering all the technical, fundamental, and psychological issues, the S&P 500 could be heading for a 10% pullback in the coming weeks, and I don't want to be left standing out in the rain when the storm arrives.

First Red Flag: The Technical Image Is Weakening

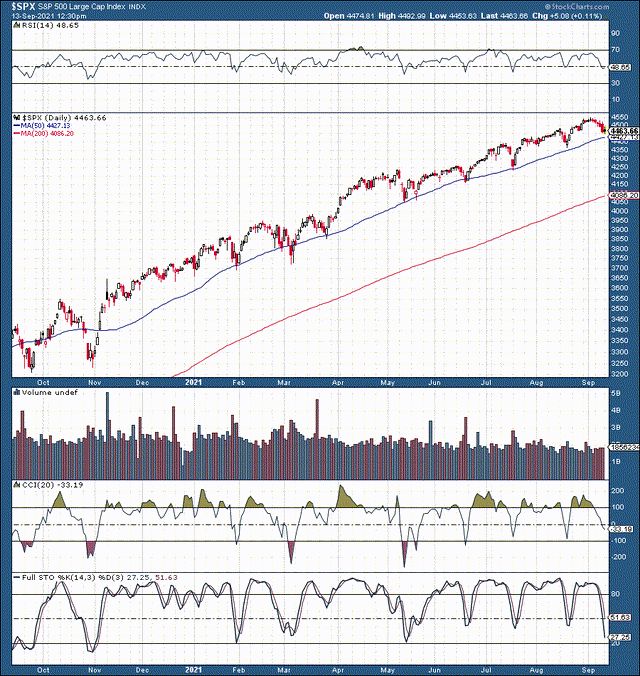

Source: stockcharts.com

The SPX continues to climb higher and higher, bouncing off the 50-day moving average with ease over the last six months. Not once in this time have we seen a pullback deeper than 3-4%. So, what is the "red flag" here, you may ask?

The market has not had a good shakeout in a very long time. Historically, a 10% pullback once a year is considered healthy and typical. Incidentally, the last time the SPX had a 10% correction was a year ago, last fall. This down move was also the last time the SPX approached an RSI of 30, or the full stochastic went below 20.

This technical dynamic illustrates that while the market has continued to get overbought and make new highs over the past year, it has not seen any notable pressure to the downside. The question is not if but when a significant correction materializes, and I believe the time is approaching soon.

Second Red Flag: Valuations Nearing Dot-Com Levels

A typical reason why we see corrections in markets is due to valuation concerns. When stock valuations get overstretched the market often contracts to bring valuations back down to earth. This phenomenon also allows buyers to come into the market at more attractive levels. The SPX had appreciated by roughly 40% from its 2020 fall lows. This is a remarkable surge in a relatively short time frame.

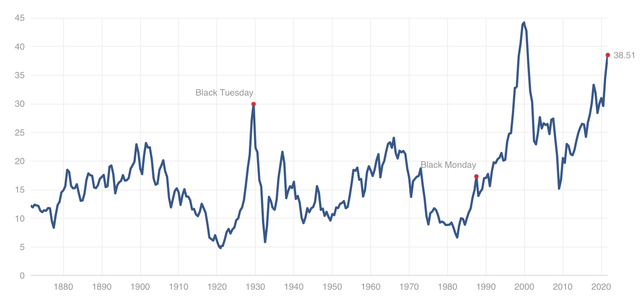

Shiller P/E Ratio

Source: multpl.com

This chart is a historical view of the cyclically adjusted/Schiller P/E ratio. Now, we see how high it is (higher than the 1929 and 2007 peaks). Moreover, the Schiller P/E ratio is about 50% higher than in 2007. The question is, how high can it go? Can it go as high as in 2000? Can it go higher? I doubt that P/E valuations will eclipse the looney days of the late 1990s, but one thing is for sure, there will be corrections along the way to the top.

You won't tell it from this chart, but the SPX went through three 10% plus corrections in the late 1990s, one in 1997, 1998, and 1999, before stocks ultimately melted in 2000. With equity valuations approaching similar levels as the late 1990s, we may be due for a significant decline here as well.

Third Red Flag: The Fed Taper Could Impact Sentiment

Everything is going so well, why would stocks go down all of a sudden? The Fed will meet and deliver its interest rate decision in about ten days. While we know that the Fed is not going to raise rates any time soon, it is very likely going to start tapering (decreasing QE) very soon.

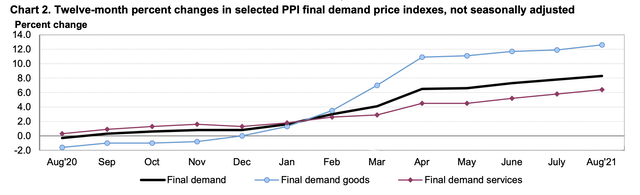

Why is this happening? The Fed has various reasons for wanting to take away the proverbial punchbowl. However, one of the more pressing factors is inflation. At 5.4% the CPI is starting to run quite hot, and final demand goods PPI for August came in at a staggering 12%+ for August.

Source: bls.gov

At this pace, we could see inflation inflict some real damage to the economy while eroding the purchasing power of consumers at the same time. Therefore, the Fed needs to act before the inflation issue gets out of hand and transforms into a new financial crisis. The last thing that the Fed wants is to be responsible for enabling the next financial crisis to occur. Therefore, the central bank will act, and when it does, sentiment could change very quickly.

Fourth Red Flag: The Coronavirus

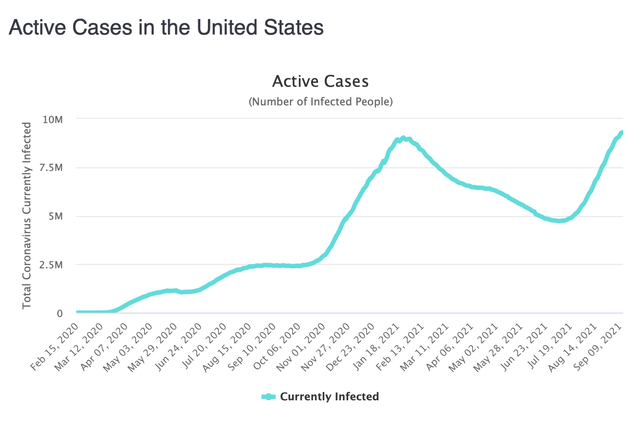

Another issue that could start to plague the stock market again is the coronavirus. Cold weather is coming, and the flu season is approaching. Despite all the vaccinations and talk about improvements, the U.S. currently has the most significant number of active coronavirus cases since the Coronavirus pandemic began.

Source: worldometers.info

With this many active infections now, things will probably get a lot worse in the coming fall and winter months. Continued coronavirus cases will likely cause economic activity to slow in the U.S. and should contribute to the severity of the upcoming correction in stock markets.

The Bottom Line: Sentiment Change is Approaching

Fundamental elements and technical factors are aligning, and these elements could impact the collective psyche in markets. Most prominently, the overheated technical setup combined with the upcoming Fed taper, increasing coronavirus cases, and sky-high valuations could enable a sentiment shift to occur shortly. Sentiment has been extremely high for a long time, but with a possible change in sentiment this fall, we will likely witness a substantial stock market correction of 10% or more in the S&P 500. Therefore, I am taking steps to bulletproof my All-Weather Portfolio, are you?

Are You Getting The Returns You Want?

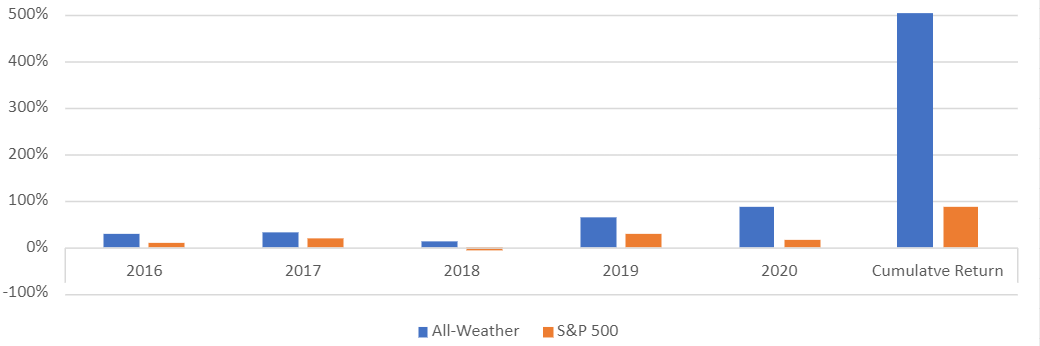

- Invest alongside the Financial Prophet's All-Weather Portfolio (2020 return 87%), and achieve optimal results in any market.

- Our Daily Prophet Report provides the crucial information you need before the opening bell rings each morning.

- Implement our Covered Call Dividend Plan and earn an extra 40-60% on some of your investments.

All-Weather Portfolio vs. The S&P 500

Disclosure: I/we have no stock, option, or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this ...

more