A Conservative Way To Play The 5G Revolution

This week I want to explain to you why 5G is such a big deal. Everyone is talking about it, and the ramifications are going to be big, not just with investing but also with communications and entertainment.

Let’s start at the beginning. 5G is shorthand for the fifth generation of technology. 5G is superior to 4G in a few important respects. One is that it’s faster—much faster. That means more users can move more data, and that shortens download speeds. The technology is also more responsive. Thirdly, the technology allows you to connect more devices.

Let’s break down those three items in more detail. Realistically, 5G will be about five to ten times faster than 4G. No longer will you have to wait minutes to upload a simple photo.

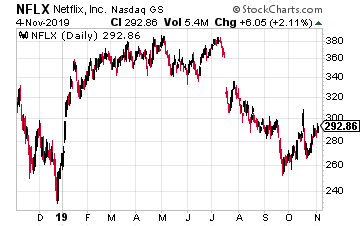

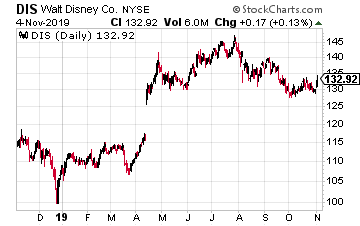

Of course, the increased speed will be a big help for companies like Netflix (NFLX). Don’t forget, Disney (DIS). The Mouse House is about to get into streaming in a big way with its much anticipated launch of the Disnet+ streaming service next week. (Watch for a future article from me on how the streaming media space is heating up.)

In my opinion the real game-change of 5G is what’s called “lower latency.” What do I mean by that? Lower latency is a fancy way of saying that with 5G, your devices will be more responsive. Have you ever used Waze or Apple Maps and missed a turn because the app didn’t update fast enough? I often use Skype and can hear my voice at the other end a few seconds after I stop talking.

Today, those delays are a minor inconvenience, but what if it happened with a self-driving car? That could mean severe injury or even death. 5G promises to do away with those latency problems. As a result, newer technologies would be feasible for consumers.

Just think about what the future could hold! Imagine a doctor preforming a difficult medical operation remotely. And, while not as important from a safety standpoint, the gaming and entertainment industries are really excited about this. Soon, you can play an opponent from the other side of the world with no lag time.

We all know that when the kids get home from school and get on their phones, tablet, or Xbox, our internet connection can slow to a crawl. Well, 5G will take care of this. 5G could be able to provide 100 times greater traffic capacity than 4G.

This all comes down to the amount of bandwidth. The difference is that 5G uses a much higher frequency than 4G. That means that 5G can handle a lot more traffic. In practical terms, this means you can easily send a text or video when you’re at your favorite team’s stadium or at a concert. Imagine fewer spinning icons on your phone when trying to call an Uber.

While 5G is definitely cool, there are several challenges in getting it rolled out. The biggie is cost. (Isn’t it with everything?) 5G isn’t built on top of 4G. Rather, the infrastructure is almost completely new. That ain’t gonna be cheap.

The cost to build 5G ranges from the hundreds of billions in the U.S. to several trillion globally. Intel estimates that a continuously connected self-driving car would consume as much data in a 1.5 -hour ride as 1,000 smartphone users would in an entire month. As with any new technology, those living in big cities (and are willing to pay) will benefit first.

This brings up another problem. What happens when you have a 5G device that starts in a place where there’s coverage and goes to a place where there’s not? A smaller device like a phone might be able to make do, but that’s not the case with, say, a self-driving car.

Sure, the cost of 5G devices will come down as more and more people gain access, but the initial adopters will pay a higher cost for both devices and access to the network. As a result, it’s likely we’ll see an uneven rollout of 5G, not just in the U.S. but around the world.

The Demand for More Towers

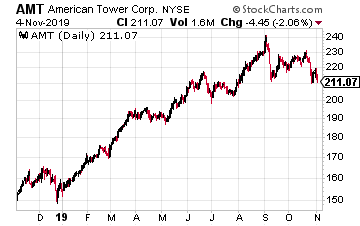

That leads me to how to invest in 5G. One of the best ways is by investing in those critical to 5G infrastructure. That’s is why I like American Tower (AMT). AMT is a Real Estate Investment Trust (REIT) that’s in the cellphone tower business. Tower companies lease the space on their structures to several tenants like wireless carriers and government agencies.

The move toward 5G will require dramatically denser networks, which means more demand for cell towers and massive deployments of smaller cell solutions. As a result, tower companies could benefit from higher cents.

American Tower currently has over 171,000 tower sites, but what I like is the economics of this business. Investors need to understand that towers have significant operating leverage.

Adding tenants to existing towers adds more revenue while adding little incremental costs. As American Tower related to Bloomberg: “single-tenant’ towers have gross margins of 40% from rentals… two tenants have 74% margins…three tenants have 83% margins.”

Another big plus I see for American Tower is its vast overseas footprint. This is important because the U.S. doesn’t lead in 5G technologies. While we were investing in social media, other countries have been investing in 5G.

I’ll give you an example. American Tower has its largest international exposure in India, where data usage has been growing by 100% per year, and carriers have been substantially increasing spending to improve networks. Recently, American Tower impressed Wall Street with another strong earnings report.

American Tower is a conservative way for investors to profit from the 5G Revolution.

Disclosure: None.