A Cash Flow Gusher Secures This 6.6% Yield

Oil stocks are about as popular as a gangsta rap at a nursing home.

Wannabe tough-guy rappers brag about money that they don’t really have. Meanwhile, investors in oil stocks are (to quote Rakim, one of the greatest rappers of all time) “paid in full.”

Climate change and the negative impact of burning fossil fuel have oil companies out of favor. College students protest their existence, and some investment managers shy away from them for social reasons.

Yet despite low oil prices, these companies continue to generate tons of cash flow.

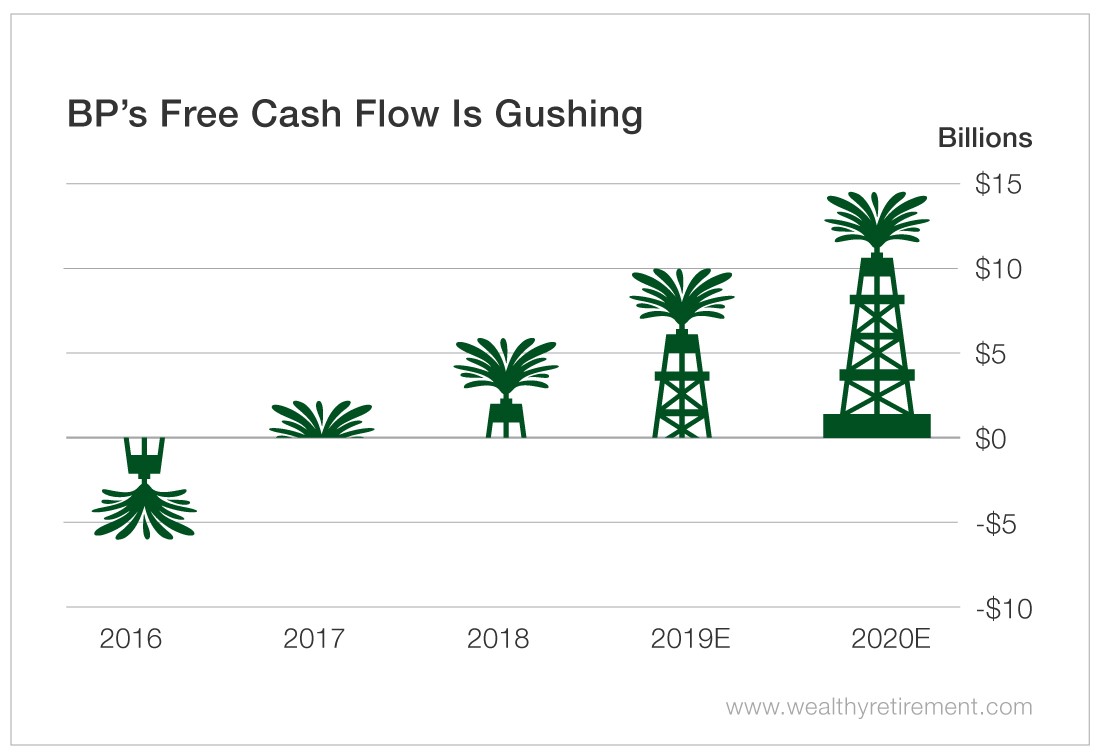

I last covered BP (NYSE: BP) in Safety Net back in February. At the time, the company was expected to generate $10.9 billion in free cash flow while paying out $6.7 billion in dividends.

That cash flow estimate for 2019 has come down to $10 billion, but that still easily covers the now $6.6 billion dividend forecast.

Next year, cash flow is predicted to soar to $14.8 billion. Earnings are forecast to rise 15% and double that figure over the next five years. Over the next three years, free cash flow is projected to more than triple.

(Click on image to enlarge)

As free cash flow climbs next year, BP’s payout ratio is expected to fall from 66% to 44%. So the payout ratio is well below SafetyNet Pro’s 75% threshold.

We want to see less than 75% of cash flow paid out in dividends to give us confidence that a company can continue paying its dividend during tough times.

The only blemish on BP’s dividend safety is that it eliminated the dividend for three quarters in 2010 after the Deepwater Horizon oil spill.

Barring another disaster, which is always a risk in the oil business, BP’s dividend should be as safe as a mint condition Run-D.M.C. vinyl record at my mother’s house.

In other words, no one is going to touch it, so it should be just fine.

Dividend Safety Rating: B

Disclaimer: Nothing published by Wealthy Retirement should be considered personalized investment advice. Although our employees may answer your general customer service questions, they are not ...

more