90 Billion Reasons To Buy Apple Stock

Apple (AAPL) is a cash producing machine, and the company distributes massive amounts of capital to investors via dividends and buybacks year after year. Over the trailing twelve months, dividends and buybacks together amounted to nearly $90.6 billion. Cash is king, and cash distributions from Apple are a powerful tailwind for investors in the company.

Massive iCash Flows

FAANG stocks are widely discussed nowadays, and many investors consider that these tech giants are overvalued at current prices. Personally, I believe that this is a short-sighted view of the issue, valuation should always be analyzed on a case-by-case basis, and considering the company's long-term growth prospects in addition to traditional metrics such as price to earnings or price to sales. In other words, the true value of the business depends on the cash flows that the business is going to produce over the long term, so considering only current cash flows can be misleading.

When it comes to Apple, however, that discussion is quite easily solved because the stock is very reasonably priced based on current cash flow generation. The price to free cash flow ratio is currently in the neighborhood of 21, which is hardly excessive for one of the strongest businesses in the world.

Even better, the company distributes a large share of those cash flows to investors in the form of dividends and buybacks. It's one thing to say that a company is reasonably priced based on the cash flows that it generates and retains, but when it comes to hard cash distributions to investors, then undervaluation becomes far more tangible

Over a trailing 12-month period, Apple allocated $14 billion to dividends and $76.6 billion to buybacks, reaching $90.6 billion in total cash distribution. This brings the total shareholder yield, meaning dividends and buybacks as a percentage of market cap, to nearly 6%. Not bad at all in times when a 10-year US Treasury bond is yielding a minuscule 0.67% per year.

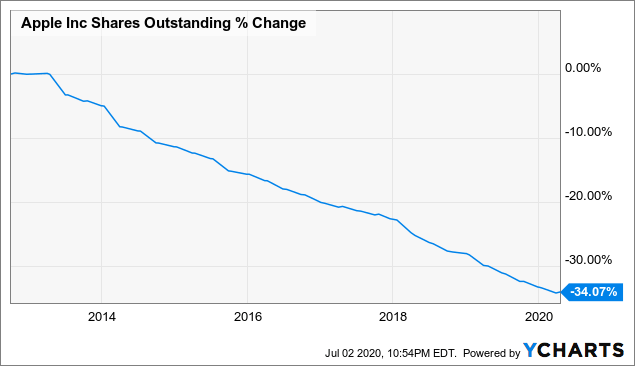

Many tech companies generally use share buybacks to compensate for the issuance of new stock due to stock-based compensation. But this is not the case when it comes to Apple. Far from that, the company has reduced the number of shares outstanding by an outstanding 34% since it began repurchasing stock in 2012.

Data by YCharts

In simple terms, the value of the pie - meaning the company - has increased over the years due to growing sales and earnings. Besides, the pie also is split into a smaller amount of portions - a reduced number of shares outstanding. This means that the value of each share has received a double boost due to both a more valuable business and a reduced share count over time.

The Misguided Criticism Regarding Buybacks

Buybacks are a matter of much discussion among politicians and in the media nowadays. It's important to leave ideological biases aside and try to understand what buybacks really are, always keeping in mind that each case should be analyzed on its own merits.

When the company generates more cash than it needs, management can distribute this capital to shareholders via either dividends or buybacks. Buybacks are more efficient than dividends from a tax perspective, and they also offer more flexibility because investors are expecting the size of the buyback program to fluctuate over time, while dividends are expected to be maintained and even increased year after year.

More importantly, when a company repurchases stock it's basically investing its capital in its own shares. If the business prospects are good and the stock is reasonably valued then the company is making a sound investment and share buybacks can be remarkably beneficial to investors.

In the words of Warren Buffett:

When companies with outstanding businesses and comfortable financial positions find their shares selling far below intrinsic value in the marketplace, no alternative action can benefit shareholders as surely as repurchases.

Unfortunately, many companies have distributed too much cash to investors during good economic times, only to find themselves in financial trouble during a recession. Management can many times be too optimistic too, and corporate executives often pay excessively high prices when implementing share buybacks programs. But this is just a general consideration to keep in mind, it does not apply to Apple at all.

Apple actually is issuing debt to repurchase stock, but the company still has a gargantuan net cash position. Apple ended last quarter with $193 billion in cash plus marketable securities and total debt of $110 billion. This leaves the company with a net cash position of $83 billion. The only reason why Apple is issuing debt is that most of that cash is held overseas, and debt is cheaper than repatriating that cash when considering the tax impact of cash distributions.

In a nutshell, buybacks can be a destructive practice when the stock price is too expensive and even more destructive when the business is fragile from a financial perspective. But Apple stock is very reasonably priced, the company has a rock-solid balance sheet and it produces massive amounts of cash through good and bad times, so the typical criticisms about buybacks don't apply to Apple at all.

Money Talks

Cash distributions are valuable on their own merits. It obviously makes sense to invest in companies that can reward investors with growing dividends and buybacks over time, since cash distributions can be an important component of investor returns. In addition to this, dividends and buybacks are an important sign of confidence from management.

If the company is distributing lots of cash to investors, even during a recession, this is clearly indicating that management has confidence in its ability to consistently deliver solid results through good and bad times. Needless to say, if management has any doubts about the company's future, it will choose to retain the cash flows as opposed to rewarding investors with dividends and buybacks.

CFO Luca Maestri clearly stated in the earnings conference call that Apple decided to increase dividends and buybacks because valuation is attractive and business prospects remain solid.

We also continue to believe that there is great value in our stock, and we are maintaining our target of reaching a net cash neutral position over time. As a testament to the confidence we have in our business today and into the future, our Board has authorized $50 billion for share repurchases in addition to the over $40 billion authorization remaining under the current share repurchase plan. Our Board has also authorized a 6% increase in our quarterly dividend

This conference call happened on April 30, so the recession was already quite evident by that time. Even a mediocre company can make big cash distributions when the economy is strong and the wind is on its back. But it takes a particularly resilient business and a highly convinced management team to make generous cash distributions during one of the worst recessions in history.

Disclosure:I am/we are long APPLE.

Disclaimer: I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship ...

more