7 Monster Stock Market Predictions For The Week Of Dec. 7

S&P 500 (SPY)

Stocks continued to rally this past week, closing just below the 3,710 target level. While it feels like the full bull mode is upon us with a seasonally strong time of the year, many things suggest the rally is overextended.

It doesn’t mean it is about to end tomorrow, but typically these things end sooner than expected, and without notice. It likely means this is a time in which we should be thinking about de-risking. There is what appears to a rising triangle counted out, along with an RSI that has hit just about the overbought level at 70.

A larger version of the same pattern is also visible in the S&P 500 futures, with an RSI near overbought and volume levels diminishing rapidly, along with 5 of 5 wave count. Again, suggesting a topping pattern and the potential for a big reversal.

Meanwhile, last week the most-shorted stocks continued to lead all of the major indexes higher. Probably not the group that should be outperforming.

It’s not the best sign for the AMD bulls that the stock is struggling to break out at resistance with an RSI that is around overbought levels. My view hasn’t changed, which is that Xilinx’s weight will keep a lid on this stock and AMD will get dragged lower towards $75, which will drag Xilinix down in turn.

Nvidia (NVDA)

Nvidia hasn’t participated in the SMH rally and has many of those same negative qualities as the broader markets. I still contend the stock will fall to around $460.

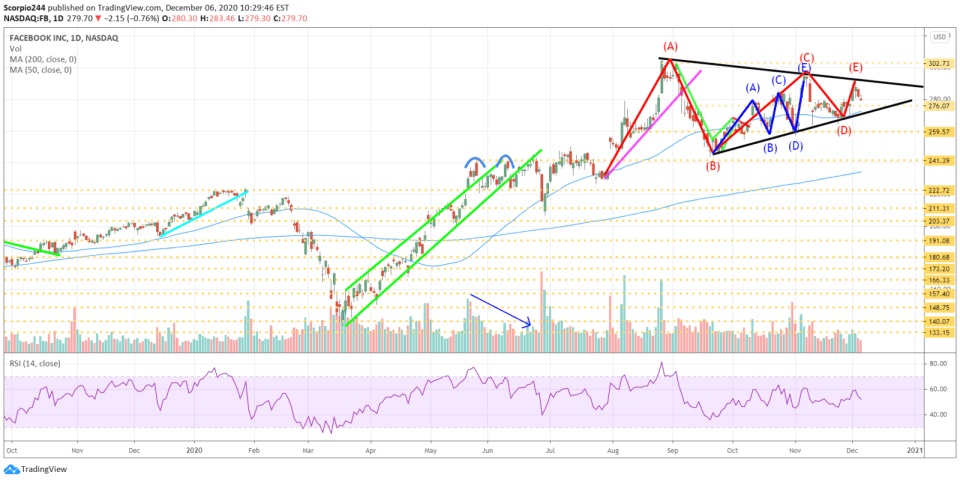

Facebook (FB)

Facebook also has a similar triangle pattern, which has formed, and likely suggests the stock may pullback to around $260.

Twitter (TWTR)

Hopefully now that the gap is filled, the stock will head down again.

AT&T (T)

The worst thing AT&T did was buy Time Warner. I’ll admit that I thought it was a great idea at the time; it turned out to be a horrible deal. Now they are left with a bloated balance sheet due to all the debt and news networks. 92% of the S&P 500 is above their 200-day moving average, and AT&T is one of the 8% that isn’t. The 200-day may continue to act as tough resistance for the stock.

Disclosure: Mott Capital Management, LLC is a registered investment adviser. Information ...

more