5 Undervalued Companies For Value Investors With A Low Beta – July 2017

There are a number of great companies in the market today. By using the ModernGraham Valuation Model, I’ve selected five undervalued companies with a low beta reviewed by ModernGraham.

A company’s beta indicates the correlation at which its price moves in relation to the market. A beta less than 1 indicates a company is less volatile than the market.

Each company has been determined to be suitable for either the Defensive Investor or the Enterprising Investor according to the ModernGraham approach. Defensive Investors are defined as investors who are not able or willing to do substantial research into individual investments, and therefore need to select only the companies that present the least amount of risk. Enterprising Investors, on the other hand, are able to do substantial research and can select companies that present a moderate (though still low) amount of risk.

With a low beta, Mr. Market may not hit these companies as harshly in a downturn, so be sure to check them out in depth!

LGI Homes Inc (LGIH)

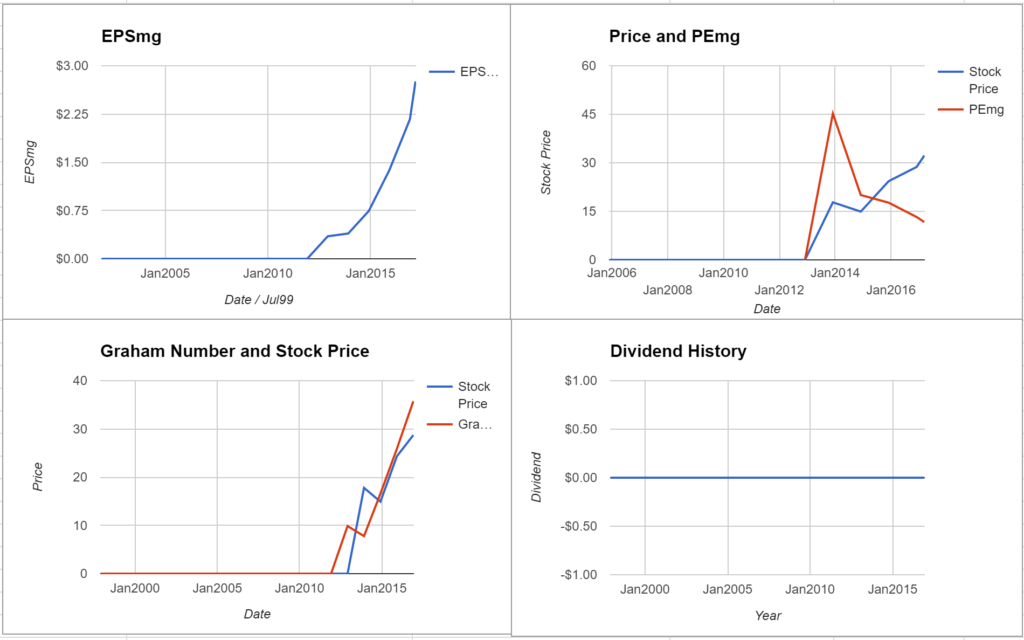

LGI Homes Inc is suitable for the Enterprising Investor but not the more conservative Defensive Investor. The Defensive Investor is concerned with the small size, insufficient earnings stability over the last ten years, and the poor dividend history. The Enterprising Investor is only concerned with the lack of dividends. As a result, all Enterprising Investors following the ModernGraham approach should feel comfortable proceeding with the analysis.

As for a valuation, the company appears to be Undervalued after growing its EPSmg (normalized earnings) from $0.39 in 2013 to an estimated $2.76 for 2017. This level of demonstrated earnings growth outpaces the market’s implied estimate of 1.6% annual earnings growth over the next 7-10 years. As a result, the ModernGraham valuation model, based on the Benjamin Graham value investing formula, returns an estimate of intrinsic value above the price.

At the time of valuation, further research into LGI Homes Inc revealed the company was trading below its Graham Number of $36.13. The company does not pay a dividend. Its PEmg (price over earnings per share – ModernGraham) was 11.7, which was below the industry average of 28.49, which by some methods of valuation makes it one of the most undervalued stocks in its industry. Finally, the company was trading above its Net Current Asset Value (NCAV) of $15.24. (See the full valuation)

(Click on image to enlarge)

Michael Kors Holdings Ltd (KORS)

Michael Kors Holdings Ltd is suitable for the Enterprising Investor but not the more conservative Defensive Investor. The Defensive Investor is concerned with the insufficient earnings stability over the last ten years, the poor dividend history, and the high PB ratio. The Enterprising Investor is only concerned with the lack of dividends. As a result, all Enterprising Investors following the ModernGraham approach should feel comfortable proceeding with the analysis.

As for a valuation, the company appears to be Undervalued after growing its EPSmg (normalized earnings) from $0.96 in 2013 to an estimated $4.07 for 2017. This level of demonstrated earnings growth outpaces the market’s implied estimate of 1.92% annual earnings growth over the next 7-10 years. As a result, the ModernGraham valuation model, based on Benjamin Graham’s formula, returns an estimate of intrinsic value above the price. (See the full valuation)

(Click on image to enlarge)

Super Micro Computer, Inc. (SMCI)

Super Micro Computer, Inc. is suitable for the Enterprising Investor but not the more conservative Defensive Investor. The Defensive Investor is concerned with the small size, and poor dividend history. The Enterprising Investor is only concerned with the lack of dividends. As a result, all Enterprising Investors following the ModernGraham approach should feel comfortable proceeding with the analysis.

As for a valuation, the company appears to be Undervalued after growing its EPSmg (normalized earnings) from $0.64 in 2013 to an estimated $1.42 for 2017. This level of demonstrated earnings growth outpaces the market’s implied estimate of 5.17% annual earnings growth over the next 7-10 years. As a result, the ModernGraham valuation model, based on the Benjamin Graham value investing formula, returns an estimate of intrinsic value above the price.

At the time of valuation, further research into Super Micro Computer, Inc. revealed the company was trading above its Graham Number of $21.83. The company does not pay a dividend. Its PEmg (price over earnings per share – ModernGraham) was 18.85, which was below the industry average of 38.13, which by some methods of valuation makes it one of the most undervalued stocks in its industry. Finally, the company was trading above its Net Current Asset Value (NCAV) of $10.02. (See the full valuation)

(Click on image to enlarge)

Tyson Foods, Inc. (TSN)

Tyson Foods, Inc. is suitable for the Enterprising Investor but not the more conservative Defensive Investor. The Defensive Investor is concerned with the low current ratio, insufficient earnings stability over the last ten years. The Enterprising Investor is only concerned with the level of debt relative to the net current assets. As a result, all Enterprising Investors following the ModernGraham approach should feel comfortable proceeding with the analysis.

As for a valuation, the company appears to be Undervalued after growing its EPSmg (normalized earnings) from $1.7 in 2013 to an estimated $4 for 2017. This level of demonstrated earnings growth outpaces the market’s implied estimate of 3.43% annual earnings growth over the next 7-10 years. As a result, the ModernGraham valuation model, based on the Benjamin Graham value investing formula, returns an estimate of intrinsic value above the price.

At the time of valuation, further research into Tyson Foods, Inc. revealed the company was trading above its Graham Number of $55.42. The company pays a dividend of $0.6 per share, for a yield of 1% Its PEmg (price over earnings per share – ModernGraham) was 15.37, which was below the industry average of 34.94, which by some methods of valuation makes it one of the most undervalued stocks in its industry. Finally, the company was trading above its Net Current Asset Value (NCAV) of $-21.1. (See the full valuation)

(Click on image to enlarge)

Motorola Solutions Inc (MSI)

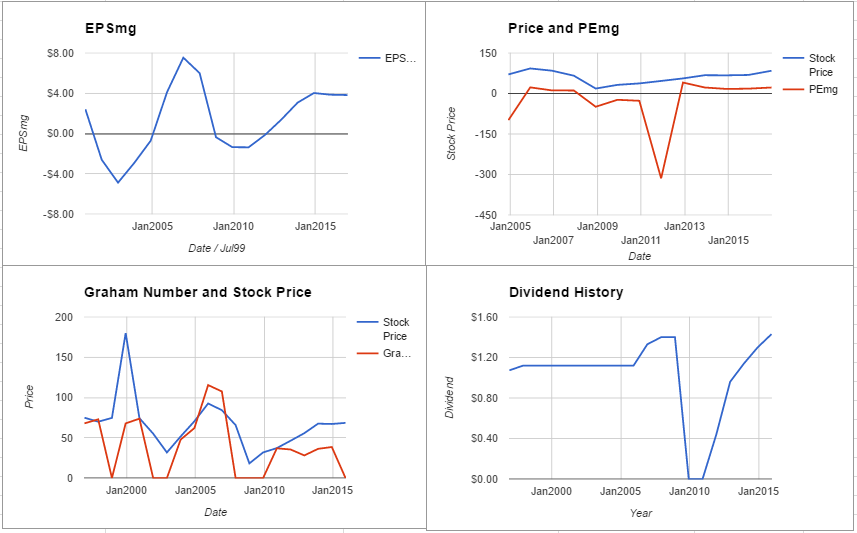

Motorola Solutions Inc is suitable for the Enterprising Investor but not the more conservative Defensive Investor. The Defensive Investor is concerned with the low current ratio, insufficient earnings stability or growth over the last ten years, the poor dividend history, and the high PEmg and PB ratios. The Enterprising Investor is only concerned with the level of debt relative to the net current assets. As a result, all Enterprising Investors following the ModernGraham approach should feel comfortable proceeding with the analysis.

As for a valuation, the company appears to be Undervalued after growing its EPSmg (normalized earnings) from $1.38 in 2012 to an estimated $3.82 for 2016. This level of demonstrated earnings growth outpaces the market’s implied estimate of 6.76% annual earnings growth over the next 7-10 years. As a result, the ModernGraham valuation model, based on the Benjamin Graham value investing formula, returns an estimate of intrinsic value above the price.

At the time of valuation, further research into Motorola Solutions Inc revealed the company was trading above its Graham Number of $0. The company pays a dividend of $1.64 per share, for a yield of 2% Its PEmg (price over earnings per share – ModernGraham) was 22.02, which was below the industry average of 38.13, which by some methods of valuation makes it one of the most undervalued stocks in its industry. Finally, the company was trading above its Net Current Asset Value (NCAV) of $-32.28. (See the full valuation)

(Click on image to enlarge)

Disclaimer:

The author did not hold a position in any company mentioned in this article at the time of publication and had no intention of changing those holdings within the next 72 ...

more