5 Top Stocks To Survive A Trade War

President Trump has just announced that the US is about to impose 25% tariffs on steel imports and 10% on aluminium imports. The decision caused global markets to shudder, especially on concerns that Europe and Asia would retaliate. For the week, the S&P 500 closed down 2%, nearly twice as much as any decline in 2017.

But for Fundstrat founder and head of research Tom Lee the market is overreacting. He says:

“We are buyers of this pullback. The equity environment is more challenging than 2017, and as noted above, is characterized by greater skepticism of Washington (deficits, tax cuts, etc), synchronized normalization by central banks and inflation increases—however, we view these as healthy transitions and supportive of earnings growth.”

He recommends tracking these 20 stocks with low trade war exposure. In order to find these stocks, Lee looked at each company’s overseas sourcing as a percentage of cost of goods sold and their exports as a percentage of sales. If the sum of the two percentages came to under 40%, he concluded that the company had a low trade war exposure.

Pinpointing top stocks

From this list, we used TipRanks to identify the 5 top stocks with a bullish Street outlook. TipRanks’ algorithms track and rank almost 5,000 Wall Street analysts. This allows us to: 1) see the overall analyst consensus on any stock and 2) extract stock insights from the Street’s best-performing analysts.

All of the stocks below boast a ‘Strong Buy’ analyst consensus rating from the Street’s top analysts. The advantage of these five low exposure stocks is that they represent compelling investing opportunities according to analysts with a proven track record of success.

So with this in mind, let’s take a closer look now:

Boeing

One of the world’s largest aerospace companies, Fundstrat has calculated that Boeing (NYSE:BA) actually has a trade war exposure of just 35.2%.

While aluminium (a key aircraft component) could become more expensive, this is unlikely to do much damage according to top JP Morgan analyst Seith Seifman. “The impact should be small, however, as…aluminum prices increased by more than 30% last year (significantly more than the proposed tariff), with little to no discernible effect on Boeing and most major suppliers.” Plus Seifman finds it unlikely and unfeasible that China would move beyond a similar tariff imposition to cancel its order of 300 Boeing planes.

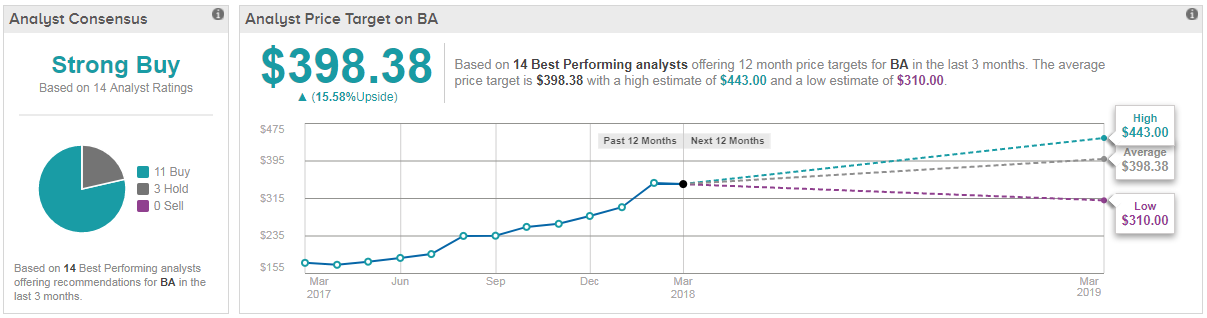

Over the last three months, BA has received 11 top analyst “buy” ratings, with three analysts on the sidelines. With a $398 average price target, upside potential stands at 15%. Five-star Cowen & Co analyst Cai Rumohr notes that BA has the sector’s largest Tax Act pluses and says “Boeing remains our top pick for a $415 price target [20% upside].”

Alexion Pharmaceuticals

Alexion (Nasdaq:ALXN) is a US pharma company best known for its development of Soliris, a drug used to treat rare blood disorders. And top Oppenheimer analyst Hartaj Singh has just selected ALXN as his top stock idea for February-March. Bear in mind this is a five-star analyst with a top 200 ranking on TipRanks (out of over 4,700).

Singh is confident that Alexion can explode 48% from just $118 to $175. He says the stock’s risk/reward profile is oriented to the upside and concludes: “With a robust rare disease platform, a slowing yet cash-generating asset in Soliris, and two newly launched products in Strensiq and Kanuma, we believe that it is not a question of if, but rather when, the shares positively re-rate.”

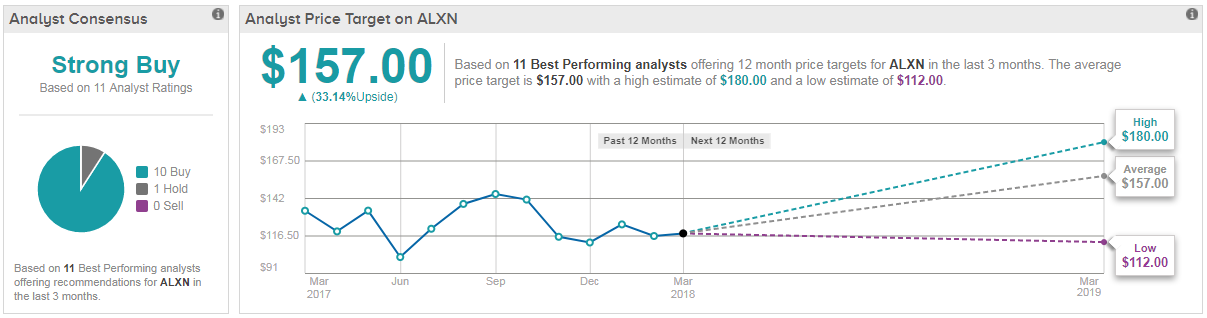

In total, Alexion has scored 10 buy ratings and only one hold rating from best-performing analysts in the past three months. These analysts predict that Alexion will rise 33% to reach $157.

Pioneer Natural

Texas-based Pioneer Natural (NYSE:PXD) is now a pure-play on one of the world’s most lucrative oil fields, the Permian Basin. The company has just announced that it is divesting all non-Permian assets in an asset sale of approx $1 billion. This ‘strategic realignment’ makes sense to B.Riley FBR analyst Rehan Rashid.

“We believe this platform and the substantial resource base it has to offer are simply not replicable. We reiterate our Buy rating and $305 price target and add PXD to the B. Riley FBR Alpha Generator list” says Rashid. He has a $305 price target on PXD.

Over the last three months, TipRanks shows that Pioneer has received 3 buy ratings and 1 hold ratings from top analysts. Given that the stock is now at $169, analysts are projecting (on average) big upside potential of 28%.

Vertex Pharmaceuticals

Global biotech stock Vertex (Nasdaq:VRTX) has a growing portfolio of drugs for cystic fibrosis (CF). Most recently VRTX scored a key approval from the FDA for its third CF drug, Symdeko. The approval- delivered by the FDA two weeks earlier than expected- has cemented Cory Kasimov’s bullish VRTX outlook. He is anticipating a ‘strong launch’ for Symdeko and says:

“We continue to believe that VRTX’s dominance in the CF space, compelling bottom-line growth trajectory (43% CAGR through 2022), and significant free cash flow generation could potentially allow the company to substantially expand the breadth of its investor base.”

Overall, this ‘Strong Buy’ stock scored 14 top buy ratings and just 2 hold ratings in the last three months. Meanwhile the average analyst price target of $192 works out at 13% upside from current share levels.

Raytheon

Defense giant Raytheon (NYSE:RTN) is the world’s largest producer of guided missiles. According to Fundstrat, it has a trade-war exposure percentage of 35.2%.And from a Street perspective, the outlook on RTN is also very bullish right now.

“Strong broad order momentum, a large Patriot backlog, and untapped financial firepower give RTN extended EPS and cash flow per share growth potential” cheers five-star Cowen & Co. analyst Cai Rumohr. He notes that the Harpoon replacement missile bid, a massive $8 billion opportunity, could be decided as soon as fall 2018.

All in all, RTN has received seven buy ratings from the best analysts in the last three months. In this same period, only one analyst has decided to stay on the sidelines. The average analyst price target indicates 8% upside potential from the current share price.

Disclosure: Here we looked at stocks highlighted by just one firm on the basis of their trade war exposure. But the

more