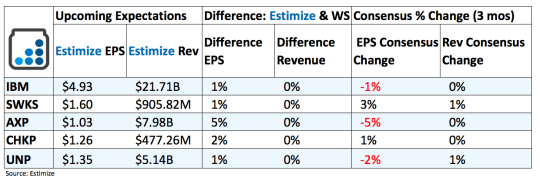

5 Stocks To Watch That Report Earnings Tomorrow - Thursday, 19. Jan

International Business Machines (IBM): Cloud computing was one of the lone bright spots in the second quarter report. Cloud as a service revenue for the quarter increased 66% to $7.5 billion while overall cloud revenue edged higher by 44%. Analytics, mobile and security sectors made equally impressive strides, rising 16% from a year earlier. Cloud computing remains one of the most competitive markets though, with Amazon and Microsoft leading the charge. If IBM can’t establish a solid footprint in the space then its days are numbered.

IBM can unfortunately count on further declines in IT spending particularly in on-premise and data center hardware. Meanwhile volatile exchange rate fluctuations and intensifying competition in the industry pose additional headwinds to IBM’s legacy business.

IBM continues to make strategic acquisitions to offset some it losses and expedite the transition to the cloud. Many of these moves led to incremental revenue gains and a more favorable product portfolio. A strong balance sheet consisting of robust cash flow provides IBM with the flexibility to pursue additional takeovers in a changing computing landscape.

Skyworks Solutions (SWKS): Skyworks kicks off its fiscal 2017 by looking beyond its two major customers, Apple and Samsung, to drive quarterly results. Moving ahead, the company will be looking to Internet of Things to complement its growing presence in mobile. Its latest IoT application released last week provides additional support to a leg of the company that makes up 25% of total revenue. Whether its autonomous vehicles, smart homes, or routers, Skyworks plays an important role as long as mobile connectivity is involved.

American Express (AXP): American Express topped earnings and revenue expectations in the past 3 quarters despite the perception of a weak spending environment and lost revenue from Costco. In the third quarter the company reported higher spending on recent marketing and promotional initiatives. Meanwhile improving credit quality and lower default rates resulting in a 5% decline in provisions for losses to $504 million. On the downside, co brand loans continue to experience declines with each passing quarter. Management responded to these losses by shifting its portfolio mix away from co-brand loans to non-cobrand card members. Tomorrow’s report, whether good or bad, also provides insight on the retail earnings in the coming weeks.

Check Point Software (CHKP): Recent events in the news about Russia hacking the past election brought to light the growing need for cyber security. Both candidates indicates they would devote greater resources to the space to effectively fend of new digital threat. Many companies including Check Point capitalized on these ongoing promises by frequently updating and releasing cyber security products. Check Point, in particular, witnessed a surge in adoption rate and subscription rate that continues to support overall top line growth. In the third quarter subscription revenue came in at $99 million, making up nearly a quarter of the company’s total revenue for the period. That number will only continue to grow as the threat of a consequential digital attack increases.

Union Pacific Corporation (UNP): Railroads made some of the biggest gains in 2016 with Union Pacific, CSX and Kansas City Southern leading the way. Union Pacific, in particularly, hit its stride after the election amid speculation that Trump would revive the coal industry. UNP currently generates a large portion of revenue from coal so any possibility that coal comes roaring back would prove beneficial for top line growth. Otherwise, financial performance has been lackluster in recent quarters. Earnings and revenue plummeted in the recent years due to overall weakness in the industrial sector and coal regulations laid down by Obama. The Estimize consensus data points to a small comeback tomorrow with earnings forecasted to rise by 3% and sales down a marginal 1%.

Disclosure: None.