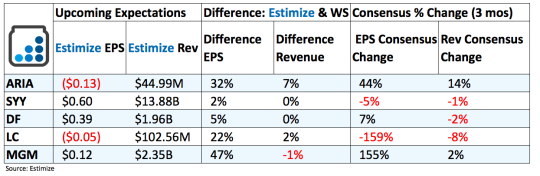

5 Stocks To Watch Before The Market Opens On Monday- November 7

(Click on image to enlarge)

Ariad Pharmaceuticals (ARIA): Ariad has seen estimates edging significantly higher leading into its third quarter report, with expectations now reflecting a 49% increase on the bottom line and 56% on the top. It’s recent success has rewarded shareholders with the stock up 40% in 2016. Shares were up well over 100% until this past month’s sell off into the election. Investor’s focus will be primarily on its core leukemia treatment, Iclusig, which currently generates a majority of total revenue. Continued demand for the drug along with expansion into new territories will help support the top line. In addition to increased traction in domestic markets, Iclusig was recently approved in Japan which is expected to increase exposure and provide a new layer of revenue for this very successful drug. The only downside to its recent success comes from an over reliance on one particular drug. Many pharmaceutical companies often have a robust pipeline and catalogue of treatments to offset any losses when its other treatments struggle.

Sysco Corp (SYY): Sysco has made significant strides in recent quarters on the back of continued acquisitions and efforts to diversify and strengthen its product portfolio. Its efforts appear to be paying off as the second quarter delivered a robust 23% increase on the bottom line and 10% on the top. Strong sales can be attributed to its success as a major supplier of organic and healthy foods across major markets. This will likely continue when the company reports earnings Monday morning but margins could start to tick down. Food cost deflation along with unfavorable currency headwinds is likely to result in weaker margins and softer earnings growth. The deflationary trend is reflected in current estimates that are calling for about 15% growth.

Dean Foods (DF): Dean Foods’ recent focus on price realization, cost productivity and creating a balance between price and volume is expected to deliver strong returns despite industry wide headwinds. Analysts are expecting this to lead to a 29% increase in earnings but a 4% decline in sales. The top line is more likely to be impacted by the broader pullback from processed and unhealthy to organic and high quality ingredients. Shares have been on the up this month after news broker that the company was fielding takeover bids. Any hints of chatter surrounding sales during the company’s conference call will overshadow the outcome, good or bad, of the earnings results.

Lending Club (LC): Lending Club was one of the earliest pioneers of what we are now calling fintech but it is now also the first company in the space to come under regulatory scrutiny due to questionable business practices. This hiccup may not have a long lasting impact on financial performance but it certainly dented share prices and brand reputation. Shares are down 55% in 2016 heading into what’s expected to be a lackluster third quarter report. Heavy marketing investments and rising expenses related to attracted users is likely the biggest threat to margin growth. Lending Club posted a loss in the second quarter and is projected to do the same in the third, marking two consecutive quarters of unprofitability. The top line is unfortunately trending down as well with current estimates forecasting a 10% decline from a year earlier.

MGM Resorts (MGM): Travel trends have picked up this earnings season beginning with strong results from airlines and continuing with better than expected results from Las Vegas Sands this week. Major hotels are lined up to report next week with expectations edging higher on improving industry trends. MGM in particular is expected to report a beat Monday morning from higher demand at its Las Vegas resorts. Strong employment and increased tourism has been largely credited with this surge during the third quarter. Near term headwinds include potential struggles in Macau gaming, despite some promising reports that the region is improving.

Disclosure:None.