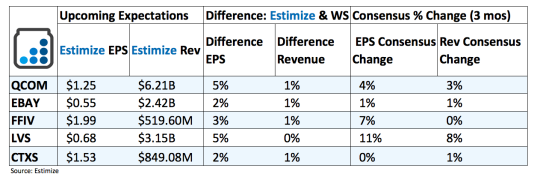

5 Stocks To Watch After The Market Closes Tomorrow - Wednesday, Jan. 25

(Click on image to enlarge)

Qualcomm (QCOM): Qualcomm consistently tops analyst’s expectations each quarter thanks to the success of its high margin license business. This portion of the company generated about $8 billion in revenue but came under fire following a lawsuit from Apple last week and the FTC in 2015. Its unclear whether Qualcomm is at fault but anytime a company is at the center of multiple lawsuits, it doesn’t bode well for business.

Meanwhile Qualcomm faces multiple threats to its planned $47 billion takeover of NXP Semiconductors. Trump’s recent rhetoric surrounding mergers and China raise the odds that regulators squash the impending deal. When or if the deal is completed, it should help diversify Qualcomm’s holdings and provide a new layer of support to the top line.

On the bright side, the company’s involvement with Verizon to deploy 5G technologies along with a growing presence in high growth technologies including automotive, networking and mobile computing bodes well. Many new and pre existing products already feature Qualcomm’s flagship Snapdragon processor. As Qualcomm continues to expand and release new products, so has its competitors. Intel and Broadcom, its closest rivals, remain committed to capturing market share through many of the same initiatives.

eBay (EBAY): Ebay popularized the concept of online shopping in the late 90s and early 2000s, but now it must reinvent itself to compete with the next wave of e-commerce led by Amazon. eBay’s realignment as an online marketplace comes amid a rapidly changing consumer environment. Active buyers now amount to 165 million, over 1 billion live listings and across 30 countries. The broad turnaround helped boost comparisons in light of these changing trends and the spinoff of PayPal nearly a year and a half ago.

eBay’s transition from an auction site to online marketplace also includes several acquisitions and strategic brand partnerships. The result is a company driven by continually strong performance across its now core marketplace business, eBay classified ads, and Stubhub. Recent acquisitions aim to leverage the immense amount of structured and unstructured data to drive user acquisition and refine search results.

F5 Networks (FFIV): Strengthening product sales in the second half of 2016 helped F5 deliver better than expected fiscal fourth quarter results but more importantly post record high annual figures. Consistent efforts to rollout out new products and update current ones continues to drive revenue growth. Management expects the recent release of iSeries under the BIG-IP platforms to accelerate the top line in fiscal 2017. Meanwhile, the company’s pricing strategy labeled GBB, Good Better Best, remains a near term tailwind. Ongoing product refreshes along with a sound pricing strategy will help F5 capture greater market share in the rapidly changing enterprise technology market. With that in mind, F5 faces multiple near term threats, mainly increased competition from Citrix, Cisco and Juniper Network and a volatile IT spending environment. Meanwhile a downturn in EMEA markets on a sequential and year over year basis pose an additional problem heading into the new fiscal year. Each of these headwinds can realistically cause FQ1 results to fall below analyst’s targets.

Las Vegas Sands (LVS): The market in Macau somewhat stabilized in the second half of 2016 creating an optimistic outlook for Las Vegas Sands’ fourth quarter report. The region will yet again dictate results but early indications now appear promising. Per the Macau Gaming Inspection and Coordination Bureau, gross gaming revenue for the three months that make up Q4 rose, thereby continuing the resurgence in Macau. Tomorrow’s numbers will provide a glimpse at growth driven by VIP gamers, promotional activity and non-gaming revenue. Meanwhile, resorts in Singapore and Las Vegas continue to perform well, on increasing tourism and traffic trends. In the third quarter revenue per available room, the equivalent of PRASM for hotel operators, grew 10.5% in Singapore locations and about 9% for the three Las Vegas locations.

Citrix (CTXS): Citrix continues to show tremendous progress in many of its core areas of business thanks to persistent efforts to expand its product portfolio and make strategic acquisitions and investments. In the third quarter, revenue from SaaS and license updates increased by high single digits while products and licensing revenue remain flat. Professional services continued to come in light compared to previous years, decreasing by nearly 20% during the period. In the report, management gave an early outlook for 2017 with sales expectations in the range of positive 3 to 4%. As for any company in this space, weak IT spending, increasing competition and weak FX translation remain near headwinds.

Disclosure: None.