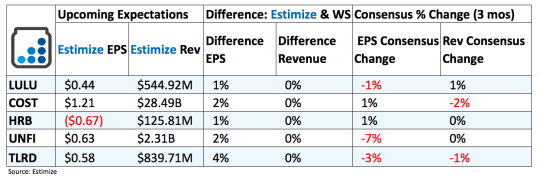

5 Stocks To Watch After The Market Closes Today - Wednesday, Dec. 7

Lululemon (LULU): Investors have begun to write off the athleisure trends that lifted Lululemon for so many years. The stock has taken a beating in response to this perceived weakness in the space. Shares are down 14% in the past 6 months and historically drop 2% immediately following an earnings report. Analysts at Estimize expect the slowdown to continue with forecasted comparisons of a 25% increase on the bottom line and 13% on the top for tomorrow’s report. Lululemon’s new focus centered around geographic expansion and a heavier emphasis on its new men’s category should help negate some of the expected losses. But given LULU’s high price points and reluctance to discount in this challenging retail environment, a near term turnaround seems highly unlikely.

Costco (COST): Costco is one of the few retailers that still announces financials on a monthly basis, leaving quarterly reports less of a mystery. The biggest number typically released during these reports is membership growth. Investors were pleasantly surprised last quarter after memberships surpassed their tepid expectations. It was believed that Costco would lose members after switching its house credit card to Visa from Amex. As for financial performance, revenue for the fiscal first quarter came in 3% higher from a year earlier at $27.47 billion. Comparable store sales were steady at 1% and about 2% excluding impacts from gasoline prices and foreign exchange rates. These results are relatively in line with the past 3 quarters

H&R Block (HRB): HRB delivered negative growth in 3 of the past 4 quarters resulting in weak price movement immediately following each report. Shares have dropped about 33.5% this year in response to the string of weak reports with the upcoming expected to be more of the same.. Analysts at Estimize are forecasting a 32% decline on the bottom line combined with a 2% drop on the top. HRB faces a slew of litigation fees in connection with its operating activities that could push margins further below consensus estimates. Weak underlying fundamentals and unimpressive initiatives will continue to stress performance

United Natural Foods (UNFI): UNFI continues to see increasing demand for its wholesale offerings of organic and natural food products. This group of products has the largest upside given consumers newfound eating habits. Productivity initiatives and improved operation efficiency helped UNFI reach this point where it can now make acquisitions to bolster its position in target markets. Unfortunately as more companies begin to offer healthy products, a price war will ensue that could undercut profits and revenue growth.

Tailored Brands (TLRD): Quarterly results have been mixed recently due to the difficult consumer and retail environment. These conditions are steadily improving as witnessed by the resurgence in the retail space earlier this earnings season. Tailored Brands could greatly benefit from a victory this quarter as shares are down 65% in the past 12 months. Its two flagship brands, Men’s Wearhouse and Jos A. Bank have delivered abysmal results despite frequent discounting. Last quarter Men’s Wearhouse delivered a comparable sales increase of 2.9% but Jos A. Bank dropped by 16.3%. Given how poorly the company has performed its not surprising that the stock historically drops 2% immediately following an earnings report.

Disclosure: This article was originally published in Forcerank on November 30, 2016. To learn more visit the more