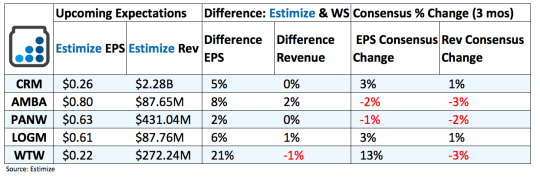

5 Stocks To Watch After The Market Closes Today - Feb. 28

Salesforce (CRM): Last quarter Salesforce maintained its lengthy climb on sustained demand for new and pre existing cloud based products. Revenue jumped 25 percent on a 24% increase in subscription and support revenue as well as a nearly 40% rise in professional services and other sales. Along with robust report, management raised guidance for fiscal 2017. Revenue is projected to increase 25 percent to 26 percent in 2017 to the range of $8.37 to $8.38 billion.

Salesforce failed to make a splashy acquisition in 2016 while Microsoft secured the coveted services of Linkedin. Investors believe that Salesforce will start to lose ground to Microsoft as it integrates the professional network into its namesake CRM products. But often times analysts fail to acknowledge that Salesforce’s other acquisitions have been largely successful in recent years. Considering adoption rates and demand aren’t having a detrimental impact on financial performance, Salesforce growth strategy seems to be working effectively

On the other hand, increased competition and weak currency translation remain near term headwinds that potentially negatively impact earnings growth. Oracle and now Microsoft could potentially hamper long term prospects if its native products gain traction. Currency fluctuations, as its does with other multinationals, takes toll on international operations and sales growth.

What are you expecting for CRM? Get your estimate in here!

Ambarella (AMBA): Ambarella continues to share in the failures of its biggest client GoPro, which capped off fiscal 2016 on back to back disastrous reports. Shares of the action camera maker tumbled nearly 35 percent in the past 6 months owing to weak results, while its chipmaker, Ambarella fell 15 percent. Nonetheless, analysts at Estimize expect a 25 percent increase on the bottom line and nearly 30 percent on the top. A partnership with Google to support its “Helpouts” service promises to have an additive impact on revenue growth. Meanwhile, new efforts to penetrate high growth markets such as automotive and IP security will help diversify Ambarella’s offerings and lessen its reliance on GoPro. Historically the stock is prone to large swings in the month prior to and after an earnings report, whereas through the print it usually trades sideways.

What are you expecting for AMBA? Get your estimate in here!

Palo Alto Networks (PANW): Palo Alto Networks is one of many cyber security companies to have emerged in recent years. Like many of its peers, the company has suffered during earnings season from decelerating earnings and revenue growth. Investors received a gift last year after it was revealed that the DNC was hacked during the election. This raised concerns over the state of cyber security and the need to bolster protection. Meanwhile, frequent product refreshes coupled with an expanding user base also promises to positively impact top line growth. Additional strength across all its markets and business segments will help as well. Nonetheless, decelerating revenue growth from weak IT spending and increased competition will dampen growth.

What are you expecting for PANW? Get your estimate in here!

LogMeIn (LOGM): Shares of LOGM soared over 85 percent from a year earlier on the back of strong financial performance. Revenue growth exceeded 20 percent in each of the past 5 quarters whereas earnings posted double digit comparisons in 4 of the past 5 reports. Analyst at Estimize expect a slight deceleration compared to previous periods, calling for a 19 percent increase on the bottom line and 15 percent on the top. Historically the stock takes on higher ground during earnings season, gapping up by as much as 6 percent immediately through the print.

What are you expecting for LOGM? Get your estimate in here!

Weight Watchers (WTW): Oprah didn’t just do herself a favor by losing 40lbs, she also helped out shareholders who received significant returns from the announcement. In the past 6 month shares popped 6 months, largely on the back of Oprah’s beaming endorsement and subsequent success using the program. Analysts at Estimize strongly believe that the recent publicity and general economic improvements can boost financial performance moving forward. With that in mind, the stock typically takes a step back during earnings season, gapping lower by an average of 3 percent up to 30 days following a report.

Disclosure: There can be no assurance that the information we considered is accurate or complete, nor can there be any assurance that our assumptions are correct.