5 Safe High-Yield Stocks For Double-Digit Income

Turn to these five high-yield stocks going through significant changes to boost their businesses and start earning a safe income stream with strong upside potential. With potential ROIs of 15%, 14%, 17%, and even 36%, these stocks leave traditional income investments in the dust.

A high-yield portfolio is built around only one metric: yield. Typically, a yield around 4% is considered both high and safe. While yields in the double-digits are common, such yields tend to be associated with risky stocks.

Thus, the 4% “safe” stocks comprise the average high-yield portfolio. Such a portfolio is stereotypically boring, consisting of companies that hold stable positions in their respective industries. But within that solution set of near 4% yield stocks exist a handful of companies undergoing significant changes.

Those changes can bring growth to an otherwise stationary dividend portfolio. By ensuring that your high-yield portfolio contains companies undergoing business strategy changes, you can expose yourself to both significant yield and significant price gains. While this portfolio creation strategy requires more research, the added time expense can pay off in the long run.

Of course, substantial changes in the business model add risk to investment in the stock. For this reason, the possibility of a negative price reaction increases. Thus, option strategies can be employed along with holding the stock (for the dividends) to develop a limited-risk holding strategy.

In the meantime, I’ve done the research for you. What follows are five gems in the high-yield category along with appropriate option strategies to minimize risk. These stocks are making significant changes in 2016 that can lead to attractive growth in their share prices.

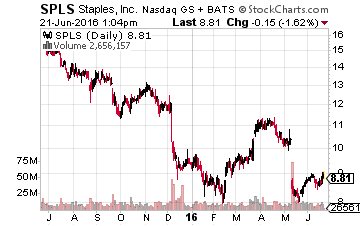

Staples (NASDAQ:SPLS)

After the Staples-Office Depot merger fell apart, Staples sees itself once again as a competitor of Office Depot. The same goes for Office Depot. Both companies are engaging in new business practices to overtake the other.

Staples’s plan seems to be the better of the two. Drawing from the success of Amazon, Staples will be turning its focus to online sales. A new system, “Staples Rush,” allows customers to receive online purchases via same-day delivery.

Along with this system comes several more catalysts for growth:

- Increased product variety.

- Expanded delivery area coverage.

- Cost cuts of approximately $300M.

- Closures of underperforming stores.

While I expect Staples’s strategy to pay off in the long-run, news of store closures and the online transition could result in negative reactions from Wall Street. The online movement in particular puts Staples in an environment where competition with Amazon is necessary. The following holding strategy will allow us to gain the most from holding Staples during this transition.

- Buy 100 shares SPLS stock

- Sell 1 Dec $10 call

This covered call strategy limits our upside during the transition period but also adds 10% to the annual yield. This results in a 15% yield, regardless of how SPLS moves. SPLS can move upward 14% before our upside is capped.

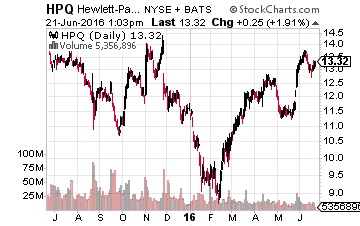

HP Inc. (NYSE:HPQ)

HP has recently entered the 3D printing industry. As it enters, it shakes the industry due to its significantly larger size compared to the current players. The big players,

3D Systems (NYSE:DDD) and Stratasys (NASDAQ:SYSS), are roughly one-tenth of HP’s size, meaning that HP can easily take over if it chooses to dedicate a major amount of resources to this segment of its business.

HP will likely begin by testing the waters to see whether the ROI is reasonable. If so, the company’s growth will attract more investors, allowing the stock price to rally. But the transition period will almost certainly eat into the company’s balance sheet.

The risk-reward profile for this industry entrance should be attractive. The costs spent on entering are minor, but the potential payoff is major. While holding and waiting, investors gain access to a 4% yield.

The dividend is also a substantial draw for 3D printer investors, as the competing companies do not offer dividends. You could apply the “wait and see” strategy with DDD – a yield-less stock – or with HPQ – a stock that pays you to wait. Of course, HPQ is logically the better choice.

Still, HP failing in this industry is not an impossibility. Thus, HPQ holders should use options to tilt the risk-reward profile in their favor. The following option strategy is ideal:

- Buy 100 shares HPQ stock

- Sell 1 Nov $14 call

Here, again, the covered call allows us to increase the dividend yield while we wait for HPQ to finish moving into the 3D printing industry. We add 10% to the annual yield via this strategy, allowing for a 14% total yield.

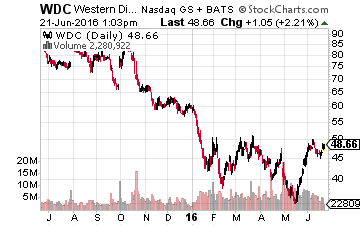

Western Digital Corporation (NASDAQ:WDC)

Western Digital is a leader in the hard disk drive (HDD) market. However, the company has seen recent headwinds due to a general industry shift from HDD to solid state drives (SSD). In response, Western Digital has entered the SSD market.

The entry is not a pure industry transition but is actually exposure via the acquisition of SanDisk, an SSD company. In the SSD industry, a new technology, 3D NAND, shows potential to override the traditional SSD market. Currently, SanDisk and Samsung are showing the most ability in 3D NAND production.

Although the SanDisk acquisition was quite expensive for WDC, it will pay off handsomely should 3D NAND take off. WDC has positioned itself to avoid the devastation that 3D NAND could bring to the HDD market. Regardless of what happens with this new technology, WDC is hedged, with exposure in both markets.

Competitors in the HDD and SSD markets are much riskier holds than WDC, which straddles both industries. In addition, while we wait to see how things play out in these industries, we can gain an annual 4% ROI via WDC’s dividends. Of course, investors are expecting much from WDC’s large investment in SanDisk, and if a significant payoff is not seen from this investment, WDC could take a plunge.

The current atmosphere of WDC is one of increasing uncertainty. This makes the stock suitable for a long volatility play. Using a strangle under the stock price in addition to holding the high-yield stock, we can leverage the upside while limiting the downside should the stock plunge:

- Buy 100 shares WDC

- Buy 1 July 42.5 call

- Buy 1 July 37.5 put

The long option strategy will increase in value as volatility increases and can be rolled over monthly. Should WDC see a major movement upward, both the stock and the call option will provide significant gains. Downward momentum will not hurt us past $37.5, as the put option protects us from any further loss.

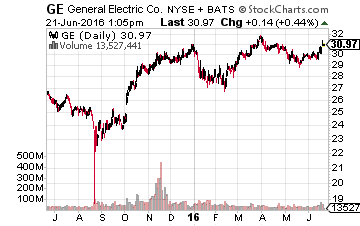

General Electric (NYSE:GE)

Much of the recent bull rally has been sustained by record highs in corporate buybacks. Companies with large cash stockpiles have been buying back outstanding shares, thereby increasing the price of their stocks. Whether this is a good strategy in the long-term is debatable; what is not debatable is that this method tips the odds in favor of the shareholders.

If the market consolidates or moves downward, companies with buyback programs will likely see their stock prices increase regardless. For stocks paying high yields, the buyback program adds to the attractiveness of these investments, as investors can expect not only yields but growth. In 2016, Apple (NASDAQ:AAPL) was cited as having the largest buyback program, but recently the high-yield stock GE looks to be overtaking AAPL in this regard.

Although large buyback programs are hardly business model shifts, they do have implications for significant stock gains. GE is on the path of hitting $20B in buybacks in 2016, which should raise the stock price by approximately 10%. Add this 10% gain to the 3% dividend yield, and you’re looking at a reliable upside of 13%.

Also, note that while the 3% dividend is taxed as ordinary income, the 10% growth in buybacks is essentially tax-free. The main danger with a buyback program is the possibility of the company buying shares at unjustifiably high prices. My discounted cash flow model shows that GE’s stock price has gotten ahead of its implicit valuation, so we do have some downside despite the future buyback-fueled gains:

The discounted cash flow valuation puts GE at over $26 per share, making 26 a good strike price for the short leg in a credit spread. The credit spread will pay off as long as GE does not fall below $26. By adding one extra long put to the credit spread, we also cut our downside risk for holding the stock by 75%.

You can use as many options contracts as you want for the credit spread. I use “x” to represent your choice of contracts:

- Buy 100 shares GE

- Sell x Dec 26 put

- Buy x+1 Dec 24 put

For example, you can sell 10 puts and buy 11 puts. Or, you can sell 2 puts and buy 3 puts. In either case, you gain roughly $22 for opening the play.

Assuming you go with 10 and 11, you gain 14% yield, which is added to the 3% dividend yield for a total 17% ROI. You cannot lose any more money after GE falls below $24, which is unlikely due to the buyback program. This is a safe strategy overall and allows you to reap slow but reliable income from a stock almost certain to rise.

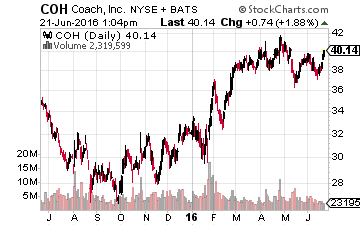

Coach (NYSE:COH)

The retail sector is one of fierce competition. Choosing the wrong company here is easy, which is why many investors choose to diversify. In luxury brands, Coach tends to be seen as a safe choice because of its 3.5% yield.

Comparing COH to its competitors Michael Kors Holdings (NYSE:KORS) and Kate Spade & Co. (NYSE:KATE), we find that only COH offers dividends in this sector. This has been enough to keep it attractive to investors during hard times in retail. But if the dividend weren’t enough, COH is now collaborating with Disney, further separating itself from other luxury retail stocks.

The Coach/Disney bags stand to be well-received by the Chinese market, which is already an important market for Coach. A new Disneyland just opened in Shanghai, which will almost certainly lead to increased sales for Coach. Still, Coach faces the headwinds of a declining retail sector and slowing growth in China.

With COH being particularly volatile and showing significant dips every month, a covered call strategy will work well, provided you watch the stock. In this strategy, instead of sitting and waiting for the short call to expire, you buy the sold call back on the dip. Each dip should drop the price of the call to $5 or $10:

- Buy 100 shares COH

- Sell 1 Jul 39 call

This strategy can give you a steady 3% ROI each month. This is in addition to the annual 3.5% dividend yield. Always buy back the covered call before earnings season, as you do not want to cap your upside with COH.

Conclusion

In 2016, changing businesses give investors the rare opportunity to gain both growth and yield under a single ticker. As you’ve just seen, adding options strategies to high-yield stocks with changing businesses can intensify the expected gains of your portfolio. High-yield dividend stocks are already cash machines by their very nature, and the power of options can not only enhance ROI but also reduce the downside risk.

Finding stable companies that regularly increase their dividends is a strategy you can use to produce superior results, no matter if the market moves up or down in the shorter term. The combination of a high yield and regular dividend growth can give you the most consistent gains out of any strategy that you have tried over your investing career.

Disclosure: Tim Plaehn, income expert with Investors Alley, met with the CEO of one of America’s fastest growing specialty banks, and what he told me ...

more