5 Nasdaq 100 Stocks For Momentum Investors - April 26, 2016

Today I used Barchart to sort the NASDAQ 100 Index stocks first for the most frequent number of new highs in the last month, then again for technical buy signals of 80% or more. Next I used the Flipchart feature to review the charts for consistency.

Today's watch list includes: 21st Century Fox (Nasdaq: FOX), Gilead Sciences (Nasdaq: GILD), Liberty Interactive (Nasdaq: QVCA), Amgen (Nasdaq: AMGN) and Ulta Salon Cosmetics (Nasdaq: ULTA)

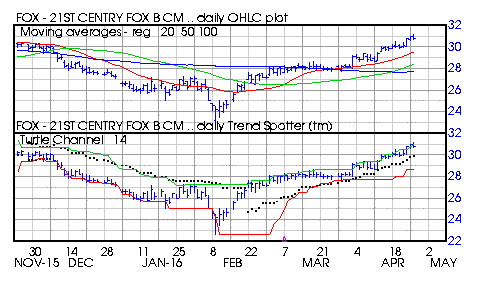

21st Century Fox

Barchart technical indicators:

- 96% technical buy signals

- Trend Spotter buy signal

- Above its 20, 50 and 100 day moving averages

- 15 new highs and up 9.85% in the last month

- Relative Strength Index 73.46%

- Technical support level at 30.42

- Recently traded at 30.83 with a 50 day moving average of 28.40

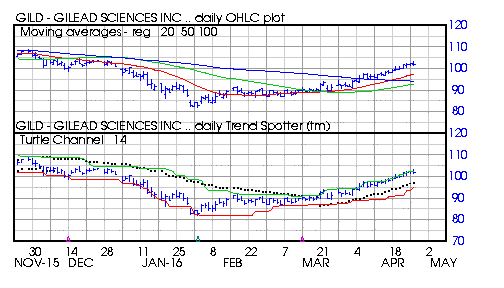

Gilead Sciences

Barchart technical indicators:

- 80% technical buy signals

- Trend Spotter buy signal

- Above its 20, 50 and 100 day moving averages

- 15 new highs and up 11.06% in the last month

- Relative Strength Index 70.36%

- Technical support level at 101.18

- Recently traded at 101.45 with a 50 day moving average of 92.79

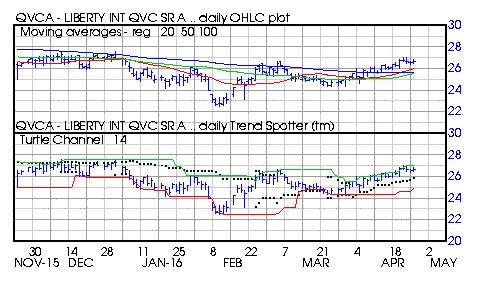

Liberty Interactive

Barchart technical indicators:

- 80% technical buy signals

- Trend Spotter buy signal

- Above its 20, 50 and 100 day moving averages

- 14 new highs and up 7.81% in the last month

- Relative Strength Index 62.65%

- Technical support level at 26.31

- Recently traded at 26.71 with a 50 day moving average of 25.53

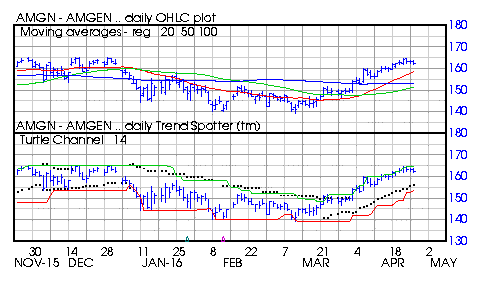

Amgen

Barchart technical indicators:

- 80% technical buy signals

- Trend Spotter buy signal

- Above its 20, 50 and 100 day moving averages

- 13 new highs and up 8.62% in the last month

- Relative Strength Index 64.60%

- Technical support level at 161.55

- Recently traded at 162.57 with a 50 day moving average of 151.36

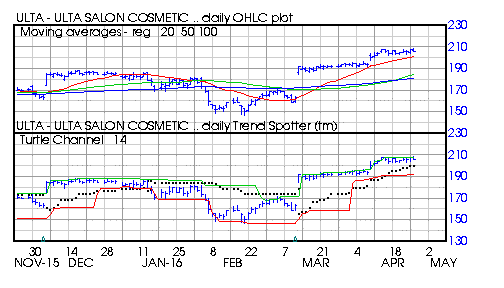

Ulta Salon Cosmetics

Barchart technical indicators:

- 80% technical buy signals

- Trend Spotter buy signal

- Above its 20, 50 and 100 day moving averages

- 11 new highs and up 7.44% in the last month

- Relative Strength Index 66.49%

- Technical support level at 202.50

- Recently traded at 206.04 with a 50 day moving average of 184.62

Disclosure: None.

Comments

Please wait...

Comment posted successfully.

No Thumbs up yet!