5 Large Caps For Momentum Investors - May 16, 2016

Today I used Barchart to sort the S&P 500 Large Cap Index stocks to find stocks for momentum investors. First I sorted for the most frequent new highs in the last month then again for positive short term buy signals. Next I used the Flipchart feature to review the charts.

Today's watch list includes: Oneok (NYSE: OKE), Baxter International (NYSE: BAX), L-3 Communications (NYSE: LLL), Republic Services (NYSE: RSG) and Martin Marietta Materials (NYSE: MLM)

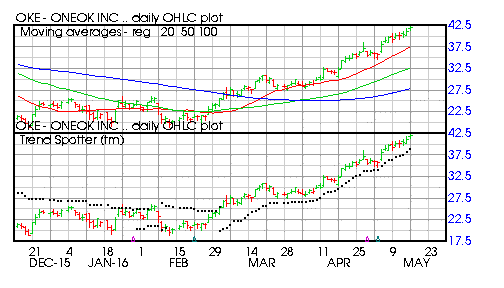

Oneok

Barchart technical indicators:

- 96% technical buy signals

- Trend Spotter buy signal

- Above its 20, 50 and 100 day moving averages

- 17 new highs and up 32.21% in the last month

- Relative Strength Index 79.75%

- Technical support level at 39.29

- Recently traded at 41.98 with a 50 day moving average of 32.60

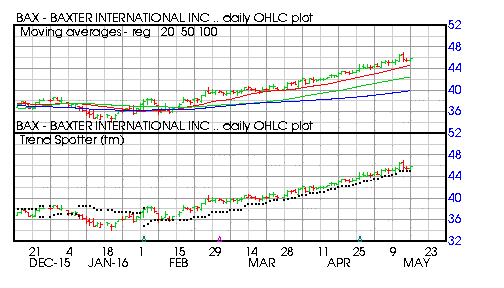

Baxter International

Barchart technical indicators:

- 88% technical buy signals

- Trend Spotter buy signal

- Above its 20, 50 and 100 day moving averages

- 15 new highs and up 7.41% in the last month

- Relative Strength Index 68.35%

- Technical support level at 44.87

- Recently traded at 45.85 with a 50 day moving average of 42.45

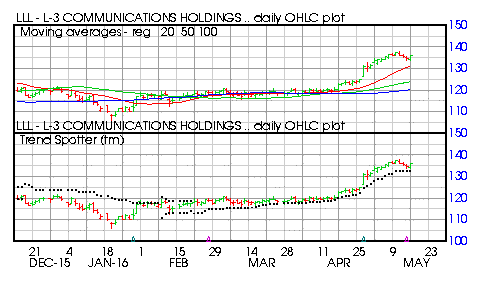

L-3 Communications

Barchart technical indicators:

- 72% technical buy signals

- Trend Spotter buy signal

- Above its 20, 50 and 100 day moving averages

- 14 new highs and up 12.17% in the last month

- Relative Strength Index 71.20%

- Technical support level at 133.05

- Recently traded at 135.99 with a 50 day moving average of 123.89

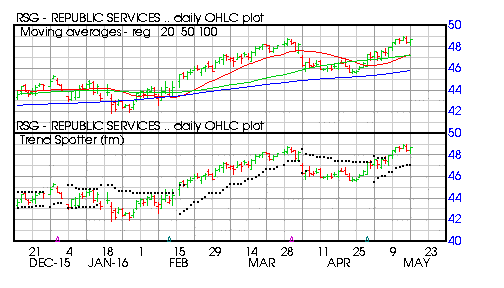

Republic Services

Barchart technical indicators:

- 88% technical buy signals

- Trend Spotter buy signal

- Above its 20, 50 and 100 day moving averages

- 14 new highs and up 5.37% in the last month

- Relative Strength Index 64.10%

- Technical support level at 47.99

- Recently traded at 48.72 with a 50 day moving average of 47.21

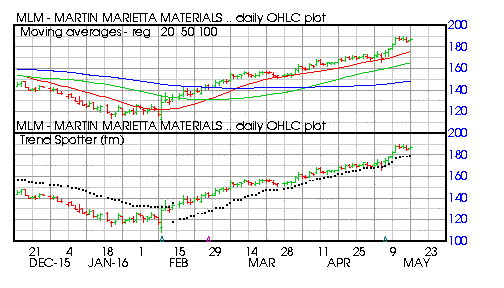

Martin Marietta Materials

Barchart technical indicators:

- 96% technical buy signals

- Trend Spotter buy signal

- Above its 20, 50 and 100 day moving averages

- 13 new highs and up 13.33% in the last month

- Relative Strength Index 72.19%

- Technical support level at 181.06

- Recently traded at 187.13 with a 50 day moving average of 165.23

Disclosure: None.