4Q’19 Earnings Are Tracking At Their Worst Pace Since 4Q’18

The week of January 27 will see earnings pick up in a meaningful way, and the results that come out will need to be significantly better. Based on data from S&P Dow Jones through January 23, earnings have been topping estimates at the slowest pace since the fourth quarter of 2018. It is dragging down earnings for 2019 and 2020, so this week really will be critical.

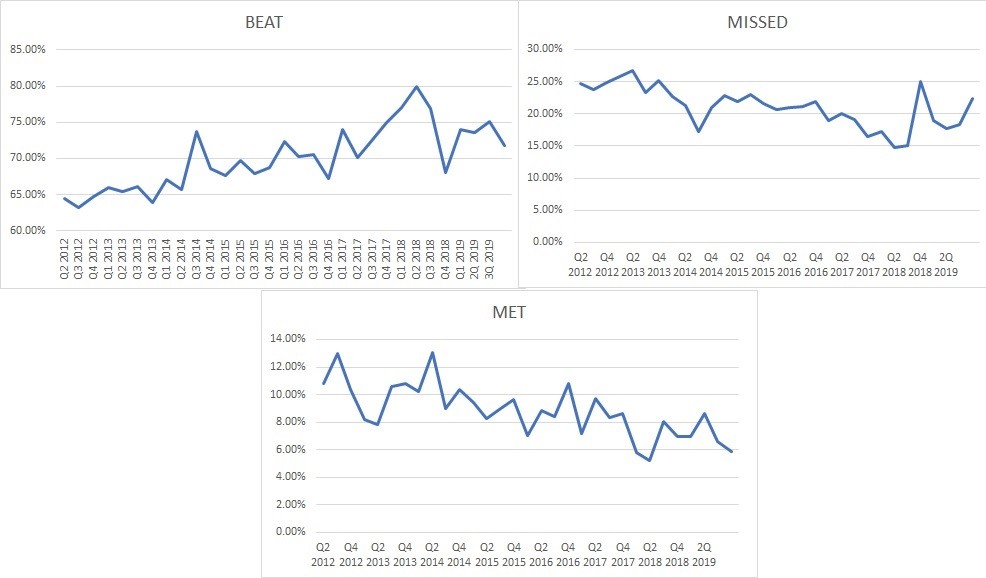

So far, 85 companies have reported results with just 61 beating estimates. It means that only 71.8% have beaten their estimates, while 22.4% have missed, and 5.9% have met. Across the board, these are some of the worst results since Q4’18. What may be most concerning is that the number of companies missing is way up.

(Data from S&P Dow Jones)

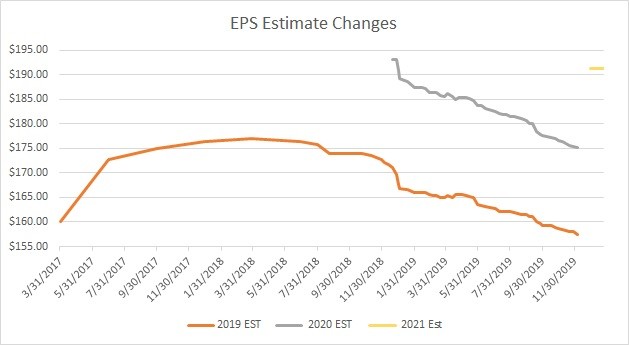

The weak results are dragging down estimates for 2019 to $157.45 per share, which would bring 2019 operating growth to just 3.9%. Meanwhile, estimates for 2020 have also declined to around $175.08, growth of about 11.2% over 2019. Forecasts for 2021 remained unchanged at $191.22.

(Data from S&P Dow Jones)

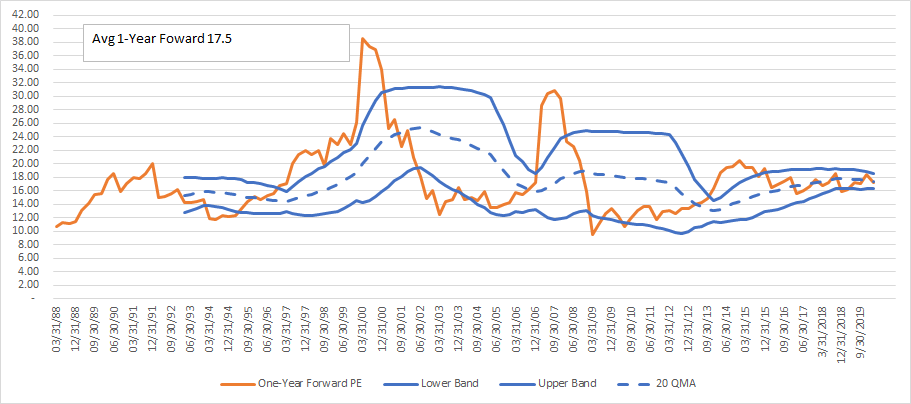

It leaves the S&P 500 trading for roughly 17.3 times 2020 earnings estimates, which is just below the historical average since 1988 of 17.5. It is also below the 20 quarter moving average of 17.4.

I have applied a new technique to my analysis of the S&P 500 valuation, using the concept of Bollinger Bands to determine if the current market earnings multiple falls in line with the historical trend. However, I made one modification of using one standard deviation from the 20 DMA, instead of two.

I first introduced the concept on my live webinar, using a slightly different variation of this method, but have enhanced it further after doing some work. Based on the data, it would suggest the S&P 500 could trade within a range of 16.3 to 18.5 and still be in a reasonably valued range.

Essentially we are right in the middle of that range.

(Data from S&P Dow Jones)

Companies Reporting

This week will crucial in determining how much further earnings could rise or fall for the balance of 2020. On Tuesday afternoon, we will have Apple, AMD, and Starbucks. Wednesday morning will feature Boeing, AT&T, and Mastercard; in the afternoon, we will see Microsoft, Facebook, and Tesla. Thursday will be Amazon and Visa.

Disclaimer: This article is my opinion and expresses my views. Those views can change at a moment's notice when the market changes. I am not right all the time and I do not expect to be. I ...

more