4 Stocks To Watch Tomorrow After The Election

(Click on image to enlarge)

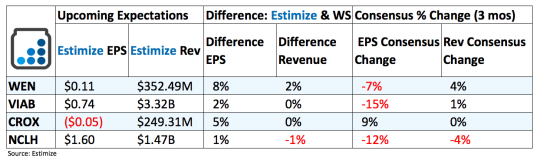

Wendy’s (WEN): The fast food sector is seeing a bounceback in recent quarters as spending habits shift to value channels. This ongoing transition has helped propel earnings from McDonald’s in the third quarter and is expected to bode well when Wendy’s reports tomorrow morning. Wendy’s recent surge can also be credited to the multi-year brand transformation that includes menu innovations, promotional campaigns and bolder packaging. Meanwhile, the burger chain is heavily invested in expanding its technological presence through a mobile app and self ordering kiosk. Many of these initiatives contributed to a 0.4% increase in same store sales and 370 basis point increase in margins for the second quarter. Analysts are still expecting softer year over year comparisons as its recovery continues to gain steam.

Viacom (VIAB): Mainstream media networks have seen their share of misfortune in recent quarters as cord cutting habits continues to pick up pace. This has reflected weak earnings from notable networks like Disney which is seeing a sharp downturn in ESPN subscribers and will have an adverse impact on Viacom’s earnings tomorrow. The media conglomerate has posted negative top line growth in 5 of the past 6 quarters thanks in part to tougher competition and cord cutting. Analysts expect this to continue in its upcoming quarterly results, forecasting a 47% decline on the bottom line and 11% on the top. Some of this will be offset by efficient cost controls and operational improvements during the quarter. Key partnerships with Sony and Verizon are worth noting and may be determining factors on Viacom’s return to glory. Investors may overlook these recent indiscretions if management suggests a rumored merger with CBS is on the horizon.

Croc’s (CROX): CROX has had its share of ups and downs in the past few quarters. The shoe maker returned to profitability in the first quarter of 2016 but subsequently posted negative growth on the top line. Expectations are edging lower this quarter as we head into the colder months when Crocs historically have not done as well. Analysts are calling for a 5 cent loss per share on a 7% decline in revenue to $249.31 million. Shares are down 24% in 2016 and historically drop 4% immediately through the print.

Norwegian Cruise Line (NCLH): Travel trends appear to be gaining steam this earnings season as evidenced by strong results from the airlines, hotel operators and cruise liners. This bodes well for Norwegian which reports its quarterly results tomorrow before the opening bell. The cruiseliner has benefited from robust year over year comparisons posted by its peers Carnival and Royal Caribbean. Norwegian still faces several near term headwinds that could dent quarterly results including its exposure to European markets and weak FX translation. Europe currently accounts for a third of the company’s capacity and could potentially throw results off course.

Disclosure: None.