4 Stocks To Watch Before The Market Opens Tomorrow (September 1, 2016)

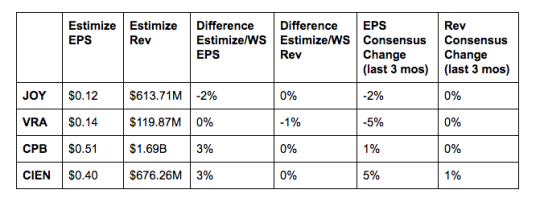

Joy Global (JOY): The company is coming off a better than expected second quarter which spurred the recent breakout. Shares are up 117% year to date and 64% just in the past 3 months. During this quarter, Japanese company Komatsu agreed to purchase Joy Global for $2.9 billion. Both companies should compliment each other in terms of earnings and revenue growth. THe deal will likely be highlighted in the company’s conference call. As for earnings, Joy Global is anticipated to extend its momentum from last quarter with expectations of delivering steadily improving top and bottom line growth.

Vera Bradley (VRA): Expectations have been set so low that despite consistently topping them, overall results for Vera Bradley have been relatively unimpressive. Last quarter’s surprise featured a 6.7% decline in comparable sales, reflecting a 3.8% decline in store sales and 11% in ecommerce sales. The lack of promotional activity and discounting was largely to blame for lackluster online sales. Discounting has been one of the only ways higher-end brands can compete in this current economic environment. If the company remains reluctant to deliver sales or discounts to clear out excess inventory, then it won’t be surprising if numbers continue to suffer.

Campbell Soup (CPB): The company’s strengths can be seen in multiple areas including solid stock performance, expanding profit margins and earnings per share. This is somewhat offset by the company’s high debt and sluggish revenue growth. Its portfolio of brands consists largely of processed food brands which aren’t resonating with modern consumers. Nonetheless the stock is up 15% year to date and 27% in the past 12 months. Historically shares tend to remain flat in the 30 days following an earnings report.

CIENA (CIEN): The company continues to benefit from strong demand for its optical transport and switching products, integrated network and service management software. This has been boosted by a greater number of international customers that will continue to boost its top line. Additionally a move toward cloud based networking is expected to bode well. Ciena’s strong product portfolio will be key to revenue growth over the long run. In spite of all these encouraging factors, the space is very competitive. Cisco and Juniper Networks are amongst its biggest threats.

Disclosure: None.