4 Stocks To Watch Before The Market Opens Tomorrow (August 25, 2016)

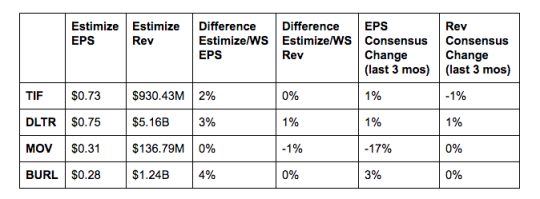

TIffany (TIF): Gold, silver and platinum prices have risen substantially this year making it difficult for Tiffany to pass those costs onto customers. Additionally upscale brands are simply not resonating anymore as consumers shift their focus toward value based channels. Tiffany should continue to see pressure from currency headwinds, weak consumer spending and competitive pressure from the most unlikely sources. eBay, for example, is making it difficult for Tiffany to generate online sales while maintaining respectable margins. Rapid new store expansion should help offset some of its losses in other parts of the business.

Dollar Tree (DLTR): Deep discounters have performed well in recent quarters thanks to a broader trend toward value channels. The company’s long term strategy which includes growth initiatives, store expansion, productivity gains and tapping of new markets bodes well. Its recent acquisition and integration of Family Dollar is also progressing well. This should create long term synergies but in the short term could have a slight adverse impact on sales and margins. MKM Partners reiterated its buy rating and $104 price target on shares ahead of the company’s results tomorrow morning.

Movado (MOV): It can’t be said enough that luxury retailers aren’t getting treated as well as discounters in this current economic environment. Movado is one of those names which have been victimized by value plays. Shares are down nearly 13% in the past 6 months on slowing sales and profitability. In 2 of the past 3 quarters, the company has missed its sales target with negative year over comparisons. Downward revisions activity and weak projected growth suggest Movado is unlikely to right the ship this quarter. Fortunately the stock historically increases 3% following an earnings report.

Burlington Stores (BURL): This earnings season has proved that discounters are dominating the retail sector. Discounters such as Walmart, TJX and JCPenney all topped expectations thanks to the broader trend towards value channels. Burlington’s report tomorrow morning is likely to echo this ongoing shift. Shares of the discount retailer are up 84% year to date and historically the stock increases 4% after an earnings report. If Burlington can maintain upbeat earnings and maintain its positive outlook then don’t expect this stock to falter.

Disclosure: None.