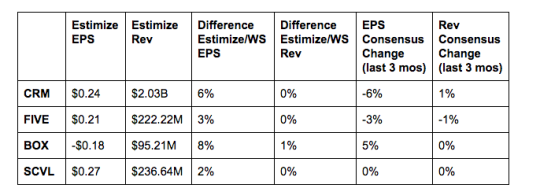

4 Stocks To Watch After The Market Closes Today (August 31, 2016)

Salesforce (CRM): Acquisitions have been a key part of the company’s growth strategy. Over the past few years, new acquisitions and partnerships have helped Salesforce improve and build its native offerings. Year to date the company has completed 9 transactions, the most recent being the buyout of Demandware. The rapid adoption of its platform has propelled earnings and revenue growth quarter after quarter. Revenue growth has exceeded 20% for 8 consecutive quarters and counting while earnings have been nothing to take lightly. The stock is up 14% from a year earlier and historically increases 3% following an earnings report. Competition, currency headwinds and higher operating costs from continued acquisitions could hamper growth this quarter. The long-term goal of Microsoft’s acquisition of LinkedIn earlier this year is to challenge Salesforce for CRM market share. This could be a long-term problem for Salesforce but is unlikely to be brought up in the near term.

Five Below (FIVE): Discounters have prospered in this current retail environment that has favored value channels. Five Below has been along for the ride with the stock and earnings thriving. The past 3 quarters have delivered over 20% gains on both the top and bottom line. Year to date the stock is up 38% and historically increases 2% following an earnings report. Tomorrow’s report is expected to continue this trend with a projected 60% jump in earnings and 22% increase in revenue. Unfortunately similar to the dollar stores, expectations might be set to high for Five Below. The dollar stores fell short of expectations last week not because they had bad quarters but because expectations were too high. This problem could be echoed if tomorrow’s report falls short.

BOX (BOX): Quarterly results have followed a universal theme plaguing the tech sector: mounting losses and decelerating revenue growth. Box has reported double digit revenue growth and unprofitability in each quarter as a publicly traded company. In the year and half since its IPO the stock is down nearly 42% but has slowly recovered. This year shares are only down 4% providing investors with hope for a quick turnaround. Investment in security, compliance and administrative technology should improve adoption rates. Partnerships with leading enterprise technology companies like Cognizant and Adobe are expected to do the same. Increased investments are likely to take its toll on margins as well as profits, which have otherwise struggled

Shoe Carnival (SCVL): Recent reports have followed a pattern of beat, miss, beat, and so on. If this is any indication of what will happen tomorrow then investors should expect to see a beat with a pop in the stock. This would add to the 28% gains made this year and 17% in the past 12 months. Unfortunately earnings don’t work this way. It’s more likely that we see results similar to what DSW printed yesterday. DSW reported in line results and weak guidance which sent shares plunging nearly 9%.

Disclosure: None.