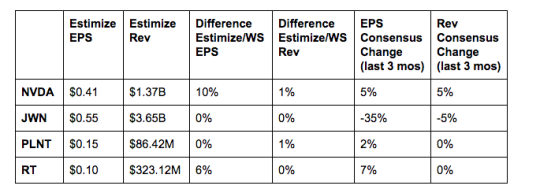

4 Stocks To Watch After The Market Closes Today - 8/11/2016

NVDA: NVidia is one of the biggest winners in the tech space lately. The stock is up 80% year to date and a resounding 155% in the past 12 months. Continued strength in the gaming industry has been the primary driver of strong GPU sales. The addition of its first Polaris graphics cards is expected to be another source of revenue moving forward. Other business ventures such as automotives, data centers and major league gaming could push the stock and company to the next level. NVidia should be aware that AMD is closing the gap. AMD’s most recent chips have been lauded as the best available products on the market. If AMD continues to capture more market share, don’t expect NVidia to sustain its gains.

JWN: Department stores, on the other hand, are some of the biggest losers lately. Shares of Nordstrom are down 40% from a year earlier as consumers are spending more on fast fashion trends and with online retailers. The considerable downturn of in-store sales have contributed to weak financial performance. Fortunately, its off price business and ecommerce platform have been gaining traction. Last quarter Nordstrom saw an 11% jump in sales from Nordstrom Rack and Hautelook. Management also indicated that its annual Anniversary Sale was generating strong traffic trends. Macy’s and Kohl’s better than expected report this morning bodes well for Nordstrom later today. Shares of Nordstrom are up 8% in premarket trading on the good news from Macy’s and Kohl’s.

PLNT: Low priced and discount goods have attracted consumer across all sectors and Planet Fitness hasn’t been any different. The budget gym has performed remarkably well since its IPO late last year. Since its debut on the stock exchange, shares are up 26%. The company has also beat expectations in each of the past 3 quarters. Unfortunately, like many new companies, revenue growth has decelerated over past quarters. After posting double digit gains throughout fiscal 2015, growth in the first and second quarter have been just shy of 10%. If this continues to be an ongoing trend expect the honeymoon period to end.

RT: Unfortunately the company hasn’t been apart of the broader surge in the casual dining sector. Ruby Tuesday has incurred losses in 4 of its last 6 quarters. Higher labor and operating costs are taking its toll on margins and should continue to do so for the quarter to be reported. Traffic is also expected to decline as competitors implement more attractive promotional campaigns. Like its peers, frequent menu innovations, limited time offers and increased marketing efforts will help the company return to profitability.

Disclosure: None.