4 Stock Market Crash Tips From Peter Lynch

Peter Lynch, one of the best investors ever, shares 4 stock market crash tips that will help you do the right thing when a stock market crash comes. A stock market crash can come in 2020 or later on, but if you are doing the right thing, you don’t have to fear for your stock market portfolio.

Image source: YouTube Video Screenshot

4 Stock Market Crash Tips From Greatest Investor Ever – Peter Lynch

Q3 2019 hedge fund letters, conferences and more

Transcript

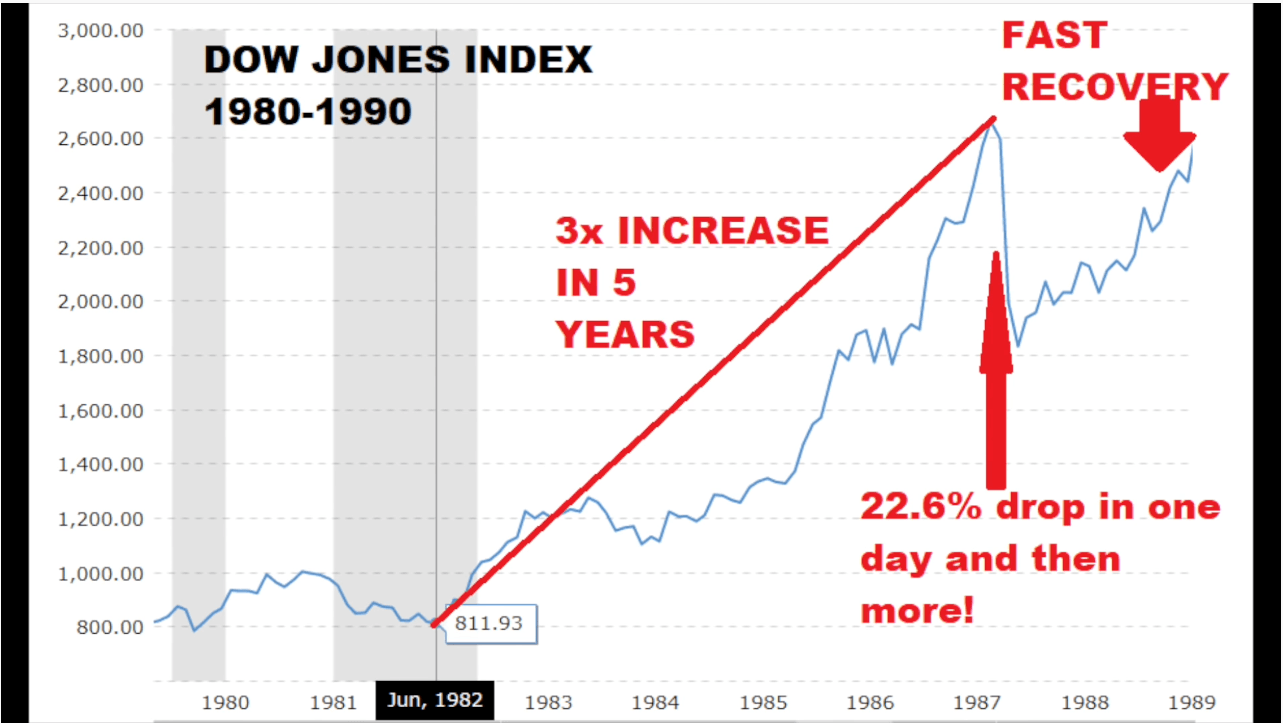

Good day fellow investors. We are continuing with the summary of One Up On Wall Street, probably one of the best-investing books out there. And what we're going to summarise today's is how to invest true stock market crashes how to behave, because Peter Lynch's discusses how he behaved during the 1987 stock market crash. That was a big crash with stocks falling 22.6% in one day, how are you going to behave? What's important? What's not important? One of the greatest investors of all time is telling us.

We're going to discuss what Peter Lynch did, how he behaved, what is important when it comes to stock market crashes and how to invest through stock market crashes. We'll finish this video with his summary and four investing lessons, how to invest through stock market crashes. Before we start, just quickly click the like button. If you enjoyed these videos, subscribe and click that notification bell so that you get notified each time a new video comes out for you that you don't miss the most important videos.

What Peter Lynch can teach you

Let's start the stock market crash of 1987 happened on Black Monday, October 13, 1987. When the Dow blanched 500 points in one day, down 22.6% from 1982, the Dow index jumped from 2000 points to 6000 points. And when October came market panic created the selling spiral also computer programme selling spiral stop losses that sent the market down. The news related to the crash was all about panic comparing it to the 1929 crash. But it is a serious situation that can happen anytime the Dow went up three times in five years, which means that maybe tomorrow the stock market can crash 20% easily. However, Peter Lynch reactions to the 1987 stock market crash is very, very peculiar.

The first funny thing is that he was on holiday in Ireland, while his investors lost $2 billion in one day that still be with a billion dollars. He was visiting Blarney Castle kissing the Blarney Stone and playing golf in the beautiful fields of Ireland. Later he was more on the phone because they had to sell stocks. He was always 100% invested to cater for the fund redemptions, he says that Fortunately, there was just 3% of investors that wanted their money back so he had to sell 3% of the fund. And when that panic strikes the markets, it's normal that people want to sell even if Great Investors would never sell in panic, they are forced to sell and therefore push stocks even lower. That's the unfortunate truth when it comes to stock market.

You can be smart but panic fund redemptions, people start selling, and therefore you have those flash crashes like we had in December 2018. It's something completely normal, just as government only one investor is protected for from having to sell. And it's Warren Buffett, he doesn't have a fund. He has a company which is Berkshire. So you cannot redeem stocks or money from that. That's why Buffett has a company, not the fund.

Stock Market Crash Tips from great investors

Now, going to Peter Lynch's for market crash lessons. The first is ignore the ups and downs of the market. something extremely hard to do because we are bombarded with constant news about stock price and market moves. But you have to focus on business fundamentals. You should also forget about stock prices. And the funny note from Lynch is that in the 1970s, stock market news was hard to find. However, today, stock market news is hard to avoid. To quote Peter Lynch When you sell in desperation, you always sell cheap. So don't ever sell in desperation, be prepared for it. Secondly, stocks go up over the long term. The funny thing about the great panic in 1987 Is that pretty soon, stocks recovered passed through the previous high and never looked back.

The Dow Jones index went from 1833 points in the bottom of the 1987 stock market crash to 10,000 points by 1999. Thirdly, don't let nuisances ruin a good portfolio. Those that own the good portfolio like the Dow Jones did really well. And this is perhaps the most important thing to understand when investing you can predict crashes but you can own great businesses. Of course, every stock will fall in a crash in a recession. But if you have great businesses, those businesses will do well over the very long term, compound and deliver amazing returns.

Disclaimer: This article is NOT an investment recommendation, please see our disclaimer - Get our 10 ...

more