4 Reliable Dividend-Paying Companies That Sell To The Companies That Sell To You

When most people think about publicly traded companies, a small number of companies come to mind. There are the hot tech stocks like Amazon, Facebook, and Tesla. You may also think of old-school companies like Johnson & Johnson, Walmart, and Bank of America.

Yet, once people begin investing, many are surprised to learn there are over 5,000 publicly traded companies. Each of these has shares of stocks that trade either on one of the stock exchanges or over-the-counter. When you get away from the well-known, name-brand companies and their shares, you can find tremendous investment opportunities.

One strategy to find little-known stocks with excellent prospects is to look at the companies that supply the big names on the markets. I focus on dividend-paying stocks, and when a popular stock doesn’t pay dividends, you can ride the popular companies’ successes by investing in their suppliers, especially if you find dividend-paying, dividend growth stocks.

Here are four stocks to get you started:

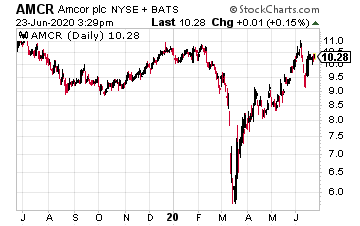

Amcor Ltd. (AMCR) is a global leader in producing responsible packaging for food, beverage, pharmaceutical, medical, home, personal care, and other products. The company was founded in Australia in 1860 and now has 250 plants in 40 countries. Products include a wide range of flexible and rigid consumer packaging.

About half (46%) of Amcor’s sales come from North America. The balance is split between Western Europe and emerging markets. Surprisingly, only 3% of sales come from Australia and New Zealand.

The bulk of Amcor’s product sales (68%) are for food and beverage packaging products.

Packaging sales is a growth business. From 2014 through 2019, Amcor reported a 7% compound annual EPS growth. Over the same period, the company grew the dividend by a 12% yearly growth rate.

The current yield is 4.4%.

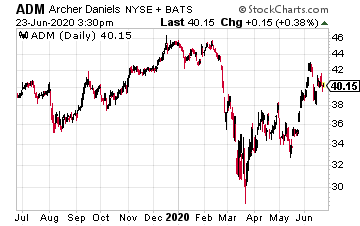

Archer-Daniels-Midland Company (ADM) is an agricultural products company. The company divides its offerings into four product lines: Food & Beverage Ingredients, Animal Nutrition, Industrials—chemicals and ingredients for packaging and personal care—and Biofuels. Services include Farmer Services, Financial Services, and Logistics.

Agricultural products and services are big business, and Archer-Daniels-Midland is a big company. The stock has a $22 billion market cap. For 2019, the company reported revenue of $64.3 billion and gross profits of 4.17 billion.

Archer-Daniels-Midland is also a Dividend Aristocrat, increasing its dividend rate for 27 straight years. The company has paid a dividend for 353 consecutive quarters, a record of 88 years of payments to investors.

Annual dividend growth is in the high single digits, and the current yield is 3.55%.

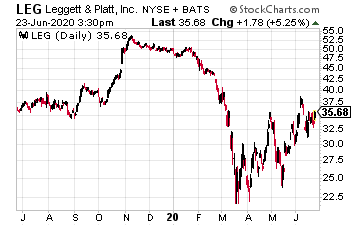

Leggett & Platt, Inc. (LEG) manufactures components that are used to manufacture bedding, furniture, flooring, and automotive interiors. The company started producing bedding components, such as mattress springs and specialty foam, over 135 years ago.

Because Leggett & Platt manufactures component products that go into home furnishings and bedding, the company will benefit from home sales. Whether buyers go with new or existing homes, they often want to buy new furniture for their new dwellings.

Leggett & Platt grows through a combination of organic growth and acquisitions. The target is 6% to 9% annual compound growth. The company’s dividend has increased for 47 consecutive years, and it is one quarter overdue for its 2020 increase. Investors should expect a boost in the payout when the economy gets back on track.

The current yield is 4.6%.

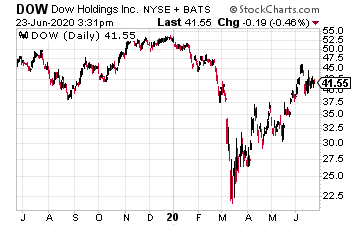

Dow, Inc. (DOW), a chemical company that produces a wide range of products, calls itself a materials science leader committed to delivering innovative and sustainable solutions for customers in packaging, infrastructure, and consumer care.

Dow’s product technologies list has over 20 items, each of which covers a variety of chemicals in the specific categories.

Although not related, Dow is one of the 30 Dow Jones Industrial Average (DJIA) stocks. The current Dow is the result of the separation of Dow and DuPont in April 2019. For 2019 the company reported revenue of $42.9 billion, with gross profits of $6.37 billion. Operating income was $3.8 billion.

In November 2017, Dow cut its dividend from $0.46 per share down to $0.38 per share. The reduction came after a decade of strong dividend growth coming out of the 2007-2009 recession.

In April 2019, after the spin-off, the dividend was dramatically increased to $0.70 per share. The current yield is 6.7%.

Disclaimer: The information contained in this article is neither an offer nor a recommendation to buy or sell any security, options on equities, or cryptocurrency. Investors Alley Corp. and its ...

more