4 Hot Stocks To Follow As Earnings Season Heats Up

The first quarter of calendar year 2019 has wrapped up, so it’s time once again to tune in for earnings season. At least it may provide some relief from the electoral silly season, and it will definitely provide greater value for your portfolio.

Whether you’re looking to get away from election news, or to find the best investment, a good earnings calendar tool will make it easy. Knowing when your favorite companies are reporting their earnings, and what to expect when they do, will help you to plan your investments to get the best returns.

We’ve used the TipRanks Earnings Calendar to screen for ‘Strong Buy’ stocks that are earning their headlines this quarter. These are companies that are generating the returns and growth for their investors and showing great potential for the rest of this year. So, let’s dive in, and see where they stand this quarter.

Anthem, Inc. (ANTM – Research Report)

The health insurance giant, which showed well over $90 billion in revenues for 2018, will report its Q1 FY19 earnings on April 24. The company’s biggest change heading into the new quarter has been bringing its pharmacy benefits manager, IngenioRx, online for customers. Anthem’s management believes that Ingenio has potential to save the company up to $4 billion annually, with some 20% of that going to shareholders. So far, industry analysts are optimistic about Anthem’s prospects, and expect the company to deliver on EPS; the consensus forecast of $5.83 is a significant gain over the year-ago quarter’s $5.41.

Writing from Cowen, Charles Rhyee sees IngenioRx as the prime mover in Anthem’s success this quarter. He says, “The key factor in achieving the better than expected L-T outlook is clearly IngenioRx, given how often it was referenced throughout ANTM’s investor day during various presentations. It is … a key factor driving 20%+ EPS growth in 2019 and 2020, [and] the biggest driver behind ANTM’s 10%-12% top-line growth.” Rhyee’s price target, $364, reflects his positive outlook, and suggests an upside for 24% for the stock.

Just as upbeat for Anthem is Cantor Fitzgerald’s Steven Halper. In his note, he also took cognizance of IngenioRx and its impact on the parent company’s growth going forward: “We reiterate our OW rating on Anthem shares and our 12- month price target remains at $360. The company hosted an investor meeting, which highlighted many of the company’s new growth initiatives. Indeed, many of the initiatives are likely to be driven by redeploying the savings generated by the launch of IngenioRx. …The company increased its long-term EPS growth target to 12-15% CAGR (2021-2023)…”

Halper gives ANTM shares a price target of $360, implying a 22% upside.

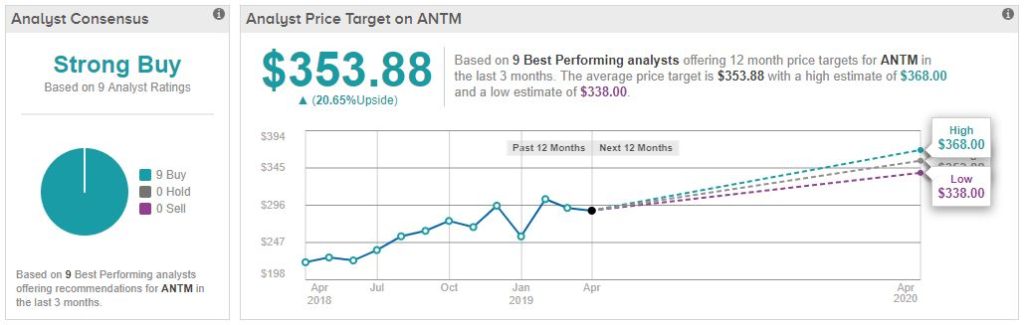

Overall, Anthem has received 9 buy ratings from the best performing analysts over the past three months, making the stock’s ‘Strong Buy’ consensus a unanimous vote. Shares sell for $293, so the $353 average price target gives an upside potential of 20%.

View ANTM Price Target & Analyst Ratings Detail

Boeing Company (BA – Research Report)

Boeing, of course has been in the headlines for all the wrong reasons lately. The March 10 crash of an Ethiopian Airlines 737 MAX 8 – the most popular variant of Boeing’s most popular airliner – has had serious repercussions for the company. All MAX 8 aircraft have been grounded pending results of the crash investigation. Preliminary reports have indicated that the crash – as well as a Lion Air tragedy in Indonesia last October – was caused by a flaw in the autopilot control system. The company says it has a software fix prepared, but after two fatal crashes the FAA will not approve the fix until it is certain that the software patch truly addresses the cause of the tragedies. In the meantime, Boeing has been forced to scale back production lines on the 737 MAX 8.

Like Anthem, Boeing will be reporting quarterly earnings on April 24. Considering the headwinds facing the company right now, it appears to hold a remarkably good position approaching the earnings report.

For starters, Boeing finished 2018 on a high note. The $101 billion annual revenue was the company’s first annual total in triple-digit billions, and the Q4 EPS beat expectations by nearly a full dollar. Looking at the Q1 2019 forecast, quarterly EPS is expected to come in between $4.14 and $4.25, compared to $3.60 a year ago. Quarterly revenues are expected to take a hit, but only a modest one, with the $24.87 billion forecast being $500 million lower than last quarter’s reported total. Chalk that up to reduced sales and deliveries, and software upgrade costs to the 737 MAX 8.

Wall Street’s analysts are looking at the long-term picture, and see Boeing’s fundamental strength giving it a bullish outlook. Ivan Feinseth, of Tigress Financial, says, “Long-term aircraft demand remains strong, and Boeing is benefiting from the trend of increasing passenger and freight traffic along with an upcoming increase in retiring older planes.” He also estimates that “global demand for commercial aviation services to grow about 4% per year over the next 20 years.” Feinseth does not set a specific price target, but he is firm in his ‘buy’ rating on this stock.

Peter Arment, writing for Baird, is less shy about a price target. He sees BA hitting $470, a 19% upside from current levels. He notes in his comments that the company still has plenty of work on backlog: “Last week we reset our deliveries to 134 aircraft for 1Q19 and based on our recent checks suggest BA deliveries will near that number with the KC-46 being the only challenged estimate. We still continue to recommend both short- and long-term investors buy BA stock.”

More recently, on April 5, Citigroup’s Jonathan Raviv gave Boeing a $450 price target. He bases his stance specifically on the ongoing air crash investigations, saying, “While the details of those results and other ongoing inquiries will undoubtedly be pored over in the coming weeks and months, we think that the key point is that the two tragedies indeed appear to be linked. This suggests that the problem is understood and that a fix is possible.” He believes that, with a workable fix, Boeing shares can resume their path towards $500. His current price target, somewhat more modest, suggests an upside of 14%.

Boeing’s analyst consensus of ‘Strong Buy’ is based on 18 reviews in the last three months, from top-performing analysts. These include 14 buys and only 4 holds. The average price target, $452, indicates a 15% upside from the share price of $391.

View BA Price Target & Analyst Ratings Detail

Constellation Brands, Inc. (STZ – Research Report)

Constellation Brands is the third largest beer supplier in the US, by market share, and the only company on this list has actually reported earnings for the just-ended quarter. For Constellation, it was Q4 FY19, and the results gave the stock a hefty boost.

It’s no wonder. EPS, at $1.84, beat the consensus by 13 cents (7.6%). It was the third time in the last four quarters that STZ has beaten the EPS estimates. Quarterly revenue was robust at $1.8 billion, $230 million higher than the year-ago quarter and 4.2% higher than the forecast.

A series of smart business moves are supporting the strong earnings. Last year, Constellation spent $4 billion buying a 38% stake in Canopy Growth (TSE:WEED), Canada’s largest cannabis producer. In a related transaction this past quarter, Constellation sold off its low-end wine brands for $1.7 billion, a move that streamlines the company’s business and allows it to focus on its core beer lines, Corona and Modela, and its higher-end wines and spirits, while working with Canopy to develop a line of cannabis drinks.

Constellation’s CEO, Bill Newlands, said of the product streamlining, “I’m confident that this optimized portfolio of wine and spirits brands will enable us to consistently deliver growth, exceeding the trends of the U.S. wine market…” Regarding the prospects from the Canopy acquisition, he said, “We share Canopy’s view that a significant opportunity exists going forward for the inclusion of cannabis as an ingredient in future consumer products…”

BMO Capital analyst Amit Sharma likes what he sees when he looks at Constellation, saying of the low-end divestment, “…the move re-shapes its portfolio and positions it on a clear path to double-digit core earnings growth… with added benefits coming from its free call option on Canopy.” His price target, $225, suggests an upside of 16% for STZ.

Timothy Ramey, of Pivotal Research, is even more bullish on the drinks giant, giving it a $265 price target for a 37% upside. Looking at the prospects for the company’s coming fiscal year, he says, “We expect our FY20 $8.65 estimate is in line with current guidance [and] are introducing a FY21 estimate of $10.00 and note that the company should be back to double-digit EPS growth.”

Constellation’s ‘Strong Buy’ consensus rests on 7 buy and 2 hold ratings from the past three months. The company’s average price target of $222 indicates an upside potential of 15% from the current share price of $193.

View STZ Price Target & Analyst Ratings Detail

Facebook, Inc. (FB – Research Report)

And now we get to a tech stock. The tech giants powered the market’s rise over the last couple of years, and in turn led the swoon in the second half of 2018. But they are heading up now in a big way.

Facebook has had an especially bad year. Time and again, the company has been called on the carpet for issues ranging from consumer data privacy to election interference, and founder Mark Zuckerberg’s performances in front of Congress did not help any. He was panned for his wooden demeanor and compared to the android character Data from Star Trek. As the conventional wisdom has it, it’s easy to say little and do less when you’ve made as much money as Zuckerberg.

He may have internalized the political necessities facing a giant information technology company in an age when regulatory-happy Democrats may be politically ascendant, however. On March 30, Zuckerberg released an open letter saying that he would be amenable to greater regulation of online social media, specifically in the areas of harmful content, election integrity, user privacy, and data portability. In the days since, FB shares have gained $7. Has Facebook finally gotten the bad press into the rear-view mirror?

Perhaps. FB shares are at a six-month high, and the company’s EPS forecast for the upcoming Q1 earnings report (Facebook reports on April 24) is a robust $1.65. Facebook has beaten EPS consensus estimates in 9 of the last 10 quarters.

Wall Street’s analysts have been quick to note FB’s improved prospects. On April 4, four-star analyst Michael Morris, from Guggenheim, upgraded his view of the stock from ‘neutral’ to ‘buy,’ setting a $200 price target. He points out solid user growth on the platform, as well as a rosy outlook for future profits: “…potential for commerce and messaging monetization opportunities are attractively priced within shares.” Morris’s price target indicates a potential 13% upside for Facebook.

Also giving Facebook a seal of approval isYoussef Squali, of SunTrust Robinson. Squali looks at Zuckerberg’s open letter and sees the company setting itself up for advantageous PR: “This position is also being expressed during a period of heated electoral politics when regulators from the US to India are sounding the alarm on the power Facebook wields over speech… Facebook has been trying to lead the narrative around what needs to be done industry-wide to address these issues.”

While he sees this as primarily a move for PR and damage control, Squali’s approval is undoubted, and is clear in his price target. He sees FB shares moving to $210, for an upside potential of 19%.

Facebook is currently selling for $175 per share, and holds a ‘Strong Buy’ consensus rating based on a grand total of 31 buys in the last three months. During that same time, there have been only 6 holds, giving the buys a 5 to 1 advantage. The average price target, $196, indicates 11% upside potential.

Disclaimer: TipRanks is an independent cloud based service that measures and ranks digitally published financial advice. TipRanks' natural language processing (NLP) algorithms aggregate and ...

more