3 Underrated Airline Plays For Sky-High Returns

The airline industry has been the major bright spot of the market, but has all the easy money been made? These lesser known airlines are where you will find the biggest share price gains in the industry going in to 2015. Act now before the rest of the market wises up and the rally begins.

The airline industry has been the best performing in the market over the last three months, up 30%. And over the last year, it is up 58%.

Hands down, the airline industry has been the best place to be invested over the last few years thanks to various mergers that have led to industry consolidation. The recent fall in oil prices has really helped bring the industry into focus.

It’s no secret that fuel costs are the largest expense for airline operators. About a third of an airline’s’ entire cost is usually fuel. And with oil flirting with $50 a barrel, this could be the catalyst that helps make 2015 another stellar year for the high-fliers.

And there’s a lot working in the favor of airlines; the combination of lower fuel prices and the right-sizing of the industry are the two well-known catalysts.

As well, rising employment and the strengthening economy will be big positives for airlines. More money in the pockets of consumers and businesses are positives for airline travel. Flying is becoming easier and more convenient, with airlines offering Wi-Fi, installing outlets and offering more leg room.

But everyone loves to talk about the major airlines, including United Continental (NYSE: UAL), Delta Air Lines (NYSE: DAL) and American Airlines (NASDAQ: AAL).

However, with the stock price of all three up more than 40% over the last three months, I’d expect investors looking to play the bustling airline industry to focus more on the under-followed names.

This comes as not all airlines have enjoyed the same upside as the jumbo airlines. With that, here are the three most underrated airlines for 2015:

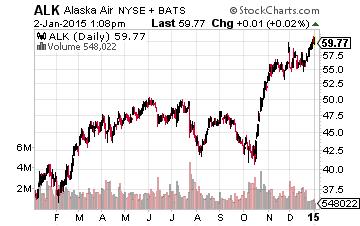

Underrated Airline For 2015 No. 1: Alaska Air Group (NYSE: ALK)

Alaska Air serves much of the Pacific Coast, focused on Alaska and various cities in Western U.S., Canada, and Mexico. Alaska Air is up an impressive 65% over the last year. Which, compared to the 13% return of the S&P 500 over the same time period, is pretty great; however, it’s still a laggard compared to the more well-known players.

Keeping its stock price tempered has been worries over Delta Air Lines aggressively entering the Seattle market. But the worries appear largely overplayed as Delta has been trying to crack into the Seattle market for over two years now. Yet, Alaska Air continues to excel and has been profitable for ten straight years now. For 2014, it was again the highest ranked airline in terms of customer satisfaction according to J.D. Power — marking the seventh year in a row.

Alaska Air has one of the best returns on equity in the entire airline industry at 25%. And with a 32% debt-to-equity ratio, its balance sheet is top notch. What’s more is that it offers a 0.8% dividend yield.

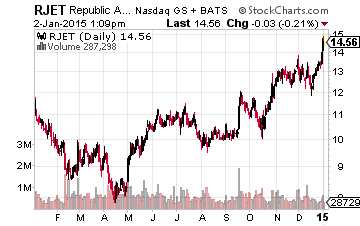

Underrated Airline For 2015 No. 2: Republic Airways Holdings (NASDAQ: RJET)

Republic Airways is a regional airline operator. Shares are up 36.5% over the last year, but has grossly underperformed its peers. Republic Airways trades at one of the lowest price-to-earnings ratios in the industry, coming in at 11. Meanwhile, the entire airline industry trades at a price-to-earnings ratio of 23.

On the contrary, its balance sheet is loaded with debt. So, Republic Airways doesn’t come without risks. However, with a solid 12% return on equity and cheap valuation, the risk versus reward might be worthwhile.

2015 should be a positive year for Republic Airways as it has turned its focus to larger planes. Many of its smaller, less-profitable, planes have been scrapped and it’s using larger planes to become more efficient. With larger planes, Republic Airways can also expand its services to include a business class on more routes.

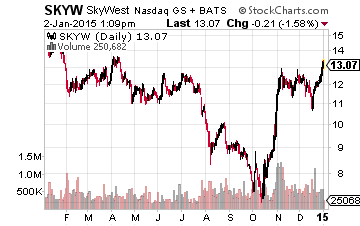

Underrated Airline For 2015 No. 3: SkyWest (NASDAQ: SKYW)

SkyWest, with a $680 million market cap, is one of the smallest players in this fiercely competitive industry. However, it also happens to be the United States’ largest regional airline.

Yet, it remains the biggest disappointment in the industry. In fact, it’s been a tough stock to own for a few years. SkyWest is down 9% over the last year, which is a big divergence from its airline counterparts. And over the last three years, shares are essentially flat.

This comes as it has had a few missteps in integrating its 2010 ExpressJet acquisition. There’s also been a number of other issues, such as a decrease in demand by American Airlines, given its merger with U.S. Airways. Both SkyWest’s profit margin and return on equity are barely positive and it has two times as much as debt as it has cash. But helping make 2014 a turnaround year should be the fact that many of its unprofitable aircraft contracts have been expiring.

The risk versus reward looks compelling here, with SkyWest trading at just 0.5x book value and its market cap is just 0.2x annual sales. The regional airline industry trades at nearly 1.2x book value and 0.4x sales. SkyWest also offers the highest dividend yield in the airline space, coming in at 1.2%.

Despite being one of the best performing industries of 2014, the airlines could again be one of the great performers of 2015. However, it might not be the big names that win again this year. Studious investors can still find value amongst airlines, with the best plays likely being the underrated stocks.

Disclosure: None