3 Top Buys In The Bull Market No One Sees Coming

A headline from Bloomberg on December 15th: “The Bull Market Almost No One Saw Coming.” The article discussed how, in 2009, no one was predicting that the next decade would be one of the greatest stock market bull markets since the 1950s. The S&P 500 was at 756 on March 13, 2009. Now it’s at 3,200!

However, the energy midstream sector has not participated in the broader stock bull market for the last five years. When the price of crude oil collapsed in 2014, so did midstream, and it hasn’t been able to sustain a recovery.

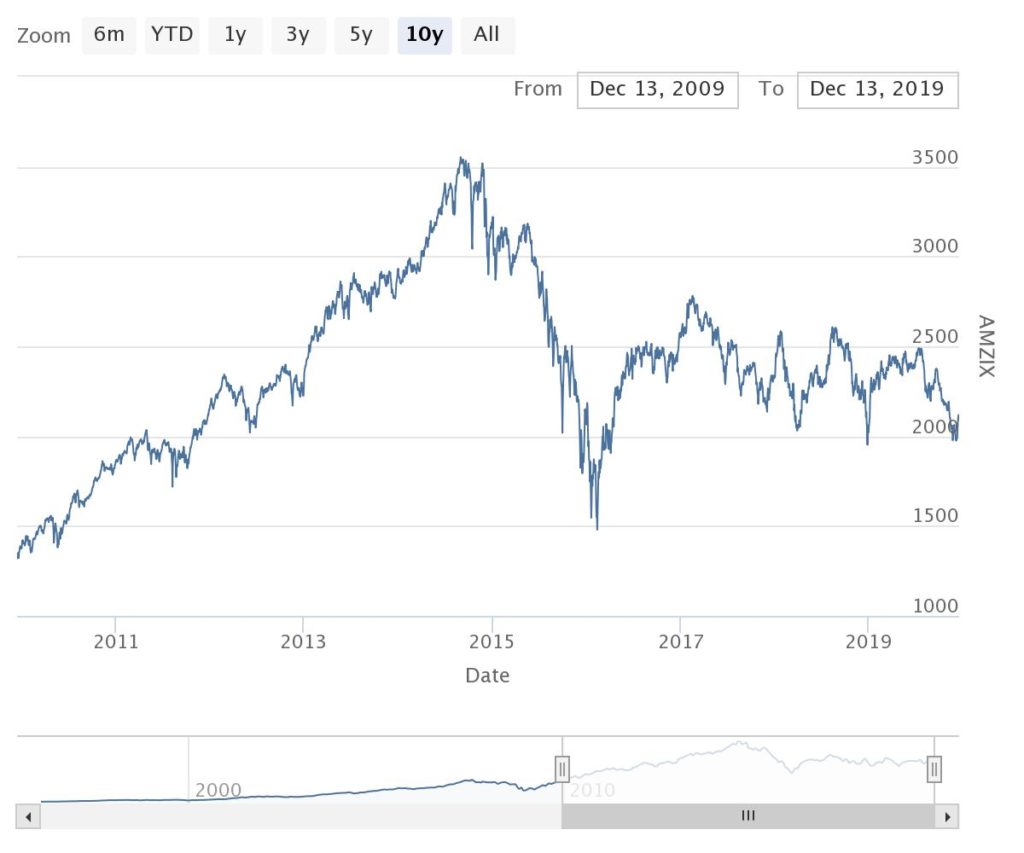

You can see from this chart how the Alerian MLP Infrastructure Index (AMZ) peaked in August 2014, and now sits over 40% lower than the high set over five years ago. The investing public again fell into hate with the sector in mid-2019, driving values down by 25% over the last half of this year.

Over the last five years, companies in the midstream sector have been hard at work, strengthening their financial houses. Here are some of the steps companies have taken:

- Master limited partnerships (MLPs) are no longer the preferred business structure. The sector is now a fairly even mix of MLPs and corporations.

- The remaining MLPs have eliminated the high-cost incentive distribution rights (IDRs) paid to MLP general partners.

- Most companies have lowered their debt to EBITDA ratios dramatically.

- Distributable cash flow (DCF) coverage of dividends/distributions has been increased. Prior to 2015, DCF coverage of 1.05 to 1.10 was considered adequate. Now quality midstream companies have coverage of 1.4 times and up.

- Growth projects are funded with internal cash flow, rather than the old-school practice of issuing new equity to raise capital.

Across the board, energy midstream companies are much more financially sound than they were five years ago. The only problem now is share prices that are down seem destined to stay that way, which brings us back to what we can learn from looking back to 2009. It is tough to find any market experts that are positive about the midstream stock market values.

That is what is telling me the bottom has finally been set, and I think these stocks will be the surprise winners of 2020. Yields are very high; cash flow is strong, and the investing public will start piling back in once they see some share value sustainability.

Related: Getting Paid 5.5% While Waiting for the Energy Rebound

Values in the sector bottomed at the beginning of December. I think this next leg up will not falter as have the last four attempts since 2016. This time the experts will be surprised.

Here are three investment ideas for the energy midstream sector.

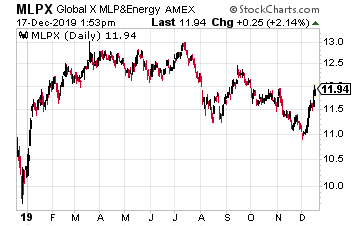

Global X MLP & Energy Infrastructure ETF (MLPX) is a midstream ETF that limits its MLP holdings to 25% of the total portfolio. The fund has over $600 million in assets.

The top five holdings are TC Energy Corp (TRP), Kinder Morgan Inc (KMI), Enbridge, Inc. (ENB), Oneok, Inc. (OKE), and Williams Companies (WMB).

Dividends are paid quarterly, with the next MLPX payout coming in January. Ex-dividend will be on December 30th. The fund shares currently yield 6.1%.

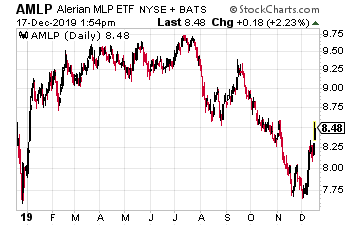

ALPS Alerian MLP ETF (AMLP) is an ETF that tracks the Alerian MLP Infrastructure MLP Index discussed earlier. The fund portfolio will be 100% MLPs.

Top holdings include Enterprise Product Partners (EPD), Magellan Midstream Partners (MMP), Energy Transfer (ET), MPLX LP (MPLX), and Plains All American Pipeline (PAA).

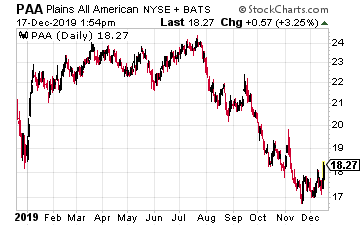

I have made Plains All American Pipeline (PAA) one of my top two stocks for 2020 to be published by The MoneyShow. Plains owns and operates the largest network of crude oil and natural gas liquids (NGLs) pipelines and storage facilities.

Over the last six months, the PAA unit price has dropped from $25 to less than $18. This means the dividend yield has increased from 5% to over 8%. DCF coverage is currently 2.0 times the dividend rate.

For 2019 Plains increased its dividend by 25%. I would not be surprised by a similar increase early in 2020. Plains GP Holdings (PAGP) shares are the 1099 reporting equivalent of the PAA MLP units.

Disclaimer: The information contained in this article is neither an offer nor a recommendation to buy or sell any security, options on equities, or cryptocurrency. Investors Alley Corp. and its ...

more