3 Tech Stocks Showing Early Signs That Their Quarterly Results Will Disappoint This Week

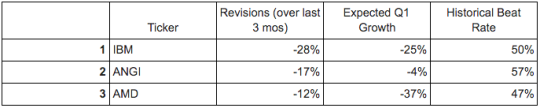

This first week of peak earnings season is loaded with quarterly releases from technology companies. While there are some that are expected to be winners, such as Alphabet Inc. and Intel, there are several that are showing indications of potential negative surprises. The three with the odds stacked against them for this week are International Business Machines, Angie’s List and Advanced Micro Devices. Each is expected to report negative YoY EPS growth, has seen their EPS consensus dramatically revised downward in the last three months, and has a historical beat rate that is below the average for our universe of stocks.

1. IBM

IBM has posted negative EPS growth for the last 3 consecutive quarters, and negative revenue growth since Q1 2012!

In Q1 investors will want to see that IBM is effectively transitioning away from its waning legacy business into more high growth markets. Weakness in discretionary IT spending, software and legacy services have weighed on financial performance. Expect mention of negative FX headwinds, but as the dollar begins to stabilize, this should be less of a concern for the rest of 2016.

IBM is investing heavily in cloud computing, Big Data, mobile and security, and of course its cognitive system, Watson. In the short term, IBM must strategically position itself as a major player in cloud computing with Amazon, Microsoft and Google. Recent partnerships with VMware and Box should help streamline business growth.

2. ANGI

Angie’s List had a rough Q4, posting negative EPS growth of -8%, but despite that, did post their first ever full-year profit. While revenues increased by 5%, they missed estimates by $750k, the fourth consecutive quarterly miss on sales. This is a stock that historically goes up incrementally 5 days before and through earnings, but slumps on average by 5% in the 30 days post earnings period.

While ANGI has been able to increase the number of paid memberships in Q4, membership revenue fell with the introduction of tiered pricing. It’s only a matter of time until FB knocks out both ANGI and YELP. ANGI recently removed its paywall, a sign they are feeling the heat from Facebook’s entry into the local business/services space. There is no competition when it comes to user base: Facebook has 1.6 billion MAUs vs. the 10 - 12 million unique monthly visitors to Angie’s List.

3. AMD

The semiconductor industry as a whole has been flailing for the last several quarters as a result of weaker PC sales and the strong dollar. Analysts don’t expect AMD to buck that trend, with estimates positioning the chipmaker for it’s 7th consecutive decline in quarterly profits and sales.

AMD’s core business as a CPU and GPU provider continues to relinquish markets share to industry leaders, Intel and NVIDIA, both expected to be winners this earnings season. Unfortunately without any new innovations and mounting debt and losses, 2016 is setting up to be another down year for the semiconductor.

One positive is the fact that Microsoft’s Xbox and Sony’s Playstation use processors developed by AMD. However these sales are minimal compared to PC related sales and won’t be enough to offset losses in that segment.

Disclosure: There can be no assurance that the information we considered is accurate or complete, nor can there be any assurance that our assumptions are correct.