3 Stocks With Explosive Potential

SPY and QQQ have entered into correction mode, breaking down below the 20 and 50-day moving averages the past two weeks. The selloff suggests these charts will need to chop around for some time to digest the recent advance. Overall, as long as these charts stay within reach of the 50-day moving average, then the depth of the correction should be limited to 6-8% off recent highs.

Although the general averages may be entering a period of chop, it is important to have a list of stocks ready to go just in case the market makes more of a quick, V-shaped type recovery, which we have seen many times the past few years.

Below are a few stocks we are monitoring in our nightly newsletter The Wagner Daily that have explosive potential. In order to make our watchlist, stocks must pass through a few filters. We require all stocks that are not recent IPOs to have a relative strength rating from IBD (Investors Business Daily) of 80 or higher. We also look for strong quarterly earnings and/or revenue growth. If a stock doesn’t have impressive fundamentals, then its relative strength rating should be in the mid to upper 90s.

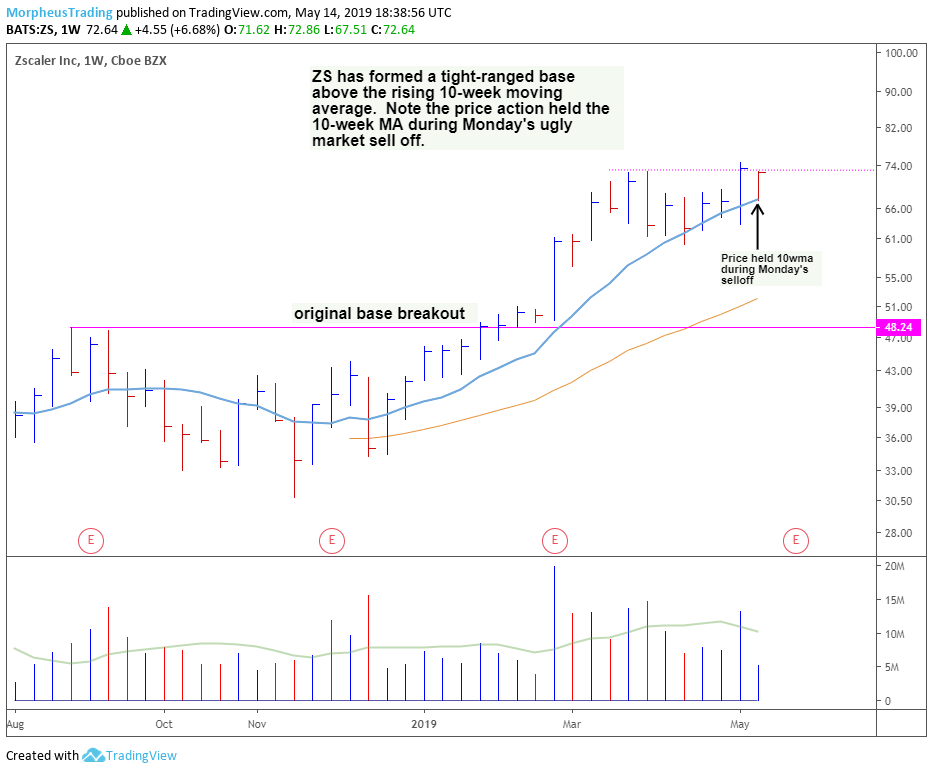

Zscaler (ZS) is a computer software stock with a few years worth of impressive revenue growth and a very strong 99 relative strength rating. It’s held up really well during the recent market selloff. We are already long in our model portfolio from $68.10.

Tradeweb Markets (TW) is a fresh IPO with a 95 relative strength rating that is trading in a tight range, ignoring the market selloff.

Sea Limited (SE) is a Singapore based internet content stock with impressive quarterly sales growth of +118% and +127% the past two quarters. The stock has formed a pretty tight base the based few months above the rising 20-day EMA with the 50-day MA now just below as well. The relative strength rating is tops at 99. The only issue with the setup is that earnings are due 5/21, which makes entering (now) ahead of the report a bit tricky. We are already long in the newsletter from $24.23. Generally speaking, we don’t like to hold through earnings unless we have a decent profit buffer of 7-10% If we are only up 5%, then we may cut back our size or sell the full position ahead of the report.

Disclaimer: Past results are not necessarily indicative of future results. There is a high degree of risk for substantial losses in trading securities. All data and material on this website and/or ...

more