3 Stocks Insiders Just Keep Buying

Last week was the most volatile week investors have seen in almost four years. The first four days of trading saw three to five percent moves daily, huge intraday reversals and whipsaw action before calm returned somewhat to the market on Friday. When all was said and done the S&P 500 ended the week with an approximate one percent gain despite all the big daily moves.

Given the amount of global concerns in the market especially on China right now I think we will continue to see an increased amount of volatility at least through the first half of September until the market knows whether the Federal Reserve will deliver the first interest rate hike since 2006 or whether they will postpone that event until later this year or into early 2016. My own opinion is given the situation in China, a plea from the IMF to not raise rates and tepid global growth, the Fed will kick the can down the road until at least December.

Until we know what the Fed’s decision is and we see some stability in the Chinese market which has huge daily moves over the past few weeks, the market is likely to see more intense swings in sentiment. Certainly more than investors have seen in some time. August is looking like it will go in the books as the worst performing month for stock market returns since the Fed ended its last quantitative easing program last October.

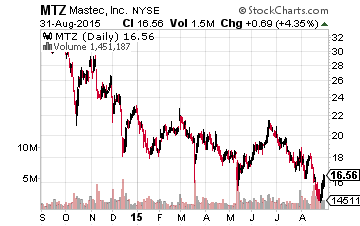

One of the things I am doing as I look for opportunities for the “dry powder” in my portfolio is to look at some beaten down equities where insiders are stepping up to the plate and doing some insider buying. It is always nice to see that sort of vote of confidence by executives in the know.Mastec (MTZ), a provider of infrastructure construction service to a variety of industries has had a very challenging 2015 as the stock is down some 25% from where it began the year and has been cut in half from its 52 week high in 2014.

The company has been hurt by a slowdown in wireless spending, poor quarterly results and negative sentiment that the demand from the energy sector is drying up. Earnings are tracking to be cut in half this year to just 75 to 80 cents a share in FY2015. Insiders seem to be taking the longer view here as three directors have bought more than $11 million in new shares over the past few weeks. Wireless spending should rebound in 2016 and most of the demand for the company’s services from the energy sector is outside the exploration & production sub-sector. Mastec might even get some lift by the lifting of sanctions on Cuba. Earnings are projected to double next year and the shares go for approximately 10 times those projections.

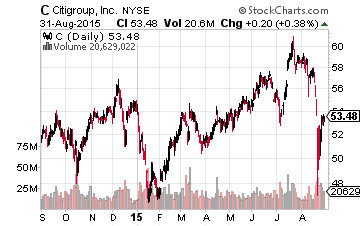

Like most major financial institutions, Citigroup (C) has been a poor performer in the month of August as interest rates have fallen on the recent bout of volatility in the market. The ten year treasury yield got back below two percent briefly last week before recovering somewhat. Higher interest rates are crucial for banks as they improve net interest margins, a key driver of earnings.

The shares have given back some 10% from their levels a month ago. At least one insider believe the stock is a bargain after its recent pullback. A director bought over $1.4 million in new shares on August 24th. It was the first straight up purchase by an insider in over a year. Citi’s earnings are on the upswing. After earning just $2.20 a share in FY2014, the bank is on track to post earnings of a bit over $5.50 this year and the consensus has it earning almost $6.00 a share in FY2016. The shares are cheap at under 10 times this year’s likely earnings. The stock pays a minuscule .4% yield but that should rise dramatically in the years ahead as regulators loosen their chokehold and allow banks to use a much greater proportion of earnings to reward shareholders.

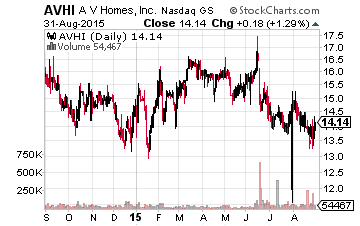

Finally, we have AV Home (AVHI) a small Arizona-based homebuilder that specializes in adult and other specialized communities. The stock is down some 15% from its highs two months ago. An insider recently purchased more than $2 million worth of shares and this follows some small frequent insider purchases earlier in the year.

I like the homebuilders here as the housing market continues to strengthen, mortgage rates continue to be near historical lows, and there should be a lot of pent-up demand after seven years of way below trend housing starts. AV Home is seeing huge revenue increases as new communities come on line. Sales should increase better than 80% year-over-year this year and by some 60% in FY2016. After posting a small loss in FY2014, the company should post a dime a share in profit this year. Next year, the consensus has earnings exploding to just under $1.00 a share. At around $14.00 a share, this growth is not properly priced in by the market.

Investors ready to put some money to work buying the recent dip in August should consider these cheap plays where insiders are putting their own money in play. Stocks with heavy insider buying are always on my radar, especially biotech stocks.

Positions: Long MTZ

more