3 Rising Chip Stocks To Know Now

Chip stocks have been volatile in recent months, exploding earlier in the year but falling more recently on concerns about US tariff policy and Chinese market. Industry watchers have real concerns that US President Donald Trump’s trade policies will impact hard on the international chip trade, affected imports and exports in the two largest markets, the US and China.

In the latest round of international bickering, the US slapped restrictions on China’s Jinhua chip maker, cutting it off from US suppliers, in response to intellectual property concerns. China responds by saying the accusation is baseless and accuses the US of trying to monopolize the semiconductor market. Business communities appear to be preparing for a more adversarial relationship between the countries’ markets. As US Treasure Secretary Henry Paulson said recently, “The American business community has turned from advocate to sceptic and even opponent of past US policies toward China. How can it be that those who know China best. . . are among those now arguing for confrontation?”

The Philadelphia Semiconductor Sector index, a measure of chip stocks on Nasdaq, shows the changes clearly. The index held steady between 1300 and 1400 from mid-May to early October, before dropping below 1200. The current reading is 1220, and the index appears was trending down at the close of last session’s trading.

Intel Corporation (INTC – Research Report)

Intel is the giant in the room, the 500 pound gorilla of the chip business. The company holds 26% of the semiconductor market, by sales, translating to an annual sales worth $56 billion dollars. Intel reached the number one slot by cornering the PC market in the 1990s, and as PC sales have declined in recent years, Intel has maintained its position by diversifying.

That Intel has succeeded in its bid to remain the industry leader is clear from its recent Q3 earnings report. The report showed a major beat, with total revenue almost 6% over the estimates and earnings per share almost 22% over. The quarterly revenue, of $19.06 billion, was up 19% year over year, and the company also recorded free cash flow for the quarter of $4.98 billion.

Some numbers don’t need a lot of elucidation. A quarter like that is good, no matter it’s sliced, and since reporting those results Intel has received six buy ratings. The two most recent came from Nomura’s Romit Shah (Track Record & Ratings) and Macquarie’s Srini Pajjuri (Track Record & Ratings). Shah set a price target of $55, while Pajjuri’s target was $58. In a comment made three weeks ago, just after the quarterly earnings, Susquehanna’s Christopher Rolland said, “Strong results and guidance, despite supply shortages, were impressively well above 2018 guidance.”

The average PT on Intel is $55, with an analyst consensus of ‘Moderate Buy.’ This equates to a 13% upside from the share price of $48.

(Click on image to enlarge)

View INTC Price Target & Analyst Ratings Detail

Broadcom, Inc. (AVGO – Research Report)

Our next stock is a mid-sized player in the microchip industry. Broadcom registers some $15.33 billion per year in sales, giving it a 7% market share. It’s a measure of just how much market share Intel holds that Broadcom is the fifth largest of the top ten chip makers. The company recently tried to acquire the number four chip producer, Qualcomm, but the deal was nixed by Chinese regulators and allowed to fall through in July of this year.

Like Intel, Broadcom recently had an excellent Q3, reporting back in September that the earnings per share came in at $4.88. This was a modest 2% over the estimates, but also the fourth straight quarterly EPS beat. Company CEO Hock Tan summed up the quarter on a positive note: “We continue to execute well on our business model. More than half our consolidated revenue is benefiting from strong cloud and enterprise datacenter spending. This, coupled with a seasonal uptick in wireless, will drive our forecast revenue in the fourth quarter to be $5.4 billion, an increase 11% from a year ago. In the meantime, our margins continue to expand.”

Industry watchers also have an upbeat take on AVGO. Nomura’s Romit Shah has also reviewed AVGO, saying, “There were so many positive takeaways from earnings that are forcing us to take a more constructive stance.” Shah’s price target, set two months ago at $200, is already obsolete. From Mizuho Securities, Vijay Rakesh (Track Record & Ratings) agreed on the positive outlook, and set a highly aggressive stance, with a price target of $295.

AVGO’s average price target is $289, a 22% upside from the share price of $237. The analyst consensus is a ‘Strong Buy.’

(Click on image to enlarge)

View AVGO Price Target & Analyst Ratings Detail

NXP Semiconductors N.V. (NXPI – Research Report)

The final stock under review today is the pipsqueak of the top ten semiconductor producers. NXP holds the tenth spot, with ‘just’ $9.5 billion in annual sales, or about 4% of the total market. NXP has a strong presence in the industrial market, especially with automotive manufacturers, IoT, and 5G technology.

NXP follows the same pattern we’ve seen for the stocks above: a strong third quarter. In the case of NXPI, this Q3 gain comes despite a sustained drop in share value from its peak in March of this year.

The Q3 beat, posted just last week, has potential to start NXPI on a new uptrend in the market. In fact, since the earnings report, the stock has gained 11%. Those gains were powered by quarterly sales of $2.45 billion, and earnings per share of $2.01, both above expectations. Outlook for Q4 was set at $2.39 billion.

Even cautious analysts showed some optimism on this stock. Oppenheimer’s Rick Schafer (Track Record & Ratings) despite giving a ‘Hold’ rating and no price target, still said, “We believe NXP is among the best positioned names in our coverage universe to capitalize on rising semiconductor content in automobiles, and one of the few pure plays leveraged to the growing secure ID, secure transactions and mobile payment markets.”

From Needham, Rajvindra Gill (Track Record & Ratings) added, “If auto shipments reaccelerate due to the completed transition to the new emissions standard in Europe and rebound in China auto units, combined with ongoing content gains in radar, battery management, and networking, we could see auto growth 8-10% … Moreover, we see growth drivers in IoT and 5G infrastructure.” Gill gave a ‘Buy’ rating and a price target of $110.

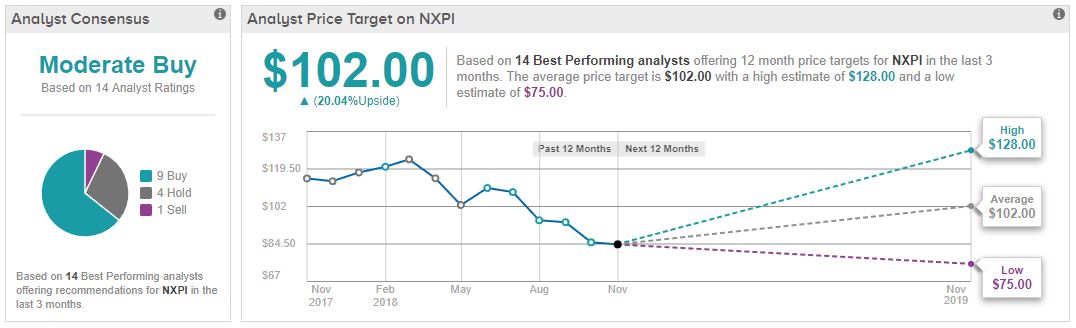

NXPI’s average price target is $102. Against the share price of $84, this gives an upside potential of just over 20%. The analyst consensus is a ‘Moderate Buy.’

(Click on image to enlarge)

Disclaimer: TipRanks is an independent cloud based service that measures and ranks digitally published financial advice. TipRanks' natural language processing (NLP) algorithms aggregate and ...

more