3 Reasons Why I Own Alphabet For The Long Term

Good investment ideas don't need to be too complex or sophisticated. On the contrary, a simple and straightforward thesis can be more effective and profitable. When it comes to Alphabet (GOOG) (GOOGL), strong business fundamentals, solid financial performance, and attractive valuation levels are three key reasons why I own the stock with a long-term horizon.

Strong Business Fundamentals

Google is the global leader in online advertising. According to the Forbes brand ranking, Google is the second most valuable brand in the world behind Apple (AAPL), with an estimated brand value of $167.7 billion. Other estimates are even much higher, Kantar calculates that the Google brand is worth as much as $309 billion.

Estimating brand values require all kinds of assumptions, so these numbers should always be taken with a grain of salt. However, it's hard to argue against the fact that Google is one of the most valuable brands in the world.

Google is everywhere across the online world and in mobile devices, and it uses the information it collects from its users to improve the quality of its services and generate more effective advertising. This means that Google gets strategically stronger as it gains size over time, which creates a virtuous cycle of sustained growth and increased competitive strength for the company.

The other bets division is a diversified group of businesses and projects in different areas with abundant potential for disruption. This includes investments robotics, high-speed internet, self-driving cars, and healthcare research, among several others.

These projects don't have much economic viability in the short term. However, when seen as a diversified portfolio of businesses in areas with massive potential, long-term opportunities are clearly promising.

Alphabet does not need any external financing to keep these projects running, so it can have a truly long-term approach to disruptive innovation, which provides a big source of advantage in comparison to smaller players in these areas.

Solid Financial Performance

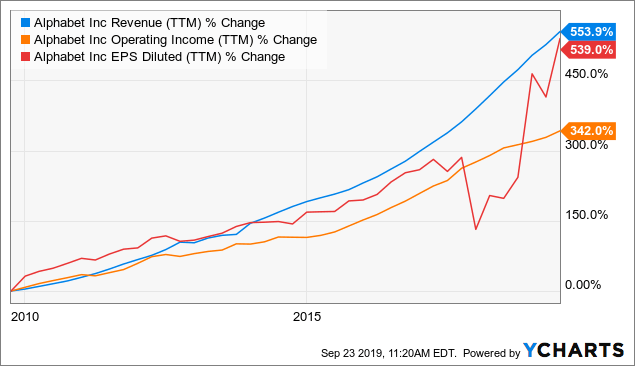

The company has delivered outstanding financial performance over the long term, with key metrics such as revenue, operating income, and earnings per share moving in the right direction over time.

(Click on image to enlarge)

Data by YCharts

The numbers from the most recent quarter look as strong as ever. The company delivered both revenue and earnings numbers ahead of Wall Street expectations, with sales increasing by 19% in U.S. dollars and 22% in constant currency terms. Alphabet retained 25% of revenue as recurrent operating profit, and operating cash flow was $12.6 billion during the quarter.

Alphabet ended the quarter with cash and marketable securities of approximately $121 billion, so the balance sheet is pristine, and the company has abundant financial resources to make all kinds of investments for growth in the years ahead.

YouTube is a remarkably promising growth engine for the company going forward. According to management, channels with more than 1 million subscribers grew by 75% year-over-year last quarter. In terms of subscriptions, YouTube Music and YouTube Premium are now available in over 60 countries, up from 5 markets at the start of 2018.

Within other revenues, the cloud segment was the biggest driver last quarter, and it's now the third-largest driver of total revenue growth for Alphabet. The company reached an annual revenue run rate of over $8 billion in the cloud last quarter, and management is quite optimistic on the growth opportunities in the segment due to strengths such as reliability and uptime, which are critical factors for customers in the industry.

When looking at historical track-record, recent financial reports, and future potential, Alphabet offers outstanding financial performance.

Attractive Valuation

Alphabet stock is currently trading at a forward price to earnings ratio of 23.5, which is more than reasonable for such a high-quality business producing rock-solid financial performance. Similarly, the forward price to free cash flow ratio stands at 14.9, which is a fairly attractive entry price.

Valuation needs to be analyzed in the context of other return drivers. A company producing strong profitability and consistently delivering earnings above expectations deserve a higher valuation than a business producing mediocre financial performance and underperforming expectations.

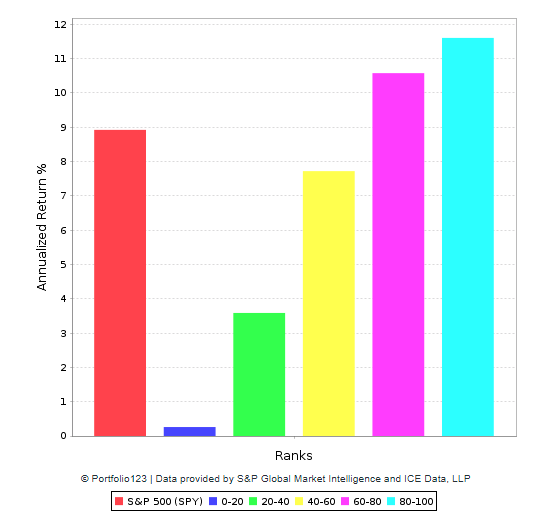

But sometimes it can be challenging to incorporate the multiple factors into the analysis in order to see the complete picture from a quantitative perspective. The PowerFactors system is a quantitative system that ranks companies in a particular universe according to a combination of factors, such as financial quality, valuation, fundamental momentum, and relative strength.

Here is a quick explanation of the factors considered in the algorithm:

- Financial quality includes profitability metrics such as return on investment, operating profit margin, and free cash flow margin. The more profitable the business, the higher its ability to create profits for shareholders over the long term.

- Valuation covers typical valuation ratios such as price to earnings, price to earnings growth, and price to free cash flow.

- Fundamental Momentum: This factor looks for companies that are performing better than expected and producing rising expectations, so it measures the change in earnings and sales forecasts.

- Relative Strength: Winners tend to keep on winning. When a stock is outperforming the market, it tends to continue doing so more often than not. For this reason, the PowerFactors system looks for stocks delivering above-average returns over different time frames.

The backtested performance numbers show that companies with high PowerFactors rankings tend to deliver superior returns in the long term. The higher the PowerFactors ranking, the higher the expected returns, indicating that the system is consistent and robust.

(Click on image to enlarge)

Data from S&P Global via Portfolio123

Alphabet has a PowerFactors ranking of 97.3 as of the time of this writing, meaning that the stock is in the top 3% of companies in the US stock market when considering financial quality, valuation, fundamental momentum, and relative strength combined.

Moving Forward

Looking at the main risk factors, Alphabet operates in a very dynamic industry, and new players focused on social media, such as Facebook (FB) and several other smaller companies, have captured a growing share of revenue in online advertising over recent years.

Amazon (AMZN) is a particularly relevant competitor to watch because the online retail giant has a relentless competitive drive, and it has been broadening its presence in online advertising in recent years.

Alphabet is a remarkably solid business from a competitive perspective, but investors in the company still need to permanently monitor the competitive landscape in order to make sure that the business is still moving in the right direction and consolidating its competitive strengths.

The biggest negativity factor surrounding Alphabet stock is the fact that the Department of Justice (DOJ) is preparing for an antitrust probe into the company. This has understandably generated some concerns among investors, but those fears seem to be exaggerated.

Looking at the historical evidence, most antitrust cases do not end up in court. The DOJ is not intended to punish companies or hurt its shareholders, but rather to guarantee that the market remains competitive. Most of the time, civil antitrust cases end in negotiated settlements.

Alphabet had a major victory in this area in 2013 when the Federal Trade Commission declared that Google had not violated antitrust statutes in the way it arranges search results. Moving forward, the most likely scenario is that regulations will be focused on areas such as data privacy and competitive behavior.

These issues could have an impact on investor sentiment towards Alphabet stock in the short term, but chances are that the company will remain a dominant player in its key markets and a massively profitable business for years to come.

In any case, regulatory risk is already incorporated into market expectations and into the stock valuation, so the short-term uncertainty surrounding Alphabet stock could be creating a buying opportunity for long-term investors.

Alphabet is a position in both my own portfolio and The Data-Driven Portfolio since I replicate such a portfolio with my personal money. As long as the company keeps providing solid competitive strengths, vigorous financial performance, and attractive valuation levels, I am planning to hold on to Alphabet stock over the long term.

Disclosure: I am/we are long GOOG, FB, AMZN.

Disclaimer: I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business ...

more