3 Powerful Growth Stocks Driven By The Network Effect

The network effect is one of the most effective sources of competitive strength for high-growth companies in the tech sector. This effect basically means that the company becomes more valuable as it gains size over time, so winners that benefit from the network effect generally keep on winning.

Investing in successful companies that benefit from the network effect can be exponentially profitable in the long term, and names such as Facebook (FB), Square (SQ), and MercadoLibre (MELI) are three notable candidates offering massive potential for growth in the years ahead.

Social media companies are under the spotlight nowadays, and for good reasons. Consumers are increasingly conscious about the importance of spending time online in moderation and carefully considering the impact that social media can have on their emotional lives and mental health. With the presidential elections approaching, understanding that information on social media can be biased or even downright false is more important than ever.

With the political landscape heating up in the coming weeks, talk about potential regulations for social media can produce a cloud of uncertainty around these names. This is just a short-term concern, though, since it is unlikely that a company such as Facebook is going to be derailed from its long-term growth trajectory due to regulatory limitations.

When used in the right way, social media platforms can be a great way to remain in touch with your loved ones and to find inspiring and uplifting content. Importantly, the larger the size of the platform, the more value it can offer to users. When most of your friends are on Instagram, then you have a bigger incentive to be engaged on the platform too.

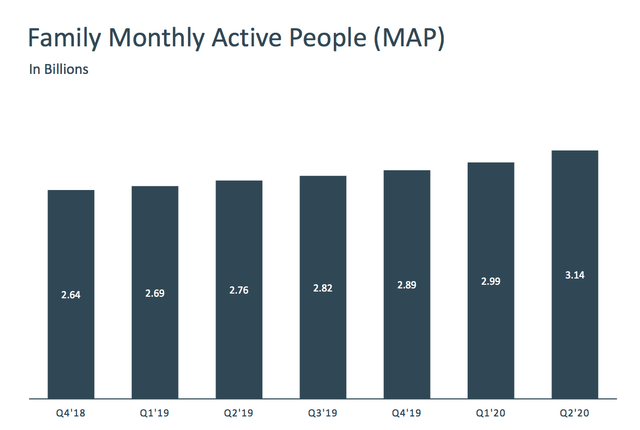

Facebook comes second to none in terms of size and reach. The company has over 3.14 billion monthly active people across its family of platforms, and the number of daily active people stands at 2.47 billion based on data for the second quarter.

Source: Facebook

This gargantuan network size provides a ton of opportunities for interactions of all kinds, and users with a wide net of connections across Facebook, Instagram, Messenger, and WhatsApp are deeply entrenched in these applications.

Facebook makes most of its money from advertising, which is a cyclical industry. But you wouldn't have guessed that by looking at the company's financial reports for the second quarter of 2020.

Even during one of the sharpest recessions in history, Facebook reported an 11% increase in revenue and a 29% increase in operating income during the quarter. It is a cash-generating machine, and the operating profit margin stands at 32% of revenue.

Facebook's online advertising business has proven to be far more resilient than expected, and the company is venturing into new areas with enormous potential. Shopping could be a huge opportunity, and the alliance with Shopify (SHOP), in combination with a larger focus on online shopping for Instagram, could open the doors to exciting opportunities going forward.

Square

Payments platforms and digital wallets are textbook examples of the network effect at play. Buyers are attracted to the stores where they can pay however they want to, and merchants need to accept the payment platforms that can bring more customers to the business. The same goes for digital wallets - the more widely used a digital wallet, the more valuable it is to those users.

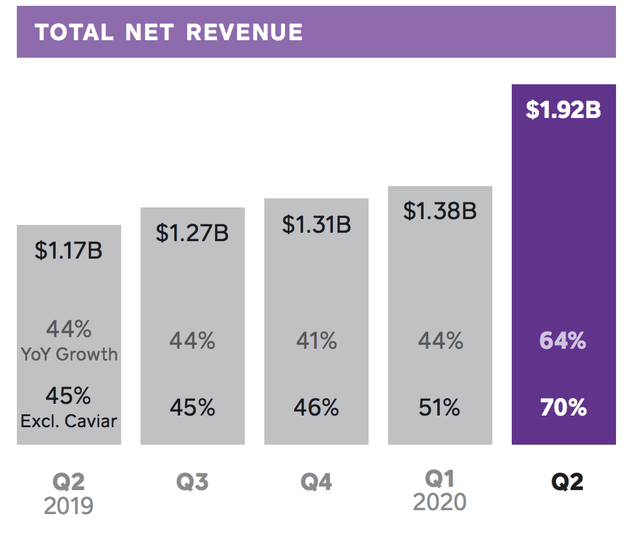

Square is a major beneficiary of the power of networks, and the company enjoyed a big increase of 70% in revenue last quarter.

Source: Square

The seller ecosystem business is under pressure due to the recession, with revenue declining 17%. On the other hand, Cash App is truly on fire, reporting $1.20 billion in revenue and $281 million in gross profit, growing 361% and 167% year over year.

A large part of that is due to Bitcoin trading, but Cash App revenue excluding Bitcoin was still very healthy at $325 million, up 140% year over year. Importantly, Bitcoin trading can attract a lot of users to Cash App, and over time, those users tend to be increasingly engaged across different features, so the benefits for Square are much larger than what the short-term impact of Bitcoin demand could indicate.

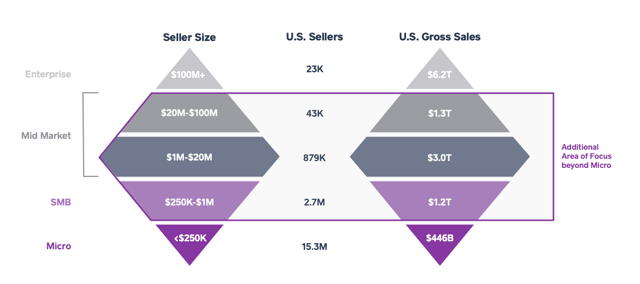

Based on management estimates, Square has only penetrated less than 3% of its market opportunity in the seller segment and less than 2% of the market opportunity in Cash App. The company calculates that the total addressable market could be worth as much as $160 billion and with multiple growth avenues for the two segments combined.

Source: Square

Square is executing very well, and the network effect is a strong tailwind for the business. Combine that with enormous addressable markets and you have a remarkably attractive growth story.

MercadoLibre

MercadoLibre is the undisputed leader in both e-commerce and digital payments in Latin America. Buyers and sellers of all kinds of products attract each other to the company's leading marketplace, and the same dynamic plays out in the Mercado Pago fintech services.

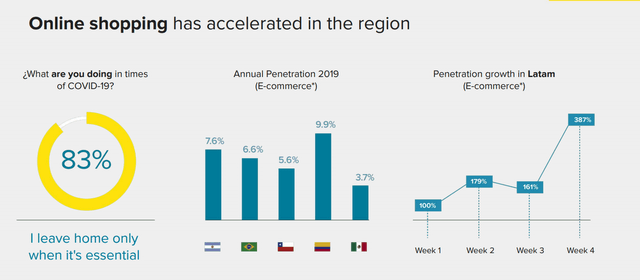

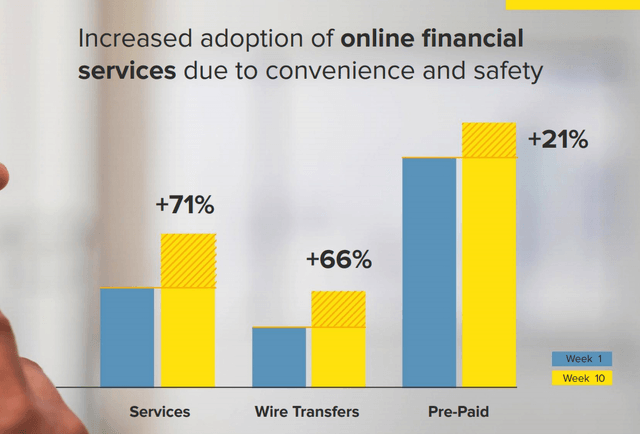

Both e-commerce and online financial services are seeing a strong acceleration in the region, and MercadoLibre is the top beneficiary of this trend.

Source: MercadoLibre

Source: MercadoLibre

Revenue during the second quarter grew 123% on a forex-neutral basis, with total payment volume growing 142% and gross merchandise volume up by 102%. Unique active users grew 45.2%, reaching 51.5 million at the end of the second quarter. Total payment transactions increased 122.9% year over year, totaling 404.8 million transactions for the quarter

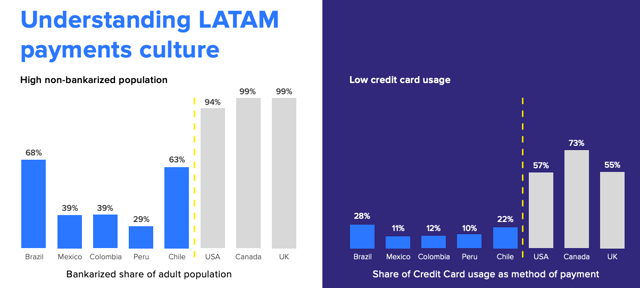

It is still day one for MercadoLibre. There are 650 million people in Latin America, and both online commerce and financial services are just getting started. Online commerce in Latin America accounts for only 3% of total retail sales nowadays, and large shares of the population have insufficient access to bank accounts and to financial services in general.

Source: MercadoLibre

Going forward, MercadoLibre still has abundant room for further growth due to the power of the network effect and a massively underserved population in both e-commerce and online financial services in Latin America.

Disclosure: I am/we are long FB, SQ, MELI.

Disclaimer: I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business ...

more