3 Mining Stocks For Investors Seeking Gold Exposure

TM editors' note: This article discusses a penny stock and/or microcap. Such stocks are easily manipulated; do your own careful due diligence.

As the U.S.-China trade spat drags on, so too could the stock market volatility that has accompanied it so far this month. The S&P 500 and Dow Jones Industrial Average both fell 2.4 percent on May 13 – their worst days since January. The longer trade negotiations remain ongoing, the longer the geopolitical and economic risks remain.

One potential hedge against volatility and market risk is having an allocation to gold, which has historically moved in the opposite direction of equities. I often recommend having a 10 percent portfolio weighting in the yellow metal – with 5 percent in physical gold and the other 5 percent in gold mining equities, mutual funds, and ETFs.

Gold mining stocks have been down so far this year, but I believe this represents a buying opportunity. The NYSE Arca Gold Miners Index, which tracks a diversified blend of small-, mid- and large-cap miners, is down 9.22 percent for the 12 months ended May 13.

To get additional insight on miners, I spoke with our portfolio manager and gold expert Ralph Aldis. Ralph has over 30 years’ experience in the gold space, and together we manage two mutual funds focused on the yellow metal. Some of Ralph’s top gold mining stocks as of late are Wheaton Precious Metals, Wesdome Gold Mines and K92 Mining.

Wesdome Gold Mines Ltd.

One miner that we really like is Canadian-based Wesdome Gold Mines. Ralph describes the company as having “delivered both operating and drilling results very consistently” and being disciplined when it comes to raising money.

The company just reported strong first quarter results, including revenue of CA$32.5 million – a 24 percent increase from a year earlier. Plus, its gold production increased 6 percent from a year earlier to 19,010 ounces. Wesdome operates two gold mining operations in Ontario and Quebec and trades on the Toronto Stock Exchange under the ticker symbol WDO.

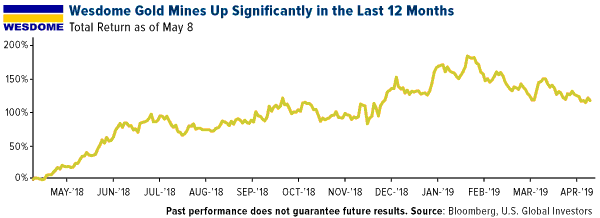

As you can see in the chart below, the company has seen massive growth in the last 12 months with a total return nearly exceeding 100 percent. We believe it’s a good candidate for a takeover by a larger miner due to its strong drilling results, competent management team and safe jurisdiction in Canada.

(Click on image to enlarge)

K92 Mining Inc.

Perhaps a less well-known name, K92 Mining is based in Vancouver and operates solely in Papua New Guinea. Ralph sums up why he likes the company: “I think K92 is another one that has a great deposit, high grade. The CEO spends time at the mine site. It's off on the other side of the world, but he goes and spends a week there every month working, so it's very much a hands-on management style.”

Strong management is an important factor for us when looking at companies. It’s one of our “5 Ms” for picking gold mining stocks: market capitalization, management, money, minerals, and mine life cycle.

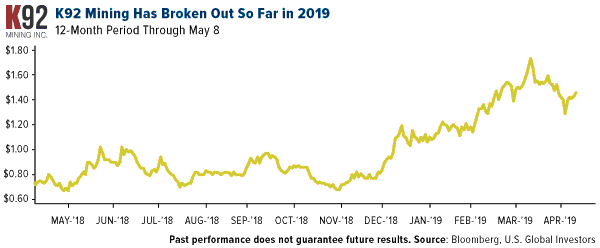

K92 has broken out so far in 2019 and could have further to go after reporting strong first quarter results. The company reported 19,125 gold ounces produced from its Kainantu mine in Papua New Guinea.

(Click on image to enlarge)

Wheaton Precious Metals Corp.

Although not technically mining stocks, royalty and streaming companies are a way to gain exposure to miners. These companies own streams on the production of precious metals, in exchange for helping finance the projects and providing upfront capital. One of our favorites is Wheaton Precious Metals Corp. In 2018 Wheaton faced a tax dispute with the Canada Revenue Agency (CRA) over income generated by foreign-owned subsidiaries. The CRA claimed that the company owed back taxes and fines that could have been as high as $1 billion. Fortunately, an agreement was reached, and although Wheaton will face higher taxes, the company can now focus attention on operations and put the issue behind it.

Ralph is in close contact with much of senior management: “In fact, Chief Financial Officer Gary Brown was at our office in San Antonio a few weeks ago and explained to our team that the tax issue has been resolved, but that investors still haven’t woken up to the good news. That’s why we believe right now could be a good time to pick up this name before word spreads.”

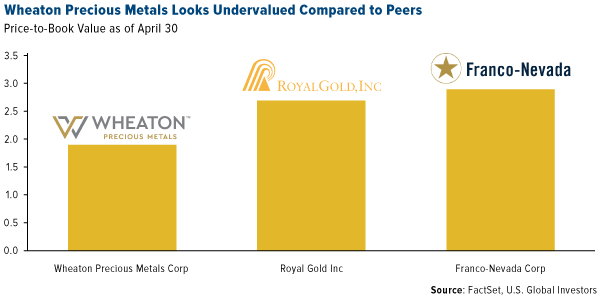

Wheaton trades in both New York and Toronto, making it easier for investors to buy. The company focuses on silver – in addition to gold, copper and other metals – and currently has streaming agreements for 19 operating mines and nine development stage projects. We like to look at the price-to-book ratio, and based on that, Wheaton looks undervalued relative to some of its royalty and streaming peers, including Franco-Nevada Corp. and Royal Gold Inc.

(Click on image to enlarge)

A consolidation bug hit senior miners late last year and early this year. When Barrick Gold bought Randgold Resources, then Newmont merged with Goldcorp, many analysts suspected there would be a selloff of assets and a flood of acquisitions and deals in the small- and mid-cap producer space.

As Ralph puts it: “I do think a wave of consolidation is going to come because we know a lot of the seniors are going to try to spin assets off.That could create a lot of interesting opportunities for smaller mining companies.”

Disclosure:

Holdings may change daily. Holdings are reported as of the most recent quarter-end. The following securities mentioned in the article were held by one or more accounts managed ...

more