3 Explosive Growth Stocks With Outstanding Management Teams

When searching for the best opportunities in the market, hard variables such as revenue growth and profit margins are obviously very important. However, the most crucial return driver for a company over the long term is arguably the quality of the management team.

Businesses are built and run by people, after all, and investing in the right people can lead you to investing in companies that can sustain rapid growth rates for much longer than the market expects, which has huge implications in terms of potential returns.

In simple terms, the current price of a stock is reflecting a particular set of expectations about the business going forward. If the company can exceed those expectations by a large margin, the stock price will need to increase in order to reflect this new reality.

A visionary management team with a long-term horizon and an innovative culture can build multiple growth engines for a business over the years, and this can produce exponential returns for investors in those companies.

Salesforce.com (CRM), MercadoLibre (MELI), and Livongo Health (LVGO) are three high-growth companies being led by outstanding management teams and offering plenty of opportunities for further expansion in the years ahead.

Salesforce.com

Software-as-a-service is perhaps the most attractive business model around, and many of the most explosive growth stories in the market are coming from this industry in recent years. Demand for all kinds of software is booming, and companies in the sector enjoy tremendous customer loyalty because those customers are remarkably reluctant to change suppliers or to reduce their investments in mission-critical technologies.

This provides for a rare combination of sustained growth and recurrent revenue, which is very hard to find in other industries. Besides, the cost of providing the software is relatively stable in comparison to revenue, and this produces expanding gross profit margin as revenue grows over time.

Salesforce.com pioneered the software-as-service business model under the leadership of founder and CEO Marc Benioff, who founded the company in 1999. Benioff has exhibited a talent for business since he was very young; while in high school, he sold his first app to a computer magazine for $75.

When he was 15, Benioff founded Liberty Software, a one-man company making games for Atari 800. While studying at USC, Benioff took a summer internship with Apple, working as a programmer in the Macintosh division under Steve Jobs himself. This was a profoundly inspiring experience for Benioff.

After a successful career at Oracle from 1986 to 1999, Benioff launched Salesforce.com and with it a new business paradigm for the industry. Salesforce.com's key advantage was that the software was accessed through a web browser and delivered entirely online, which was truly revolutionary at the time.

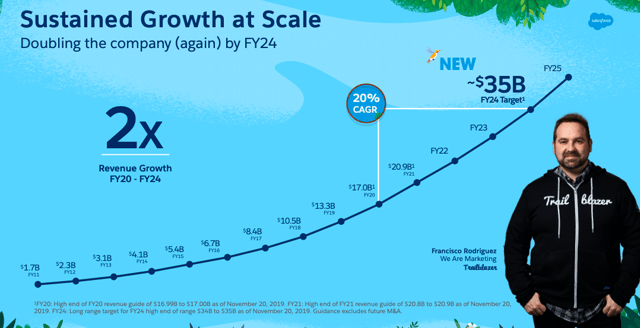

The company has delivered vigorous growth rates through both organic growth and acquisitions, and management has done a great job at expanding the addressable market and producing all kinds of opportunities for cross-selling. Financial performance has been outstanding over the long term and the company still has ambitious plans for expansion going forward.

Source: Salesforce

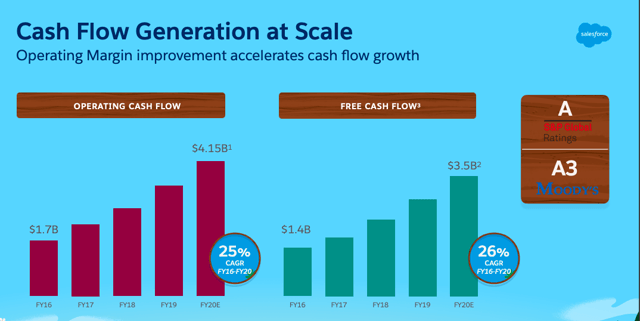

Due to the size of the business, it makes sense to expect a deceleration in revenue growth going forward, but Salesforce could more than compensate for this deceleration in growth with expanding profitability as reinvestment needs decline. It is worth noting that cash flow generation has been consistently moving in the right direction over the past several years.

Source: Salesforce.com

MercadoLibre

MercadoLibre means a free market in Spanish, and the company has done a tremendous job of powering all kinds of businesses and entrepreneurs to join the technological revolution in Latin America over the past several years. Founder and CEO Marcos Galperin created MercadoLibre in a garage in 1999, under the basic premise of matching buyers and sellers for all kinds of products with a pragmatically simple platform.

Source: Infobae

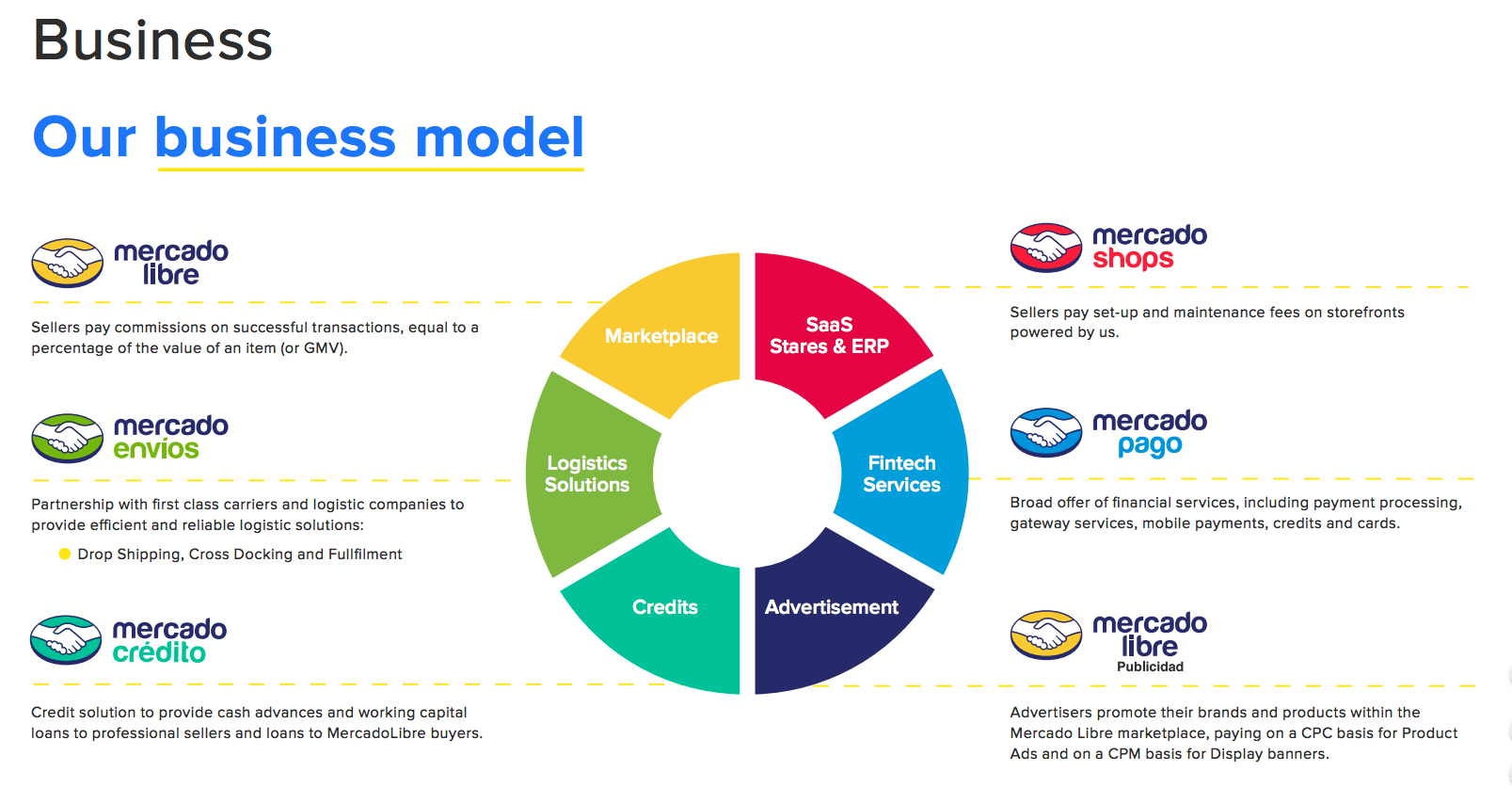

Over the years, the company has consolidated its leadership position in e-commerce, and it also became the top player in digital payments and fintech with its MercadoPago platform. The MercadoLibre ecosystem, currently, offers not only an online marketplace but also, payments, credit, logistics services, advertising, and online storefronts, among others.

(Click on image to enlarge)

Source: MercadoLibre

The marketplace business is very profitable from a structural perspective, simply matching buying and sellers and keeping a commission on transactions generates big profit margins and low reinvestment needs. It would have been easy and comfortable for MercadoLibre to stay there and keep making big margins on its core business.

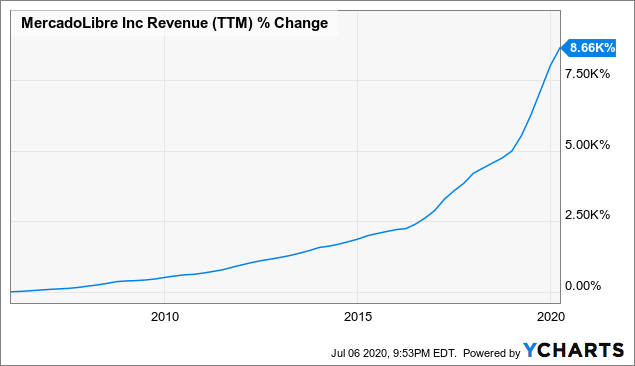

But Galperin and MercadoLibre's management team are aggressively entrepreneurial, so the company is focused on long-term growth, even at the expense or current profit margins. The strategy is paying off, and revenue growth rates at MercadoLibre have been off the charts.

Data by YCharts

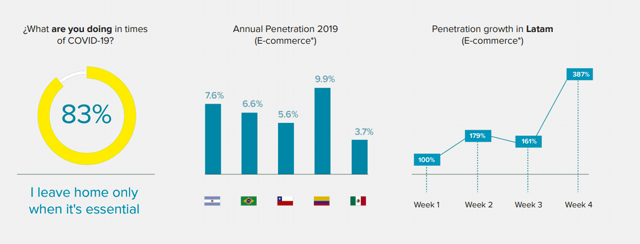

Due to the pandemic, adoption rates for both e-commerce and online financial services have significantly accelerated in Latin America over recent weeks. MercadoLibre is both the main driver and a key beneficiary from this accelerating adoption.

Source: MercadoLibre

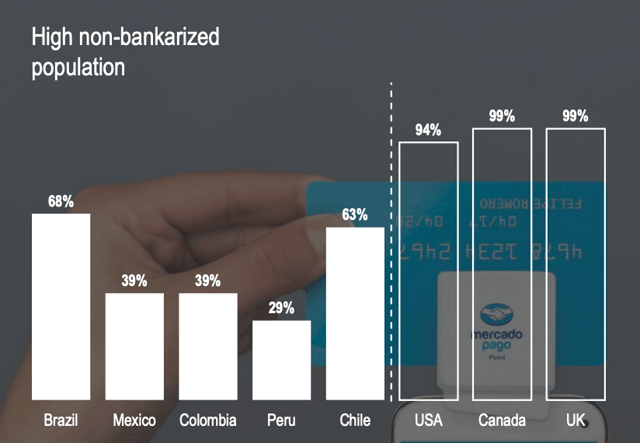

Online commerce is barely getting started in the region, and more than half of the population in some big markets has no access to bank accounts. This means that MercadoLibre still has enormous potential for long-term growth as long as management keeps executing well and capitalizing on its long-term opportunities.

Source: MercadoLibre

Livongo Health

Glen Tullman is the Executive Chairman and Founder of Livongo Health, a high-growth company that provides data science technologies to improve the health and the overall quality of life of patients with chronic and behavioral health conditions such as diabetes.

Mr. Tullman is a business leader and entrepreneur with plenty of experience in disruptive healthcare technologies. Prior to Livongo, he served as Chief Executive Officer of Allscripts, taking Allscripts public during that time. Before Allscripts, Mr. Tullman was Chief Executive Officer of Enterprise Systems, which he also took public and then sold to McKesson/HBOC.

Glen Tullman is a man on a mission. His son was diagnosed with type 1 diabetes at the young age of 8, and this provided the inspiration for Tullman to build Livongo. It certainly feels good to invest in Livongo while knowing that the leadership team is not going to quit on its mission.

Livongo is pioneering a new category in healthcare called Applied Health Signals. With Livongo for Diabetes, for example, members receive a smart cellular-connected meter, automatically-delivered testing materials, real-time coaching, and monitoring 24 hours a day, seven days a week.

Livongo's proprietary artificial intelligence engine aggregates data from multiple sources, it interprets that data and it offers advice to specific members at specific points in time. This provides a valuable tool to make behavior changes that can lead to better health results and lower costs.

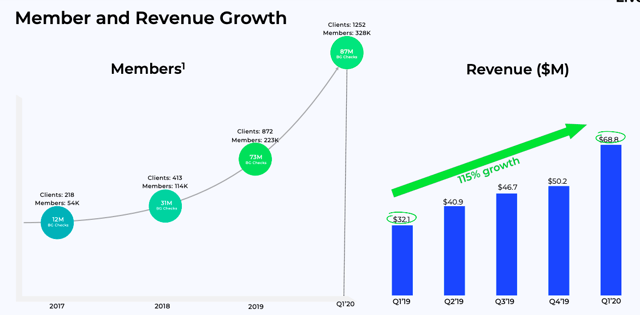

What is good for patients in terms of health and quality of life is also good for the business, and the company is growing at full speed. Total revenue during the first quarter of 2020 amounted to $68.8 million, up 115% year-over-year

Source: Livongo Health

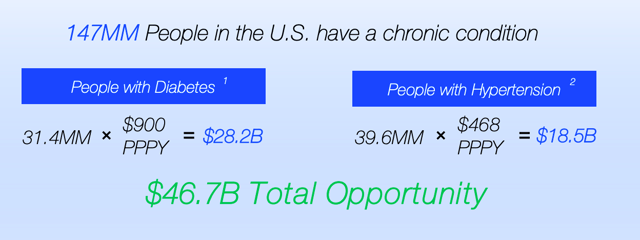

The immediately addressable markets in diabetes and hypertension are worth $46.7 billion according to management, and the company has enormous room for expansion into new kinds of areas in the years ahead.

Source: Livongo Health

Livongo Health stock has been on fire over recent months, but the company is still relatively small with a market cap value of $7.12 billion. Considering both its modest size and rapid growth rates, Livongo is a good candidate for an acquisition by a larger player in the healthcare or in the tech space.

A potential acquisition could obviously produce some big gains for investors in Livongo over the short term. However, as an investor in Livongo, I would rather see the company compounding high returns over multiple years as a standalone business.

Disclosure: I am/we are long MELI, LVGO, CRM. I wrote this article myself, and it expresses my own opinions.

Disclaimer: I wrote this article myself, and it expresses my own ...

more