3 Chinese Digital Giants To Follow Now

The major tech stocks are dropping for a variety of reasons, and investors are feeling jittery. In the US, Facebook (FB) is facing fears of regulatory pressures and declining user acquisition while Apple (APPL) is looking at falling iPhone sales. Across the Pacific, Chinese tech players face their own pressures, from declining consumer spending to a depreciating yuan. Plus the ongoing US-China trade war is obviously weighing on sentiment. However from a bull perspective, now is the time to pick up lucrative stocks at a discount.

For example, Chris Bertelsen, CEO of Aviance Capital Management, said the trade war with the US is likely to calm down. He advises investors to buy major Chinese tech stocks now before the opportunity passes.

With this in mind we will look at three of China’s giant tech players. All share: a strong upside potential, an internet base, and various combinations of e-commerce, AI, and social media applications. Dipping into the comments of TipRanks top-rated analysts, we can get a feel for how their outlook is shaping up for the months ahead.

Alibaba Group Holdings (BABA – Research Report)

Alibaba is the 800-pound gorilla of Chinese tech companies, with a market cap worth almost $400 billion. The company offers a wide variety of services, including e-commerce, online payment, search engines, and cloud computing. The spinoff AliExpress platform connects Chinese merchants with buyers outside of the country.

In terms of stock performance, BABA is benefiting from last month’s Singles Day. The biggest online shopping day of the year in China – and largely a creation of Alibaba – netted the company $30.8 billion in one-day gross sales, a 27% increase from last year, which itself set a record for sales. That success largely offset the earlier Q3 report that showed slowing growth rates for the e-commerce platform’s sales as Alibaba expands into rural China and a new domestic customer base that, while numerically large, is likely to spend less per capita than its urban counterpart.

BABA stock has gained 10% since Singles Day, part of a general rise in value since it’s recent low on 29 October. Shares currently trade for $151, and the average price target of $204 gives the stock a 35% upside potential. The analyst consensus of ‘Strong Buy’ is based on 23 recent ‘buy’ ratings, with no ‘holds’ or ‘sells.’

View BABA Price Target & Analyst Ratings Detail

Recent analyst reports agree that Alibaba, while not yet breaking the $200 level in share price, remains likely to reach that level. Gregory Zhao (Track Record & Ratings), writing for Barclays, says, “The performance came in ahead of buy-side expectations, which were around low- to mid-20s. The ‘solid’ result reaffirms the strong demand from Chinese consumers.” Zhao gives BABA a $195 price target.

Meanwhile, Youssef Squali (Track Record & Ratings), of SunTrust Robinson, gave greater detail in his comment on BABA’s Singles Day performance. “[The] continued healthy consumption and rising middle class in and around China, as well as the pervasiveness of its ecosystem,” demonstrated BABA’s strengths. “The 27% gross merchandise volume increase was particularly impressive amid concerns of the macro headwinds and [includes] a 40% increase in consumers who made purchases from international brands as well as the 23% increase in the delivery orders from Alibaba’s Cainiao logistics network.” Squali’s target price of $180 suggests a 17% upside, lower than the consensus but still indicative of a growth stock.

Baidu, Inc. (BIDU – Research Report)

Considering China’s size, it’s no wonder that the world’s second largest search engine is a Chinese company. Baidu controls between 66% and 76% of China’s search engine market, and in addition, the company has its hands in internet advertising, artificial intelligence, and even autonomous cars. In 2007, Baidu became the first Chinese company listed on the NASDAQ-100 index.

Baidu’s stock peaked at $279 earlier this year. Since then, the company has suffered from slowing economic growth in China and the increase in trade tensions between China and the US. Of the two factors, China’s slowing growth is far and away the more important. Baidu’s primary income is from online advertising through its search engine and portals; its exposure to the ‘trade war’ is slight, but if Chinese consumers spend less or have less to spend, Baidu will suffer. The depreciation of the Chinese yuan since the spring hasn’t helped Baidu’s bottom line, either.

However, Baidu also has a history of showing steep gains followed by serious losses. It tripled from 2013 to 2014, slipped, and then doubled between 2016 and 2018. Now it is trading 25% lower than its most recent peak. It’s worth pointing out, however, that China’s stock markets generally are down about 25% this year; Baidu, at least this time, is just following the pattern of its home market.

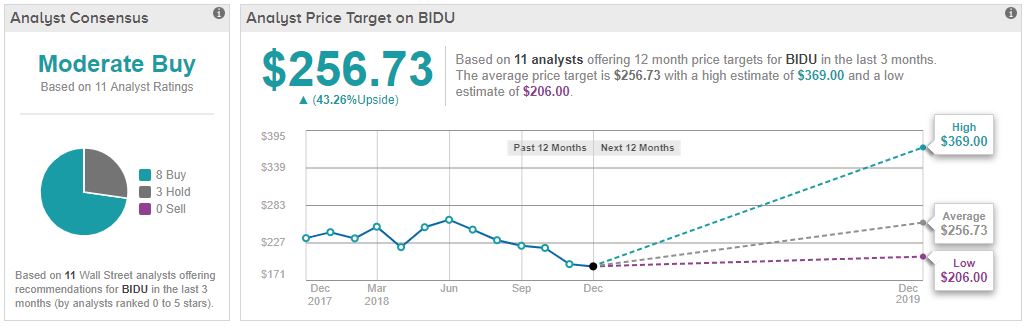

Looking at BIDU now, we see it trading at $179 per share. The analysts give it a 43% upside potential, with an average price target of $256, and a ‘Strong Buy’ consensus rating.

View BIDU Price Target & Analyst Ratings Detail

Turning to recent analyst reports on Baidu, we find that Jason Helfstein (Track Record & Ratings) of Oppenheimer recently reiterated his ‘Buy’ rating and set a $230 price target. In his comments, he said that he “thinks operating metrics remain solid and updates to mini-programs and AI seem promising long term.”

Benchmark’s Fawne Jiang (Track Record & Ratings) based her ‘Buy’ rating on similar reasoning, noting “…soft advertising growth due to regulatory headwinds, disruption from revamping healthcare search and macro concerns.” On the positive side, she noted Baidu’s AI focused strategy. Her price target, of $260, is more aggressive than the average and suggests a 45% upside potential.

Weibo Corporation (WB – Research Report)

Sometimes called ‘China’s Twitter,’ the comparison is based on a similar microblogging model. Weibo’s social platform offers features similar to Twitter: 140-character posts, hashtags, and @ messaging. At the same time, Weibo is more interactive than Twitter, and permits a greater latitude in social interaction between users. The word ‘weibo’ is Chinese for ‘microblog.’

As with Baidu, Weibo has been feeling pressure from the tariff threats flying between the US and China. At the same time, that’s really the only negative on this stock. The company’s recent Q2 and Q3 reports both showed beats on earnings, and the Q3 reported indicated 15 million new users in the quarter. Steady growth and high earnings are generally not associated with declining stocks, and in fact, WB is up 10% since the Q3 report.

At the moment, WB holds a resounding ‘Strong Buy’ on the analyst consensus. The stock’s $79 average price target gives a 29% upside from the current share price of $61.

View WB Price Target & Analyst Ratings Detail

Morgan Stanley analyst Grace Chen (Track Record & Ratings) gives Weibo a $72 target, writing, “Weibo remains one of the most resilient social platforms and will continue to ride on China’s social ad boom.”

Fawne Jiang (Track Record & Ratings), from Benchmark, agrees with the bullish outlook. She is “positive on Weibo’s healthy user/traffic growth and management’s commitment to continue to improve its products and content ecosystem.” Her target price of $81 is just above the average and indicates a 31% upside potential.

Disclaimer: TipRanks is an independent cloud based service that measures and ranks digitally published financial advice. TipRanks' natural language processing (NLP) algorithms aggregate and ...

more