3 Cheap Growth Stocks Paying Great Dividends

Given the brutal start to 2016, many investors are wisely clamoring for safer pastures. In this type of environment, it is no surprise that interest in and accumulation of dividend-paying stocks have come into play of late. With this strategy in mind, I have identified 3 small growth stocks trading under $10 that offer upside of at least 25% and pay annual dividends of 4% or higher.

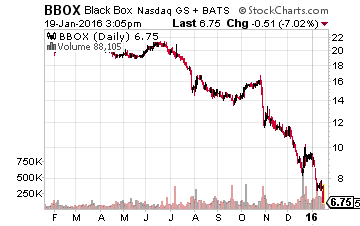

Black Box Corp. (NASDAQ: BBOX)

With a global presence and over 4,000 employees, Black Box is a leading technology solutions provider focused on building and managing its customers’ IT infrastructure. The business is somewhat commoditized which is why it does not trade at a high valuation. However, the current valuation afforded these shares clearly does not reflect the underlying value or prospects that lie ahead. For example, the stock trades at a paltry $111 million market cap, despite generating over $900 million in annual sales. Plus, with earnings per share (EPS) projected to leap from $1.33 in the March 2016 year to $1.83 next year, the price/earnings multiple on next year’s EPS is under 4x!

At current prices, the annual $0.44 dividend payout represents a roughly 6% yield with the next dividend likely to be declared in February. My near-term target price is $10 and I would not be surprised to see the stock begin its ascent back toward the $22.70 year high later this year.

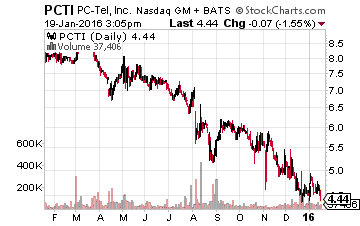

PCTEL, Inc. (NASDAQ: PCTI)

With significant expertise and experience in the RF (radio frequency) segment of the wireless industry, PCTEL optimizes wireless networks with its data tools, engineering services, and RF products. The company’s antennas and on-site solutions are used in networks serving fleet management, healthcare, public safety, and education. Looking ahead, PCTEL appears primed to record significant operating profit as EPS is projected to grow from $0.12 in 2015 to $0.30 in 2016. Clearly, management believes that the current 15x P/E valuation on 2016 EPS is not reflective of its prospects. In a recent update, the company indicated that it plans to continue its aggressive share buyback program and could purchase an additional 783,000 shares this year.

My target price of $6 assumes $0.30 in EPS is met next year and still represents a very reasonable 20x P/E multiple, which is fairly typical for PCTEL’s industry and peer group. Given management’s confidence in its future, and the current 4.3% dividend yield, PCTEL appears to offer significant capital appreciation while the downside is buffeted by the stocks’ healthy dividend.

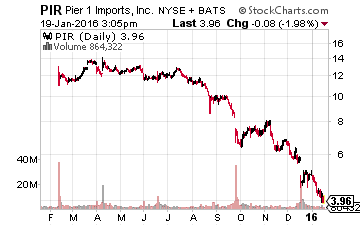

Pier 1 Imports, Inc. (NYSE: PIR)

Founded in 1970, Pier 1 Imports, Inc. engages in the retail sale of decorative home furnishings, furniture, gifts, and related items. The company operates over 1,000 stores in the U.S. and Canada and boasts a popular brand name in the retail home furnishings space. The third quarter of 2015 did not meet EPS expectations but it appears that the company has righted the ship and that the stock is now attractively priced. At current levels, Pier 1 trades less than 8x the Wall Street EPS forecast for the year ending February 2017. In fact, EPS is slated to rise from $0.44 in February 2016 to $0.52 next year, an 18% rise.

My three to four month target price of $6.00 reflects a roughly 50% jump in share price from current levels and assumes that management meets expectations in the near term. In addition to its favorable P/E valuation, the current dividend yield on this well-known company is 6.4%, which, when combined with its capital appreciation prospects, offers significant upside potential.

Disclosure: You could collect an average of $3,268 in extra monthly cash with ...

more