3 Cheap Dividend Stocks To Buy And Hold

De-risk your portfolio with these four undervalued dividend payers that have some of the safest yields in the market. With the market is pulling back again, now is a great time to start adding shares while they’re still cheap.

After a strong run in March, the stock market appears to be taking a step back.

We saw the S&P 500 make a 12% move higher from mid-February to April, but, believe it or not, the S&P 500 is now negative again for 2016. It’s shaping up to be a volatile year.

The market is in the red for April, which is historically one of the strongest months of the year.

This comes as we’re getting close to “sell in May and go away.” And I’ve mentioned the fact that some very popular dividends are worth avoiding. Instead, however, investors should be using the current selloff to buy up cheap dividends that they can own in May, June, July and in months and years beyond.

Now, there are a number of stocks that have taken a beating of late, and that’s created some great buying opportunities. There are close to 350 stocks that pay a 2% plus dividend yield and are down 10% in 2016.

However, not all of these dividends are actually “cheap” from a valuation perspective, nor do all have the balance sheets or cash flows to support their dividends.

The key is to be prudent.

Here are the top three undervalued dividend stocks that you can now buy for cheap:

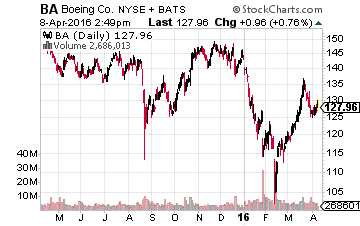

No. 1 Cheap Dividend Stock On Sale: Boeing (NYSE: BA)

Shares of Boeing, the leading airline maker, have fallen 11% this year. The stock is now trading at just 13 times next year’s earnings estimates which is the cheapest we’ve seen it trade at in close to three years.

Still, Boeing is already seeing marked demand for new aircrafts to replace aging airlines in the U.S. and U.K. But it’s also an underrated play on the emerging markets. Key growth opportunities over the next few years will be driven by new aircraft demand from emerging markets. Regardless of where the growth comes from, the aircraft business is an enticing and high margin business. Boeing has a very robust 33% return on invested capital.

Boeing also pays a 3.4% dividend yield, which is just a 50% payout of its earnings. It has a four-year streak of consecutive dividend increases. Of note, Boeing has a backlog of nearly 6,000 commercial aircrafts. This type of backlog provides a lot of visibility into Boeing’s cash flow generation capabilities. Just another thing that makes its dividend enticing.

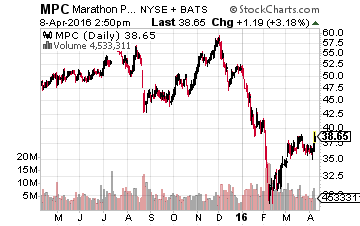

No. 2 Cheap Dividend Stock On Sale: Marathon Petroleum (NYSE: MPC)

Low oil prices can be a boon for gasoline refinery companies like Marathon Petroleum. Cheap gas prices increase demand for gasoline, which means more refining for Marathon. However, shares of this leading refiner have fallen 27% this year. The problem is that the refining business can be volatile.

Marathon is more than just a refiner as well, with midstream (oil and gas transportation – i.e. its MLP MPLX) and retail (gas stations – i.e. its Speedway stores) operations. This helps the company diversify away from the sometimes volatile refining business.

Nonetheless, Marathon’s refining business should be a near-term positive as it operates primarily in the Gulf Coast, where it can source cheaper crude oil and then sell it at higher prices in the foreign markets.

At just 7 times earnings, Marathon is the cheapest major refiner in the market right now. But, more importantly, the refinery stock is offering a 3.4% dividend yield. And that’s just a 30% payout of its earnings, leaving plenty of room for growth. Notably, it’s upped its dividend for five straight years and there should be more to come.

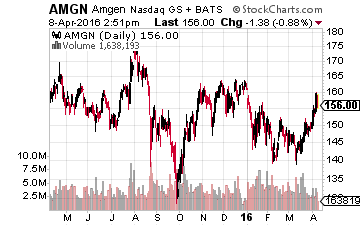

No. 3 Cheap Dividend Stock On Sale: Amgen (NASDAQ: AMGN)

This biotechnology stock has been sold off with the entire industry of late, Amgen is off 2% in 2016 and now down more than 10% from its 52-week high last summer. But what makes this $115 billion market cap biotech company special is that it has a robust pipeline of products. It’s generating over $20 billion a year in revenues and pays a solid dividend yield.

Meanwhile, it also has some of the best margins in the business, in part, thanks to recent manufacturing improvements. Its profit margin is upwards of 33% and its return on invested capital is in the double-digits.

After the pullback of late, Amgen trades at 13 times forward earnings, which is the cheapest we’ve seen in over two years. Amgen pays a 2.5% dividend yield – this is just a 57% payout of its earnings, and it’s managed to up its annual dividend for five straight years.

However, the market is concerned with rising competition for Amgen’s products, which support cancer patients and those with kidney disease. But, the biotech company has been cutting costs and streamlining its manufacturing to help cancel out any pressure on its top line. Lower operating and manufacturing costs should help keep Amgen competitive in its key markets.

In the end, investing in uncertain markets is unnerving. Most investors end up sitting on their hands. However, the more prudent strategy is to use times like these for buying opportunities. There are a number of dividend stocks on sale today, but not all have stable dividends and not all are as cheap as the three above.

Disclosure: You could collect an average of $3,268 in extra monthly cash with ...

more