22nd Century: FDA Catalyst

One stock is positioned to benefit from the FDA plan to cut nicotine levels in tobacco products: 22nd Century Group (XXII). The FDA goal is to reduce the number of deaths caused by the long-term use of the addictive products causing the Big Tobacco stocks of Altria Group (MO), Reynolds America (RAI) and British American Tobacco (BTI) to tank over the last few trading days.

22nd Century has seen some tentative rallies due to the unveiling of the FDA plan despite acknowledgment from the company of a large purchase order from the government and multiple catalysts. The key to the investment thesis is that the stock isn't entirely dependent on the FDA implementing this new plan.

FDA Plan

The FDA unveiled a plan on July 28 intended to curb the trajectory of tobacco-related disease, death and the impact on the healthcare system. The plan serves as a multi-year roadmap to reduce the level of nicotine in tobacco products with a goal of reducing the addictive effects in cigarettes.

According to the FDA release, tobacco use causes more than 480,000 deaths a year with a direct health care and lost productivity costs of nearly $300 billion per year. FDA commissioner Scott Gottlieb, M.D. succinctly summed up the perplexing situation:

The overwhelming amount of death and disease attributable to tobacco is caused by addiction to cigarettes - the only legal consumer product that, when used as intended, will kill half of all long-term users.

Very Low Nicotine Cigarettes

Several organizations have already proclaimed that low levels of nicotine in cigarettes are key to reducing addiction. The Center for Disease Control and Prevention (CDC) and The World Health Organization (WHO) suggested that consumers want to reduce tobacco exposure and a recommendation that nicotine levels be reduced to non-addictive levels of possibly less than 0.4 mg/g of dry cigarette tobacco filler.

As 22nd Century points out in its release on the FDA plan, former FDA Commissioner Dr. David Kessler had proposed in 2010 that nicotine levels in cigarettes should drop to less than 1 milligram.

The good news for investors is that 22nd Century offers a Very Low Nicotine cigarette that meets the standards to reduce nicotine below the addictive levels. The cigarettes contain less than 0.6 mg nicotine per cigarette and less than 0.05 mg nicotine yield per cigarette. The proprietary cigarettes based on tobacco grown by the company reduces the amount of nicotine by at least 95% from levels of traditional cigarettes.

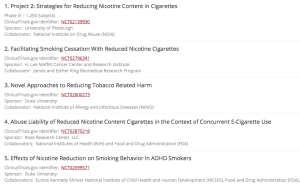

The company documents 25 on-going clinical studies on VLN cigarettes. Below is a snippet of some of the trials in the works:

The company has numerous products in the process of obtaining FDA direction on approvals or clinical trials to work towards the process of offering the products commercially.

The Brand A VLN cigarette is probably the most relevant to the new FDA plan to reduce nicotine levels. A recent meeting in June with the Center for Tobacco Products of the FDA sets the company up to expand a Modified Risk Tobacco Product (MRTP) application.

While this product will reduce smokers' exposure to nicotine, 22nd Century is moving forward with plans for its wholly owned subsidiary, Heracles Pharma, to conduct two parallel, Phase III clinical trials on X-22. The trials will test whether the X-22 cessation product will show a more robust effectiveness over existing cessation products on the market in the U.S. The company expects to start the trials in 2018 and is currently working towards a funding source.

Other work is ongoing with Brand B and hemp plants to provide multiple fronts for catalysts for the stock.

Surging Sales

Another interesting part of the story is that 22nd Century has surging sales. The best investments come from ones with multiple catalysts and definitely not one completely reliant on long-term plans from government organizations.

With the Q1 report back in May, the company raised 2017 revenue guidance to $16 million from $12 million. The guidance for 2018 was set with a target of significantly exceeding $20 million.

22nd Century suggested that new manufacturing agreements of the production of filtered cigars and other tobacco products were the reason for the sales hikes. The move flied in the face of shareholders that requested the company focus more on working with the FDA on approving the various products in development.

On top of those deals, the company announced a 2.4 million purchase order for the Spectrum cigarettes used by the government in research. Having a fully functional manufacturing facility helps with the production of these orders.

The Spectrum cigarettes are used in clinical research to test the impact of reduced nicotine levels including a recent Phase III study with 1,250 participants funded by the National Institute on Drug Abuse (NIDA).

As listed above, an incredible 25 clinical trials are using the proprietary VLN cigarettes in part because 22nd Century has proprietary plant technology that allows the company to develop Spectrum into a series of cigarettes that vary nicotine yields over a 50-fold range allowing government groups and other various parties to determine the addiction at various nicotine levels.

Takeaway

The key investor takeaway is that the new proposed plans by the FDA have lifted the stock of 22nd Century though the stock at $2 is hardly above the range of the last five years. The stock is only worth about $175 million despite all of the work with the FDA regarding product approvals and government tests on VLN cigarettes involving proprietary technology from the company.

The only reason to pause on any excitement surrounding the proclamation by the FDA is that the previous chairman made similar statements seven years ago. The news adds to a bullish long-term thesis, but the company and the FDA still faces big tobacco and the side effects of an industry addicted to the profits produced by consumers unable to kick the nicotine habit.

As always, tons of inherent risk exists in a stock that is basically a biotech that only had cash of roughly $11 million at the end of March. All of these positives should help raise more funds, but no guarantees exist when working with the FDA and facing competitors with deeper pockets.

Disclosure: No position.

Additional disclosure: Please consult your financial advisor before making any investment decisions.

This is a huge move in respect to years-long struggle in tobacco industry regulation. I am glad to see something good coming out of FDA. It would be interesting to see how the consumers to react to the fact that they are using healthier tobacco products in the near future.