2019 Year In Review: All About Multiple Expansion

Stocks closed 2019 with their best returns since 2013. The returns equation is dividend yield plus earnings growth plus change in valuation. Let’s briefly review what happened to each of these components in 2019, and look ahead to 2020.

Dividend yield

Dividends are the least volatile component of the returns equation. The dividend yield on the S&P 500 began 2019 at approximately 2.2% and fell as low as 1.76% by the end of the year. Yields and price have an inverse correlation. So as price moved higher throughout the year, dividend yield naturally fell.

Earnings growth

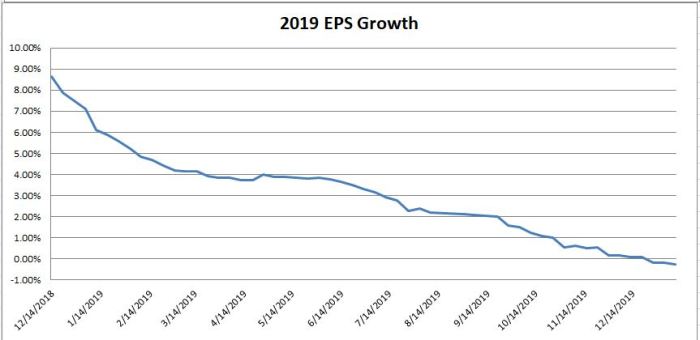

Despite the early optimism for 2019 earnings growth, actual growth estimates fell throughout the entire year (see chart below). As of today, actual reported earnings growth for 2019 was -0.25%.

Change in Valuation

So without any earnings growth and a roughly 2% dividend yield, you can deduce that almost all of 2019’s gains were a result in an increase in valuations (also called multiple expansion). The forward price to earnings ratio closed 2018 at 14.7x after the 20% decline in the S&P 500. The forward price to earnings ratio rose to close 2019 at 18.9x. That’s a 28.57% increase in valuations, accounting for over 91% of 2019’s returns.

Why the change in sentiment? Fed easing and reduced uncertainty/escalation of trade concerns are the main culprits. Changes in sentiment are the most volatile component of the returns equation and are nearly impossible to predict with any consistency.

What does this mean for 2020?

Investors shouldn’t count on a similar pace of multiple expansion in 2020. In my opinion, 2020 will come down to the ability of companies to deliver actual earnings growth. In 2019 investors gave stocks the benefit of the doubt, now companies will have to prove themselves.

Let’s briefly look at the returns equation components.

Dividend yield

Dividend yield on the S&P 500 is approximately 1.78% currently.

Earnings growth

Current EPS estimates for 2020 is looking for approximately 9.58% growth. Of course, these estimates have been reduced from 16.00% that Wall Street was expecting back in March 2019 (See chart below). This is not an unusual pattern. It’s been interesting to hear companies forward guidance on earnings conference calls. They have been a mixed bag so far, although there are some signs of increased business confidence and capital expenditures. The outbreak of the coronavirus will have a negative impact on 2020 earnings. The question is how much of an impact? It’s too soon to say at the moment.

Change in valuation

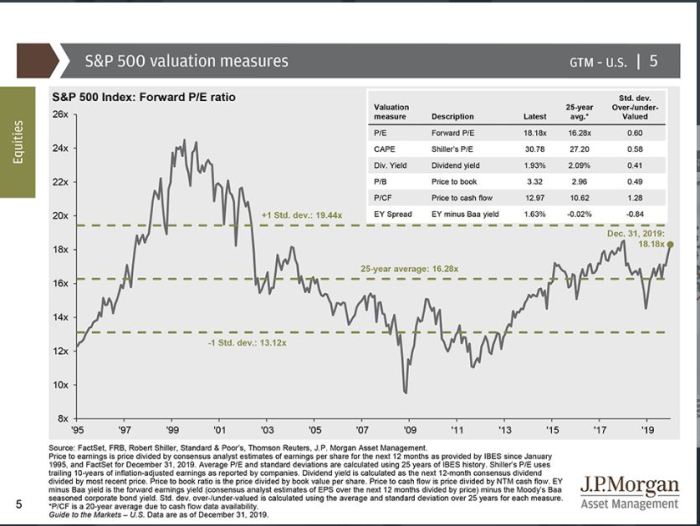

As I mentioned above, investors shouldn’t count on another 20%+ increase in valuation. Another 29% increase in valuations would take us to all time highs in PE levels not seen since the 2000 tech/internet bubble. It could happen, but I would suspect it's unlikely. The forward PE is the highest it's been during this current expansion. (See chart below)

I’ve mentioned before how interest rates play a factor in what multiple investors will pay for a company’s earnings. Low interest rates generally support higher valuations. The equity risk premium is still pretty attractive given the 10 year treasury is now around 1.50%.

An 18.9x multiple on forward earnings is still below the 24.4x forward earnings that was reached during the tech/internet bubble of 2000. (See chart below) And the 10-year treasury bond rate was 6.2% in 2000, as opposed to 1.5% today. So this is not bubble territory yet, in my opinion. But the valuation is still above the 25-year average so it's worth noting.

(Source: JP Morgan Guide to the Markets)

So what's a reasonable valuation multiple? Again, I reiterate that predicting change in investor sentiment is an impossible task. If interest rates stay low, we avoid a recession, and if companies report moderate earnings growth, I could see an increase to 20.0x multiple on forward earnings as reasonable. That would be a 5.82% increase in valuation. There are plenty of things that could derail this, though.

A baseline case (if all goes well) of 1.78% dividends, let’s say 5% earnings growth, and 5.82% increase in valuation would equate to a 12.6% return for 2020. I assume investors would be happy with that. But again, this isn’t a prediction. A negative impacting event (plenty to pick from these days) could easily derail 2020. For example, if the forward PE were to revert to its 25 year average, the 2020 returns would swing to a negative 7%, even with 5% earnings growth.

Next week we’ll get more econ data that can help shed light on what to expect in 2020. Recent history shows Q1 has started slowly and then picked up speed as we progress throughout the year.

Side note

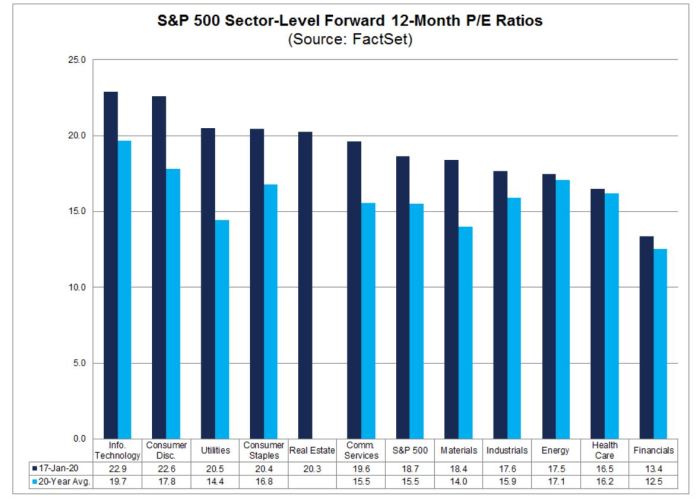

Value investing has lagged growth throughout much of this bull market. For those who want to invest but are hesitant due to current above-average valuations. A good starting point would be to look at each sector and drill down to those sectors that look cheapest.

Factset has provided forward earnings data for all S&P 500 sectors along with their 20 year averages. All sectors are above their 20 year averages (not surprising after a strong bull market run) but the Health Care (-1.82%), Energy (-2.29%), Financials (-6.72%), Industrials (-9.66%) and Technology (-13.97%) are closest to their long term averages and are below the 20-year average (on a percentage basis) of the S&P 500. Trying to uncover good beaten-down stocks in these sectors could be a start.

Disclosure: None.

Nothing on this article should be misconstrued as investment advice. Trading and investing is very risky, please consult your investment advisor before making any ...

more