20 Big Name Stocks Bucking The 2014 Downtrend

There are always bull trends and bear trends going on, even during times likes this when it seems all stocks are going in the same direction.

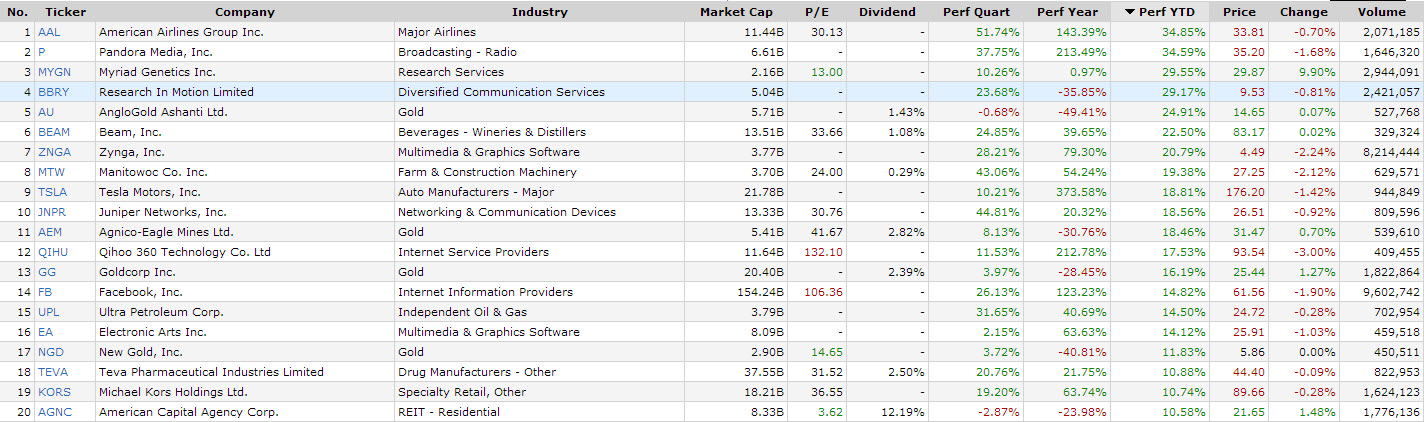

For example, here is a screen for the top performing stocks of 2014 year-to-date (YTD), with the following factors:

* Over $2 Billion Market Cap

* Over 2 Million Average Daily Volume

* Optionable & Shortable

* No ETFs

* Above Simple 20 Day Moving Average

* Above Simple 50 Day Moving Average

(click chart for bigger version):

Top Performing 2014 Stocks Chart

(data from finviz)

Some interesting names on this list, including several well-known Technology companies such as Pandora (P), Research In Motion (BBRY), Zynga (ZNGA), Juniper (JNPR), Qihoo 360 (QIHU), Facebook (FB), Electronic Arts (EA) — Tesla (TSLA) also is on the list. Note that some of the beaten down previous high fliers are rallying back a bit and bucking the overall market trend.

Also see several Gold and Gold Mining names on the list such as AngloGold (AU), Agnico-Eagle (AEM), Goldcorp (GG), New Gold (NGD) — Precious Metals sector is also extremely beaten-down and does have quite a bit of upside potential rally if this continues … also seeing somewhat of a mild 'flight to safety' into precious metals in 2014.

Finding the stocks and sectors that are charting their own course and aren't performing in a correlated manner with the broad stock market is a useful strategy for stock pickers, option traders and those looking to get a diversified 'edge' over the market.